Fighting the Global Corruption Epidemic

OVERRUN The OECD cited a World Bank estimate that $1 trillion in bribes are paid out worldwide every year while the World Economic Forum estimates corruption as an industry surpasses 5% of global GDP not to mention billions of dollars in government waste and fraud

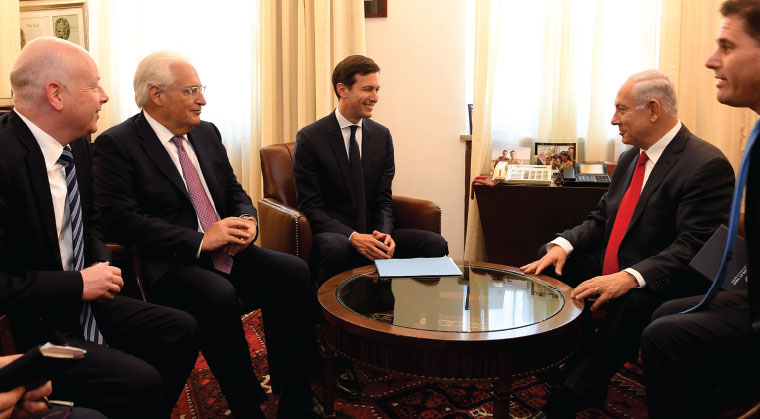

W hether Binyamin and Sara Netanyahu received cigars and champagne as gifts from friends or as part of an ominous web of bribes in return for political favors is a matter for Israeli investigators to determine.

Both Netanyahu and his attorney Jacob Weinrot admit he received some gifts and deny all corruption charges but even the scent of scandal can have consequences. Political corruption and backlash from populist anti-corruption sentiment have brought two leaders of major global economic powers to their knees in recent months.

South Korea’s President Park Geun-hye was suspended from her post in early December pending the outcome of an impeachment trial for allegedly conspiring to extort $69 million from South Korean businesses. Four months earlier Brazil’s senate removed President Dilma Rousseff from office primarily due to massive public protests following revelations that during Rousseff’s tenure as chairman of Petrobras Brazil’s largest oil company the company bribed leading politicians to gain exclusive drilling contracts.

South Korea and Brazil are not outliers.

Citizens worldwide are demanding transparency and honesty from government officials says Carole Basri an adjunct law professor at Fordham who teaches compliance law and ethics at universities in Russia and China. “There’s been an international awakening to this corruption issue ” Basri told Mishpacha in a telephone interview from China.

And for good reason: Corruption is one of the main obstacles to sustainable economic political and social development according to a 2014 report from the Organisation for Economic Co-operation and Development (OECD). The OECD cited a World Bank estimate that $1 trillion in bribes are paid out worldwide every year while the World Economic Forum estimates corruption as an industry surpasses 5% of global GDP not to mention billions of dollars in government waste and fraud.

This undermines citizens’ trust in government and the rule of law and explains to some extent Bernie Sanders’s and Donald Trump’s appeal to voters both having run on a platform of “draining the swamp.”

When it comes to anti-corruption what’s good for government officials is equally applicable to CEOs.

Basri who helped develop the anti-corruption and ethical corporate governance curriculum for the Interpol Academy of Anti-Corruption says compliance departments are the fastest growing areas of corporate law as companies navigate the growing maze of local state federal and international regulations. In 2008 Siemens the giant German engineering company appointed its first compliance monitor as part of a $1.6 billion settlement of bribery charges in the US while Wells Fargo an international US banking company was recently fined $185 million for allegedly opening two million bank accounts or credit cards without customers’ knowledge.

Running afoul of the law can also result in jail sentences for company officers and employees can decrease the value of a company and undermines well-built reputations. “As an executive you want to make sure that you can sleep at night and don’t incur personal liability because you didn’t oversee an effective compliance program ” Basri says.

Compliance programs are relatively easy to establish Basri says and the first step is to conduct a risk assessment to determine a company’s susceptibility to bribery based on its practices and location. According to Transparency International 68% of countries worldwide have a “serious corruption problem.”

Following the risk assessment the company must develop internal controls to ensure its policies procedures and codes of conduct comply with the law. This can include making sure that checks are not made out to cash or paid to third parties. For banks it includes doing due diligence to ensure they follow international laws against money laundering whether terrorism or mob related. Conducting background checks on employees and suppliers is vital. “Usually people who do the wrong thing have established a pattern of doing the wrong thing ” Basri says. Monitoring can mean checking for customer aliases as well as running employee e-mails through programs that look for key words that hint at bribery or price fixing — something that is legal in the US on company-owned devices.

Any company policy is only as sound as the people who implement it so once policies are set the company must audit and monitor them to make sure that every employee complies with the rules and update them periodically. Procedures must be established for investigating and reporting fraud or employee abuse. All company employees must be cognizant of company policies and values. Even issues such as taking company pens or using the photocopier for personal use should be standardized and made clear to all workers.

Today companies are closely examining what incentivizes people to do what they do. Does the culture encourage employees to make money regardless of whether the method used is ethical or legal?

“Sophisticated compliance programs apply to international multibillion dollar corporations; however they have implications for local business people” Basri says.

Given the eruption of populist anti-corruption sentiment throughout the world — whether in India China Russia Africa the Middle East or elsewhere — governments and corporations have been put on notice.

“You can’t have a society riddled with corruption and expect people to get jobs make money and be productive Basri says. “All corruption is a form of stealing — whether it takes away people’s earnings or employees’ dignity and safety. It’s all about doing the right thing.”

Oops! We could not locate your form.