Take the Pesach Budget Challenge

The FF Pesach budget challenge: three women tracked their Pesach expenses — then slashed them

On Pesach, we celebrate our nation’s freedom. But it can be hard to feel free when you’re worrying about paying off your credit cards... yet between groceries, clothing for the kids, and matzah, the bills keep mounting. Is there a realistic way to cut back on your Pesach expenses? Family First dared three women to find out

News Flash: Pesach doesn’t have to be a strain on your finances or your mental health, says financial planner Mara Strom of Kosheronabudget.com. How much you spend on Pesach is really a matter of choice.

Yes, you read that right.

Mara, a mother of three, personally knows the challenges of living on a tight budget — and still insists it’s possible to choose between “I can’t believe they charge this much, but I need it” servitude and financial freedom.

But can the nonfinancial planners among us do this? To find out, in 2018 Family First asked readers to track their Pesach expenses. In 2019, we selected three readers and asked if they’d be up for a challenge. The brave souls met with Mara, set new Pesach financial goals — then reported back after Yom Tov to let us know how it went.

One year later, here’s their experience.

Meet the Participants

Tamar

Location: Cleveland, OH

Family Size: 2 adults, 5 kids and a newborn in 2019, one adult guest

Years Making Pesach: 6

Cost of Pesach 2018: $3,500

2019 Goal: Spend $400 less and be less stressed and anxious over finances

Tamar’s Story: When we contact Tamar shortly before Pesach 2019, she informs us that she just gave birth a few days before! Still, chilled as iced tea, the Midwesterner says she’s still up for the challenge. Tamar usually uses her yearly tax refund to pay for her Pesach expenses — she files her taxes, gets her money, and funds her expenses from there.

This year, Tamar’s going to try to keep things simple, she says. She told her girls she wasn’t baking, but if they wanted to, they could. She also plans to take a year off from trying new recipes, sticking with the tried-and-true ones instead. No new recipes means no new (and expensive) specialty ingredients — and it also means less waste, since the family favorites she makes will be eaten, not left languishing on the counter.

Chaya

Location: Ramat Beit Shemesh, Israel

Family Size: 2 adults, 5 kids

Years Making Pesach: 10+

Cost of Pesach 2018: $2,800 (NIS 9,800)

2019 Goal: To plan and save so she won’t still be paying for Pesach expenditures months later — without taking away from simchas Yom Tov.

Chaya’s Story: Chaya, who made aliyah years ago, says she usually takes out tashlumim — deferred payments spread out anywhere from two to twelve months — to pay for her Pesach expenses. That strategy always feels fine, she says, “until the summer comes, and I realize I’m still paying off Pesach, and summer has its own expenses.”

After joining our Pesach challenge, Chaya decides to track all her expenses in Google Docs and spreadsheets. “I love keeping track of things, and this pushed me to do it,” she says. “It took up a lot of time I should have spent cleaning, but I was excited about it.”

Hanna

Location: Five Towns, NY

Family Size: 6 adults (Hanna, her husband, married daughter with husband, and two children over 18), 3 younger children

Years Making Pesach: 19

Cost of Pesach 2018: $4,000

2019 Goal: $3,000

Hanna’s Story: Hanna’s a New Yorker. You hear it in her accent and in the speed of her speech — and in her attitude, a certain no-nonsense, this is life, it costs money, and time is valuable. One reason for joining the challenge, she says, is because she often found herself dipping into savings to cover her Pesach costs.

In 2018, Hanna tells us, she pushed off her Pesach shopping until the beginning of April, then went on a one-day major shopping spree, storing all her receipts in a plastic baggy. Two weeks later she tallied them and went, “Oh, my gosh!” She’d hoped to spend a total of $1,000 on food for Pesach and had already spent $700 — and still had a lot more to buy. “That was an ‘Aha!’ moment for me,” she says. “I told myself, something’s gotta change.”

(Excerpted from Family First, Issue 684)

Mara: I encourage everyone to budget with money they have on hand rather than expected or predicted income. Until that money is in your account, it’s not yours, so there’s an element of risk in planmning for a necessary expense like Pesach in that way. What if the rebate doesn’t come through in time? Or it’s less than you anticipated?

ONE week before Pesach 2019, our intrepid participants hop on a followup conference call with budgeting guru Mara Strom. Each of the participants had already discussed her finances and budgeting goals with Mara in the months prior, and Mara had provided each of them with individual coaching and ideas. Now, they were coming together for the first time as a group to hear from each other, from Mara, and to give each other support and perspective just before they headed into the Yom Tov they’ve been planning for all year.

We’ve called Mara in to help with Pesach budgeting, but Mara stresses that Pesach is just one piece in a family’s financial puzzle. Really, she says, you need greater financial awareness throughout the year, so you can put it all into perspective. Here are some of the tips she shared to build the budget-building attitude and know-how these women will need to meet their financial goals. She also shared her approach to slashing the dreaded Pesach grocery bill (see sidebar).

- Be intentional about your spending. Budgeting is not about deprivation, but about making your money work for you. It makes spending a choice — “one that you actively and intentionally make,” stresses Mara — and not something that just happens. When you’re shopping and come across something you hadn’t planned on purchasing but feel compelled to buy, ask yourself: “Do I want this, or do I need this? And if I need it, do I need it now?” By asking these questions, you’re in control of your spending. And you’re not left wondering where all your cash went or how the credit card bill got so high.

- Create “sink funds.” Pesach happens every year. (As do Chanukah presents, mishloach manos, teacher appreciation gifts, and summer counselor tips.) So why do we act so surprised by the expenses, instead of planning for them?

- Anticipate and plan for these expenses by creating “sink funds” — set aside (aka “sink”) a fixed amount of money every month to preemptively cover annual or semiannual bills.

- If saving a bit each month doesn’t work for you, why not take advantage of the quieter months in the Jewish calendar, usually around November, January, February, and May to put money away for these future expenses.

- Make a List. It sounds obvious. And most people make a grocery list. But how many people stick to it? And do you make a list when you go shopping for clothes, housewares, etc.?

Often when we shop for clothes, our plans are ambiguous: “I need something for Pesach” or “My kids need something for Chol Hamoed.” ”Making a list is the first step in that intentional practice of spending being a choice,” explains Mara. “Take a moment to really think through your wants and needs in advance. How many tops and skirt combos? How many pairs of tights, and what sizes and colors? How much do you intend to spend for these items? It seems so simplistic, but few of us make the list and it really does set you up for success with your spending goals.

Breaking Down Pesach Expenses

With Mara’s encouragement, our participants were eager — or at least willing — to make changes. After Pesach 2018, they had logged their Pesach spending in four major categories: cleaning, food, clothing, and Chol Hamoed activities. In 2019, it was time to see how they’d stack up. Could they cut their costs?

Cleaning Up the Cleaning Costs

One of our participants showed that it’s possible to make the house sparkle for under ten dollars. Even if that won’t work for you, there are ways you can clean for less.

Tamar

- Pesach 2018: $505

- Pesach 2019: $505

This sum is the usual cost for Tamar’s regular cleaning help — she didn’t take any additional hours between Purim and Pesach, so it’s a sh’eilah if it should even be considered a Pesach expense.

Tamar gave birth a few weeks before Pesach 2019, so the fact that she didn’t increase her cleaning help and actually made Pesach gives her superwoman status. (Hmm… or maybe this is a commentary on the type of person who submits herself to such a project?) She did concede that her husband and older girls pitched in a lot more than usual.

Chaya

- Pesach 2018: 30 shekels ($8.50)

- Pesach 2019: 30 shekels

Chaya is incredibly self-sufficient. That’s why her only expenditure for cleaning was the 30 shekels she paid for cleaning spray and paper towels. (Don’t worry, she’s very normal and sweet. She just has superpowers you don’t have.)

Hanna

- Pesach 2018: $700

- Pesach 2019: $42

Hanna is our big winner in this category. When her housekeeper requested two days of vacation, Hanna told her to take five days instead, over the week of Pesach. That saved Hanna $500 right there.

“On Pesach I surrender myself to two weeks of cooking and cleaning, work is secondary,” she says.

So losing her cleaning help wasn’t as traumatic as it sounds. Additionally, Hanna’s lack of spending awareness when she started shopping — and the jolt she got when she added up the receipts — gave her the push to cancel her cleaning help for the week of Pesach.

The result was that Hanna spent only $42 on cleaning supplies. Would she do it again? Hanna says she’ll take it as it comes.

Tamar

- Pesach 2018: $1,825

- Pesach 2019: $1,635

Takeout

Tamar lives in Cleveland, which is a beautiful community with Midwestern sensibilities. Translation: There are few takeout options. Tamar did utilize the convenience of takeout minimally, but that wasn’t a significant factor in her cost-cutting measures.

Groceries

Having recently given birth, Tamar wasn’t going to run from store to store to get her shopping done. Yes, she could delegate to her husband, but she wasn’t going to dump it on him. (She’s nice like that.) Instead, she ordered from a website that sells and ships kosher food anywhere and has an extensive Pesach section.

Ordering online is an interesting option. Price comparison between brands is much easier. Also, you see your total list and cost before you purchase, which can make you more conscious of what you’re spending. And putting something back on the shelf is as simple as a click.

When Tamar reviewed her order with her husband before purchasing, they realized they could delete a few things from their cart. For instance, some products only came in sizes way too big for her family. It was easy to say, “Do we really need that sugar-loaded, unhealthy mango juice?” Click and delete.

Shopping online makes it easier to stick to your list, because going through pages and pages of food products quickly loses its allure. But it’s not a perfect solution. Not all products are available, or in the size you want them. There’s also a premium for the convenience.

Would she repeat it? Next time she makes Pesach, says Tamar, she’ll be back to normal in-person grocery shopping. But she feels the knowledge she gained from shopping online was valuable and can translate into conventional shopping.

Another unintentional change that bore fruit was Tamar’s produce shopping experience. In past years she’d buy a week’s worth of fruits and vegetables from Costco. Because it was difficult to get out with a newborn, she did a small shop locally for the first days and restocked during Chol Hamoed. The result? Less waste than usual.

Chaya

- Pesach 2018: NIS 6,830 ($1,928)

- Pesach 2019: NIS 6,659 ($1,880)

Takeout

Chaya didn’t use takeout very much, either, so it wasn’t a significant factor in her budget.

Groceries

Chaya’s overall financial goal was to eliminate tashlumim, most of which she’d been paying out for her food orders. Impressively, Chaya succeeded, with one exception. She took out one tashlum for her meat order, but easily justified it. “We’ll be eating this meat long after Pesach,” she explains, “and the pricing is great now.”

Because she doesn’t have a car, Chaya has to rely on her local makolet, which means she can’t do much bargain hunting and price matching. And because products aren’t always on the shelf of her local makolet, Chaya says she’d often overbuy. When she saw something, she’d grab five.

As part of the challenge, Chaya took out her previous year’s list to review her purchases — and discovered that having a better idea of what her family actually consumed led to better purchasing. “I only bought three ketchups instead of ten!” she says proudly.

Hanna

- Pesach 2018: $2,775

- Pesach 2019: $1,186

Takeout

New York is replete with conveniences like takeout stores. Seasons Express happens to be close to Hanna’s house and can always be relied on in a pinch. That’s wonderful for busy people, but not so wonderful for people trying to rein in spending. In the past, when her kids suggested takeout, Hanna would usually say yes. With a recalibrated focus on Pesach spending, Hanna began to tell her kids no.

It wasn’t something she or they were used to — and they did go to Seasons Express once. But when everyone has a larger goal, it’s easier to accept the no.

Groceries

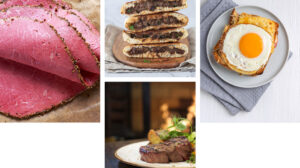

For Hanna’s family, simchas Yom Tov means family and food: a good roast, nice wine, and plenty of other delicious things to eat. So cutting back on food was challenging.

“Regardless of whether it’s the first day, third day, or last day, good food keeps the family together at the table for hours, talking, laughing, and singing,” she explains. “What more does a mother/bubby want?”

But there are ways to cut back financially without cutting quantity or quality. “If you know how to cook and you have good Pesach recipes, you can make stuff for very cheap,” Hanna says. “A potato kugel costs almost nothing. Same goes for chocolate chip cookies made with potato starch. You can bake three dozen cookies for the cost of ten cookies you buy in a box.”

A particularly empowering moment came at the end of Pesach. Hanna and her family had eaten at her sister-in-law’s home on the seventh day, and they were hosting her family on the eighth day. “She’d made a ton of stuff. She had salmon and gefilte fish. She had three different main dishes and three or four different salads. Dessert was a fancy tiramisu. It was beautiful, and I felt a little bit like gosh, they’re coming tomorrow, I need to do something just as nice.”

Fortunately for her budget, it was Yom Tov, so Hanna couldn’t race to the store and fill her shopping cart. What did she do? Hanna combed through her recipe books, looked through her fridge, and found she had plenty to work with. She made more potato kugels in addition to the cholent. Then she found frozen broccoli in her freezer and made a broccoli kugel. For salads, she made a coleslaw and cucumber salad. For dessert, she transformed leftover cookie crumbs into a crumble, served with leftover whipped cream on top.

“I made a beautiful seudah working with what I had in the house — with a shopping trip to my fridge, not the store,” says Hanna. “It felt good not to spend and not to waste anything either.”

Mara: Food waste is money waste. Americans waste over $160 billion worth of food every year, so throwing out produce that has gone bad in your fridge is really like throwing out money.

Mara: Chaya’s meat order that’s used after Pesach underscores my point: A Pesach budget in isolation is a little artificial. But Chaya can use these lessons during the rest of the year too.

Mara: When you decide to focus on your budgeting, it’s really important to get everyone in your family on board — especially if you have older children. If you encounter some resistance, it might be helpful to explain why this is important — perhaps it’s part of your larger goal to pay off debt, or maybe you want to save up for a family vacation. Understanding the “why” can help children (and spouses!) to ‘buy in’ and work with you —rather than resist your efforts.

Mara’s 9 Tips for Pesach Food Shopping

- Know Your Magic Number. When making a plan for how much you want to spend on Pesach, consider your financial situation, how many people are in your family, and how many guests you plan on having. Then determine a dollar amount that works for you. This sets the table for intentionality.

- Make a Master List. What did you purchase? What did you use up, and what are you putting away for next year? Write it down — and put it in a place where you’ll find it next year. Be sure to include how many guests you had, so you can figure that into next year’s budget calculation.

- Join Forces with Friends. Have everyone make a list of the items they intend to purchase, and put the lists on a shared Google Docs file. Then split the local stores among you. When you’re in the store, write down the prices of items on the list. Afterward, update the file, so everyone knows the best place to buy what they need.

- Go Back to Basics. Anything processed comes at a premium price. So make your own mayo and powdered sugar. Skip the packaged cereals, which don’t taste that good, and have an omelet instead. Making simple staples will bring you significant savings.

- Know the Rules. There are many things that don’t need a hechsher for Pesach, such as extra virgin olive oil and unflavored coffee grounds. Before you pay triple the price for them, check out the websites or apps of kosher certifying agencies. Many have lists of these items.

- Shop Your Pantry. For the weeks leading up to Pesach, take inventory of what you have, and make dishes based on what’s already in your pantry. You can take the money you’ve saved by not purchasing additional chometz products and use it for Pesach purchases.

- Invest in the Future. You can easily spend $100 (or more) on paper goods for Pesach; over a few years that adds up, and you could’ve bought a nice set of mid-range dishes. When buying appliances and housewares, don’t buy the cheapest, thinking you’ll only be using it once a year; instead, buy something decent, which could last a lifetime and even get passed on to your children. Keep an eye out for sales throughout the year.

- Find Money to Pay for Your Magic Number. Consider saving a little every month. You can also put “found money” — bonuses, gifts, tax refunds, etc. — toward Pesach expenses, instead of spending it on other things.

- Start Shopping for Next Pesach after This Pesach. Prices are slashed after Pesach, so if you stock up on non-perishables, you can save a lot. Also, there are many products with KLP certification all year round, so stock up when they’re on sale.

Clothing

While there’s an inyan for wives to get something new for Yom Tov, most mothers are more focused on the “new season” for their children’s wardrobe. How can you balance your kids’ clothing needs with the reality of your bank account?

Tamar

Pesach 2018: $600

Pesach 2019: $400

“Boys are the easiest,” Tamar says with a laugh. While it doesn’t take much thought to buy a white shirt and dark pants for boys, things get complicated with the girls. Tamar aims for each daughter to have three Shabbos/Yom Tov outfits. For the younger kids, Tamar loves hand-me-downs and swapping clothes with friends. She finds outfits for the older ones in the frum stores or online.

“My number one priority is that they should feel good about themselves, and that can mean something else to each kid,” she says.

One valuable lesson? “No more shopping with kids.” When Tamar brought her daughter accessory-shopping with her, she found she ultimately bought more items. “I lost my focus,” Tamar admits.

Chaya

Pesach 2018: NIS 2,450 ($680)

Pesach 2019: NIS 2,235 ($620)

“I’m not going to buy new clothes for my kids until Rosh Hashanah,” says Chaya. “This is it.”

Considering Israel’s climate, where the weather gets hotter around Pesach and stays that way till Succos, Chaya’s approach is reasonable. And with just one day of Yom Tov, the pressure of providing each girl with multiple dressy outfits is lessened significantly.

For her daughters, Chaya looks for deals and usually finds them. She bought each of her older girls two new Shabbos outfits and skirts on sale. For her four-year-old daughter, Chaya just purchased new tights and a top for Chol Hamoed. “She has so much clothing from her older sisters, she doesn’t need anything else.”

Chaya bought only one item for her son who has special needs: a new white shirt. He’s uncomfortable in suits and doesn’t like anything new that he has to “break in.”

“I don’t usually buy myself anything, but my husband threatened that he’d buy something for me if I didn’t,” says Chaya, laughing. After a trip to the local mall, Chaya was the proud owner of two tops and two skirts.

In retrospect, Chaya realized she overbought for her girls. When she found items on sale, she thought, “It’s so cheap. Let me buy two or three.” But she should’ve stopped at one.

Hanna

Pesach 2018: $700

Pesach 2019: $1,303

The reason why Hanna’s expenditures went up in 2019 can be explained in one word: shidduchim.

For her daughter “in the parshah,” Hanna purchased dresses, shells, tights, hair extensions, and more. There was also Hanna’s shidduch-aged son to outfit. He needed a new suit, a purchase she hadn’t factored into her budget. Hanna also has a 13-year-old daughter, an age she’s found can complicate a budget: Children’s clothing often doesn’t fit right and the adult options are too mature, so she needed to grab what worked, whatever the price.

Hanna started with the department stores. There was a ton of great stuff at Century 21. “What do you do when there’s a $170 sweater on sale for $10?” she laments. Hanna bought herself a sweater on sale, but said no to other bargains, which was “difficult with a capital D.”

Later Hanna reflected, “When you tell yourself you’re not spending money, you just shouldn’t step into the store.” Hanna’s attitude reminds me of Rabbi Avigdor Miller’s line: “What’s better than 50 percent off? One hundred percent off.” But it takes resolve — especially when you think you’re shopping for Pesach and your kids see things they want to buy for camp.

“No, not now,” Hanna told her kids when that happened. “There’s time after Pesach to deal with camp.”

Mara: Budgets aren’t written in stone for a reason. It’s good to be able to be flexible, especially when, like Hanna, we realize that we need to increase expenses in one area — like Hanna’s clothing. That’s fine, as long as we can offset it by decreasing our expenses in other areas. Hanna did a great job with this!

Beat the “But It Was a Bargain” Blues

We need to buy clothing for Pesach. But do we need to buy something just because it’s on sale? Before you make an impulse buy, Mara tell us, ask yourself these questions:

- Do I need this?

By just asking the question, you’ll develop an awareness of your shopping habits.

- Do I have the money to pay for this?

Even if you’ve made a budget, it’s likely you didn’t include a line for impulse purchases. So how will you pay for one? If the purchase is going on a credit card, will you have to take money out of a savings account to cover the bill? A bargain isn’t a bargain if you’re paying it off plus 18% interest months later.

- Is this something I can do without?

Do I already have something similar? If not, do I need it right now? Will it be available in six months, when money isn’t so tight?

“I don’t buy into the idea that unplanned purchases are always wrong,” says Mara. “Sometimes they really do make sense. But if you notice that impulse buying is a major budget buster for you — or that it’s masking some other emotional need — it’s good to try to get a handle on it. Asking yourself these questions questions is a good way to remind your brain to be intentional before you spend.”

Housewares & Disposables

Tamar

Pesach 2018: $190

Pesach 2019: $270

“I went to the store, and they had the cutest paper goods for the Makkos,” says Tamar. “But I realized I didn’t need the plates, napkins, and cups.” In other words, Tamar found a balance between beautifying her table l’kavod Yom Tov and not buying unnecessarily. She did spend more in 2019, though, because of an unanticipated expense: a tablecloth. Her usual Yom Tov one fell victim to a few too many grape juice spills over the first days, and she needed to buy a replacement on Chol Hamoed.

Chaya

Pesach 2018: 600 shekels ($170)

Pesach 2019: 200 shekels ($56)

Other than a new, larger hot plate for Yom Tov, Chaya bought barely any housewares for 2019.

Hannaanna

Pesach 2018: $500

Pesach 2019: $281

In 2018, Hanna bought a few new pots and pans because she’d forgotten if some of her old ones were milchig or fleishig. She doesn’t have that expense in 2019, but decided to treat herself to an Instant Pot for Pesach 2019. Pesach is the only time she really spends a solid block of time in the kitchen, so she wanted to see if it lived up to its hype.

“I knew I shouldn’t be buying something like this when I’m on a budget,” Hanna says. “But I really wanted one, and I loved it. I’m going to buy myself one for all year round.” It seems her pleasure purchase was worth it.

Mara: Budgeting isn’t about deprivation but prioritization

It seems her pleasure purchase was worth it. Budgeting isn’t about deprivation but prioritization, and Hanna now has a cool new way to cook. Go, Hanna!

Mara: If you know yourself, and you have a genuine need for something, get it. Just make sure to plan for it first!

Chol Hamoed Activities

“What are we doing today?” If parents were paid every time their child asked that on Chol Hamoed, they could easily afford all the activities their kids are clamoring to do. Since that’s not happening, how can families on a budget still have fun?

Tamar

Pesach 2018: $300

Pesach 2019: $300

Tamar aims to do one medium-sized activity each day of Chol Hamoed. “Not medium in terms of cost,” she clarifies, “but to be out of the house for five or six hours.”

Biking, which cost nothing, was one day’s activity on Pesach 2018. They spent another day at the arcades. “It’s embarrassing how much time we can spend at arcades,” she chuckles. Another day the family split up; the older kids went to a Ninja obstacle course with her husband, while Tamar took the younger ones to the zoo, which is free one day a week.

While Tamar values the time spent together as a family, she says that splitting up was great, both in terms of her budget and the activities’ entertainment value. The younger kids would have been bored at the Ninja place, which wasn’t cheap. The same would have happened if the older ones had gone to the zoo.

Tamar speculates that she’d spend up to $30 a kid per activity, but readily admits, “Years ago, when my husband was in school, we would have spent $100 or less for the whole Chol Hamoed. Circumstances and finances change.”

Mara: This really goes to the heart of my budgeting philosophy. It’s not about picking some arbitrary number and sticking to it year-in and year-out no matter what matter what, but rather thinking of your current income and balancing that against your other expenses. With a new baby at home, maybe you decide to put less money into saving, but spend more on convenience items. The ebb and flow of life must be reflected in whatever budget you determine, which means thaty like Tamar, that amount can and should change frfom one year to the next.

Chaya

Pesach 2018: NIS 415 ($114)

Pesach 2019: NIS 175 ($50)

Chaya and her family keep Chol Hamoed simple. Not only are they frugal-minded, but going out with their son with special needs can be challenging, so the family is used to understated but wholesome Chol Hamoed activities.

Ramat Beit Shemesh has a lot of new neighborhoods and parks — “cool parks,” Chaya clarifies, “not just swings, but basketball courts, ponds, and bike paths” — so the family spent three days of Chol Hamoed in different parks.

Another day, they time traveled. Chaya converted all their old family video tapes to DVD format — her only Chol Hamoed expense — which gave them over six hours of viewing time. The family watched every first step, play, and graduation, says Chaya. “They really enjoyed it!”

Mara: What a beautiful way to create memories — and spend intentionally. I love it!

Hanna

Pesach 2018: $500

Pesach 2019: $230

The weather was lousy at the start of Chol Hamoed, so she took her two younger kids to a kosher l’Pesach café. She bought a yogurt for each and two personal pizzas, one for the younger girls to share and one for the older girls at home.

“Usually I wouldn’t pay attention to how much it cost,” Hanna says. But with her new awareness, her voice is rising in indignation. “Can you guess how much that cost me? Forty dollars — for five minutes! It was a madhouse. There wasn’t even a place to sit.”

Another day she took her two younger girls to Great Adventure. The park doesn’t allow you to bring in drinks, so they had to buy water. “I spent $40 on water. I kept thinking. ‘This is ridiculous. I’m on a budget.’ Even though I was able to spend so much less than I’d spent last year, it’s upsetting, once I have this awareness, to think about how much I spent on things that were ridiculously expensive for no reason. Why should water cost five dollars a bottle? Why was a personal pizza $20? Ignorance may have been blissIgnorance may have been bliss, but now that I have this awareness, I need to start paying more attention” But there wasn’t much I could do.”

Not all of Hanna’s newfound awareness translated into her saving money at the time, but it helped her de velop the greater intentionality for future expenditures that Mara stresses.

Results & Reflections

Tamar

Cost of Pesach 2018: $3,500

Goal set for Pesach 2019: Spend $400 less and be less stressed and anxious with the process.

Cost of Pesach 2019: $3,110

Chaya

Cost of Pesach 2018: $2,800 (NIS 9,800)

Goal set for Pesach 2019: To plan and save so she won’t still be paying for Pesach expenditures months later — without taking away from simchas Yom Tov.

Cost of Pesach 2019: $2,150 (NIS 7,525)

Hanna

Cost of Pesach 2018: $4,000

Goal set for Pesach 2019: To spend $3,000, cutting her total by 25%.

Cost of Pesach 2019: $3,042

Hooray for all our participants — they each just about made their Pesach goals! Hanna saved close to $1,000. Chaya eliminated all but one tashlum. And Tamar saved $390 — just ten dollars short of her goal — while greeting Yom Tov with a calm smile.

In addition to the positive numbers, our participants say they’ve gained a lot in their financial awareness and intentionality of spending.

Chaya is very excited with her results. “It sounds so simple — save for Pesach. But until Mara suggested it, it just doesn’t cross your mind.” After successfully saving for Pesach 2019, Chaya says she hopes to put away money monthly for every Pesach, as well as for other expenses.

Hanna is more ambivalent. “I’d like to take it forward. But if I’m going camp shopping with my girls, and I only want to spend $250 on camp necessities and I see other things, I’m going to buy them so I don’t have to go out again.” Still, she adds, “I definitely feel like I could save more next year. And saving $1,000 is nothing to sneeze at. Next time, I’m going to look at my receipts every few days. Maybe I’ll even do that when I shop for camp, just to see how the money is being spent.”

Tamar is looking forward to Pesach 2020. She’s armed with a better idea of her family’s food needs. By cutting back last year, because she recently gave birth and didn’t have as much energy, Tamar realized her Yom Tov doesn’t need so many cookies and cakes. No one missed them.

As for using her tax refund to fund Pesach, Tamar plans on continuing that. “I know Mara talks about planning for expected expenses, but this really works for me,” she explains.

“I love Pesach!” Tamar adds. “Yes, it can be hard. But there’s nothing like having your own Seder in your own home. There’s a feeling of accomplishment like nothing else.”

And now, with another factor — the finances of Yom Tov falling into place — there’s yet another reason to celebrate our freedom.

Mara: All three of these women did great. I’m so proud of them for saving money, reducing their stress, and increasing their awareness about their spending behavior. I have no doubt that as a result of this Pesach challenge, they will be even more mindful and intentional going forward. Talk about freedom!

Oops! We could not locate your form.