The Down Payment Dilemma

| December 20, 2022There’s no “one size fits all” approach to finances

The Down Payment Dilemma

Sara Glaz Aloni

Tzvi and Devora Felder have been married for three years and they live in Eretz Yisrael, where Tzvi learns and Devora works as a bookkeeper for an American company. They’re financially stable and have $60,000 socked away in a bank account, earmarked for a down payment on their first home. As the clock ticks on their stay in the Holy Land, they also wonder if they should leave their $60,000 in a savings account, where it’s making bupkis — as Tzvi puts it — or is it smarter to invest it?

First, they have to ask themselves: When do we plan on using this money?

The couple anticipates moving back in a year, checking out the different neighborhoods in Lakewood and Monsey, and then buying in an “up and coming” community. Target date for using down payment: two to three years.

When it comes to finances, this is considered a “short time horizon.” When the time horizon is short, investing in the stock market is tricky. Why? In trying times such as these, there’s a chance that when they need the money, the account value will be the same or less than when they initially invested it. In other words, a shorter time horizon means less time for the market to recover in the event of a downturn. So unless the Felders are willing to take a real risk, investing in the stock market will have to go off the table for now.

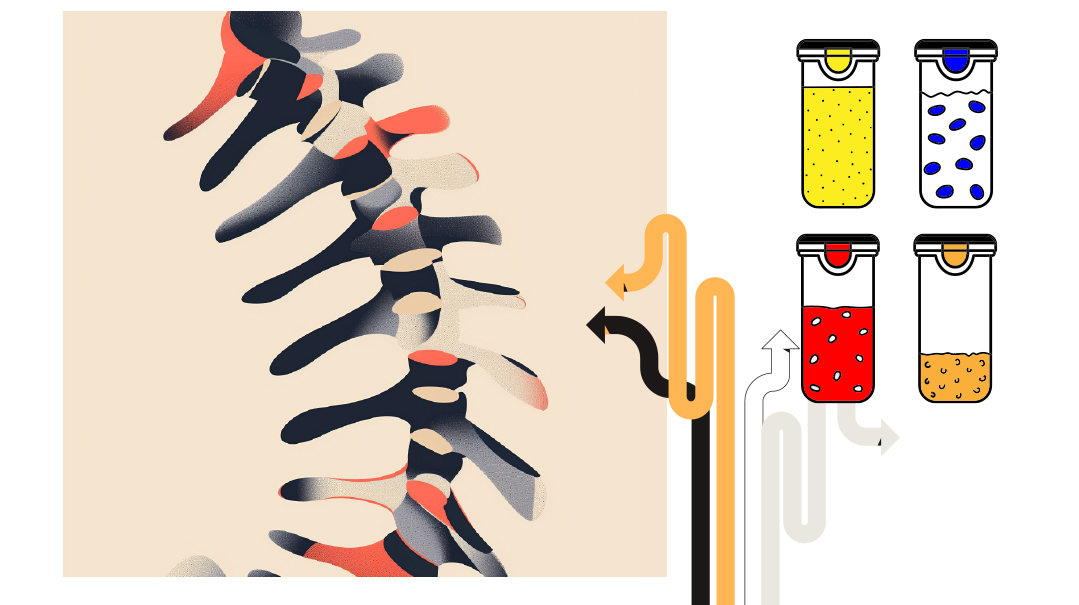

What can they do? The Felders should consider less risky options such as high-yield savings accounts, CDs, and bonds. These options offer less risk, but also less possible return than investing. Options for high-yield savings accounts can be found online. CDs can be bought at your local bank but they lock up the money. Alternatively, CDs can also be bought in brokerage accounts (think: Fidelity, Charles Schwab, and the like) and then sold (at a profit or a loss) prior to maturity if you need your money in a pinch.

Lastly, bonds can also offer relative security. To oversimplify it, you buy the bond for $1,000, and at the maturity date (such as a year or nine months), you get your $1,000 back, as well as interest received along the way. Bonds bought in brokerage accounts don’t lock up the money, but if you need to sell the bond early, it’s a gamble if you’ll profit or sell at a loss.

Each option comes with risks — e.g., bonds might offer higher returns than a savings account, but also higher risk. There’s no “one size fits all” approach to finances. A financial advisor or knowledgeable friend or family member can help the Felders weigh the risks and returns of each option.

Sara Glaz Aloni is an investment advisor and financial planner at The Munk Wealth Management Group in Cedarhurst, New York.

How to Build True Empathy

Sara Eisemann

People do things for important reasons.

A great way to build empathy is to accept that people do things for important reasons. We may not be aware of those reasons, and even the relevant party himself may not be aware of his true motivations, but he is the operating force behind the behavior.

People may protect themselves from danger that only they can perceive. They may engage in behavior that seems completely irrational to the outsider. But for them it holds tremendous importance. Awareness that behavior has meaning, even if we don’t understand it, is at the root of true empathy.

Addiction is perhaps the most confusing of behaviors. The addict can be so close to losing everything in the world that is precious to him. But as Rabbi Shais Taub teaches, the addiction continues because it’s not the problem, it’s the solution. The problem is whatever drove the person to begin using. The addiction is the solution to avoiding that intense pain. It becomes the friend to rely on when nothing else helps. And that’s why stopping is so painful; it’s like killing the part of yourself that taught you to survive. How scary is that if you don’t have new tools for survival?

Healing can work the same way. We may hold on to our pain long after its usefulness is gone. But sometimes we hold on and don’t want to heal (or can’t heal) because the pain is the last link to what we’ve lost. Whether it’s grief over the loss of a loved one, or the loss of what we needed and didn’t get, maintaining the pain is sometimes the only way we can keep the connection. And sometimes it feels as though painful connection is better than no connection at all.

With these perspectives, what seemed like crazy behavior suddenly doesn’t seem so irrational after all. And the seeds of true empathy can be sown.

Sara Eisemann, LMSW, ACSW, is a licensed therapist, Directed Dating coach and certified Core Mentor.

Watch Your Labels

Shira Savit

“I have zero self-control.”

“I’m addicted to sugar.”

“I’m a compulsive overeater.”

These are common laments from women who struggle with their eating habits. They often think they need to try harder, eat fewer calories, eliminate carbs, cut out sugar, etc. It’s important to consider: Ridding ourselves of calories and carbs might be helpful, yet ridding ourselves of negative self-labels will likely be more effective.

Whether it’s emotional eating, overeating, binge eating, or any other type of unwanted eating experience, it’s crucial to keep in mind that these experiences do not define us; they are simply behaviors, often habitual.

A practical way to differentiate is: Instead of using “—er,” switch to “—ing.” That is, instead of labeling yourself as a “compulsive overeater,” you can say, “Right now I am compulsively overeating.” Similarly, instead of calling yourself “an emotional eater,” you can identify the times you are “emotionally eating.”

Furthermore, use —ing to recognize what you’re feel-ing. Try to pinpoint a situation in which you find yourself using a behavior, such as binge eating, and describe how you are feeling. Instead of saying, “I have no self-control,” ask yourself, “What am I feel-ing? How am I feel-ing? Do I feel sad? Do I feel lonely? Am I eating because I’m stressed? Am I eating for comfort? What’s the feel-ing I’m experiencing right now?”

The “ing” language helps us bring awareness into the moment, reminding us that even with our unwanted behaviors and feelings, our inherent value doesn’t change. Letting go of negative self-labels opens the door to self-acceptance, healing, and, ultimately, growth.

Shira Savit, MA, MHC, INHC is a mental health counselor and integrative nutritionist who specializes in emotional eating, binge eating, and somatic nutrition. Shira works both virtually and in person in Jerusalem.

(Originally featured in Family First, Issue 823)

Oops! We could not locate your form.