Fuzzy Math

The mystery: How do frum families actually make it?

There's a mystery that keeps many breadwinners up at night. It's discussed in whispered tones with close friends and in rabbis' and therapists' offices. The mystery: How do frum families actually make it? How do they cover tuition, pay the bills, prevent their children from being social outcasts, and present “balabatish,” without coming out red at the end of the month? And how do they save? How do they put aside the money to make simchahs, send their children to seminaries and yeshivos, and educate their children beyond high school so they are equipped to earn themselves a living?

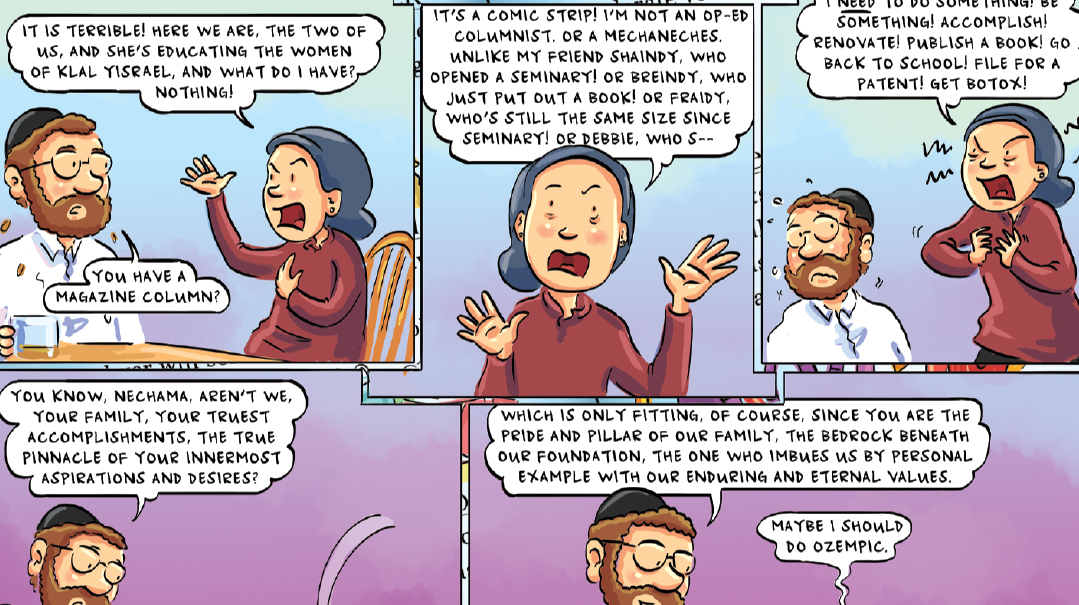

I asked a number of colleagues and friends for their thoughts and feelings about the murkiness associated with frum finances. Here is one anonymous response from a stay-at-home mom:

A few years ago, I reached out to a woman I felt close to who was 20 years older than me and whose family very much fit the chinuch-type family profile. I asked her, “How do the finances work? How do you make weddings?” She said it’s hard, they struggle, and Hashem always helps out. That response made the topic even more mystifying to me!

The mystery surrounding Orthonomics is one that many people wonder about but do not candidly discuss, due to the private nature of personal finances, and the very real role of siyata d’Shmaya when it comes to our bank accounts. However, it is obvious to anyone living in our communities that the more the issue is shrouded in mystery, with “Hashem helps” provided as a pat solution to paying the well over $100,000 needed to marry off a few children, let alone send them to study in Israel for a year, the more disheartened people become as they look around the community, with its ever-rising standards, and wonder what crash course in frum survival they missed.

People are not only mystified, they’re also frustrated. They have no idea how they’re meant to swing it without trust funds or parental support, because those are the common reasons for why people who are not in lucrative careers still seem to be managing fine. People are struggling to make it to the end of the month and feel constantly pressured by rising communal standards everywhere they turn, even as they’re trying to turn their heads away. Everything in the community — from the cars others are driving, the houses they’re knocking down, the kiddushim their friends are making and the clothes they buy — reminds them of what they must be doing wrong when it comes to frum finances.

Here is a reflection from a college-educated couple who both work full time:

We don’t understand how people do it. It is a complete black box for us. Do people just go into horrible debt as their kids get older? Do they have family money? I always feel like there is some secret that I’m not in on to what I’m supposed to be doing. We have a much more pared-back lifestyle. But it often feels like I’m doing something wrong, or that at the least, I could be doing something better.

There seems to be a lot of fuzzy math at play. Large families, large mortgages in large cities, large food expenses, large amount of clothing purchases, large simchahs. Things we have come to expect such as day camp and sleepaway camp, bar mitzvah parties, braces, and vacations to take a break from our highly stressful lives. And then there is the actual source of income. What comes in and what goes out can hardly match up. Even top 10% earners in the United States (earning $158,002 in 2018 according to data published by the Economic Policy Institute) do not make enough to sustain a frum family without financial aid in most Orthodox communities.

The 10% earners in the United States are comparable to the American frum middle class. If you do the math for an average Orthodox family of five children, you’ll quickly realize that full tuition, health insurance, mortgage, and all related expenses, frum and otherwise, makes it very tight for families on such a salary, especially in the more expensive, large Orthodox areas. Saving at the end of the month for simchahs, home improvements and repairs, and higher education is often untenable. Some yeshivah day schools do provide financial aid for these families to ease the burden, while others do not. For families in this income bracket, tuition proves to be the great equalizer.

Lifestyle expectations exacerbate an already challenging situation of meeting basic expenses of the frum household. They also disillusion many, as such upscale communal norms seem to send mixed messages regarding priorities and values. A full-time employee who is pursuing a master’s degree said the following:

I think the frum community sets up unreasonable expectations that are not congruent with both Torah expectations and realism. People will pour money into their homes and become “house poor” and put their families at a disadvantage because the expectation has become that you must have an updated home and appear wealthy, or at the very least have it all together. And even though so many community members don’t want to be held to this standard, they become enmeshed with the expectation and don’t want to be seen as a “have not,” whether this is real or just perceived. The expectations of owning a beautiful, updated home, along with dressing well and paying all the bills and still having money to enjoy life, leaves many at a deficit that in turn causes stress and possible shalom bayis issues. We’re not even talking about preparing for the future.

One professional in the mental health field came to this conclusion:

I don’t think most people have the money to support the lifestyle. The unspoken expectations and needs are way beyond what most people have to pay for them.

So how does it work? How do people get by? This candid response from someone who works in the Jewish nonprofit world is sobering:

The reality is that most people are living in debt. It’s challenging when we work hard to “do the right thing” and set the right example for our kids, yet somehow it feels like we always get the raw end of the stick. We live so frugally so that we can pay full tuition, because we believe that’s the right thing to do. That means that we don’t go jet-setting for vacations, or shop at the most expensive stores. Kids in today’s world really do struggle to understand this, especially since it’s unfortunately not the norm. It’s hard for me to see my friends spend loads of money on vacations when I know they pay less tuition than I do and most likely make more money than I do. I just have to remind myself that it’s the system that is allowing that to happen and at the end of the day, I’m doing the right thing.

Lots of questions and concerns. Not many answers. Not from me, at least.

I hope someone out there has some good ideas.

Perhaps by shining light on the elephant in the room, readers will feel validated that they aren’t the only ones struggling to figure out how to pay for the life we lead. While the work of Mesila and other such financial education organizations should be acknowledged as essential in creating more financially-healthy communities, we clearly have more work to do. As living within one’s means isn’t en vogue in our “everything is imported and photographed” culture, where do we begin? What needs to change, and how do we inspire change?

But first, how do we put the brakes on this driverless train that is off the tracks? And, how can our institutions take a hard look at the struggles of well-meaning families trying their best to live within their means, and see what changes and improvements can be made to our communal infrastructure?

Alexandra Fleksher is an educator, a published writer on Jewish contemporary issues, and an active member of her Jewish community in Cleveland, Ohio.

(Originally featured in Mishpacha, Issue 846)

Oops! We could not locate your form.