Dollars and Sense

Did you get gelt on Chanukah? Which leads us to the next question: will you spend or save?

Options, options

Ask around and people will have all kinds of answers for where they like to keep their money. Some prefer knowing their cash is on hand for whenever they need it. They might keep a stash of bills under the mattress or some other hiding place. For those who like to know their money is safe from thieves, the bank is the place to be. And then there are risk-takers who put their money into investments.

So many different options. Have you ever wondered where your money should really be?

Before deciding where to store your cash, it may help to know where you’ll get the biggest bang for your buck.

The piggy bank

Yitzy is 12 years old. For three years his father has been paying him three shekels for every blatt gemara he learns. “The first few times I got my prize money, I was so excited. I ran to the makolet to spend it straight away on some nosh,” Yitzy tells me. “After a while, I realized that if I saved it instead of spending it all, I would have a really nice amount of money. I decided to save up for that electric scooter I really wanted. A new scooter can cost as much as 3,000 shekels. But a lot of people find really good second-hand scooters that cost about half that amount.”

I ask him where he’s keeping his money in the meantime. He says it’s piling up nicely in a jar (he refuses to tell me exactly where that jar is, but I’m guessing it’s somewhere he can keep his eye on).

Yitzy is saving for a short-term goal. He’s also adding cash to his savings pretty frequently, so it makes sense that he’s keeping it all in a jar. (You may have figured out that “piggy bank” doesn’t have to be a literal piggy bank — you can stash your cash under your mattress, too.) Once he’s saved enough money, he’s going to buy an electric scooter right away. The piggy bank option is working out well for him.

To Save or Not to Save

A savings account is a popular option for kids, and most of the kids I spoke to had one. For most people, a savings account is a no-brainer. After all, it’s meant for savings. But is a savings account always the way to go?

Eliyahu opened a savings account last year when he became bar mitzvah. His savings account doesn’t allow any withdrawals before the age of 18. When I ask Eliyahu if he’s saving up for anything in particular, he says, “Yeah. I’m saving up for a Lamborghini.” He changes his mind pretty quickly when I tell him how much that particular brand of supercar can cost. Eliyahu has a paying job every Friday. He works in the office of his local mikveh and gets paid weekly. He says that this money goes into his savings account almost immediately.

I ask him if he knows how much interest his bank account earns. “Yeah, about 0.01 percent or something like that.”

What is interest? And why is it so interesting?

How Interesting

Interest is when a lender charges the borrower for taking out a loan. Say Mr. Weiss walks into Bank of America and requests a loan of $10,000. In an ideal world, the bank clerk will lend Mr. Weiss the money out of the goodness of his heart. But in the real world, the bank wants to make money out of this loan. So, the clerk will say, “Sure, you can have $10,000. You have to pay it back in full within six months. And we’ll charge you five percent interest on the loan.” This means that at the end of six months, Mr. Weiss has to pay back the original $10,000, plus five percent of $10,000, which is another $500. So, Mr. Weiss needs to pay back a total of $10,500.

Where does the bank get the $10,000 to lend Mr. Weiss in the first place? Some of it may come from the funds you deposited in your account. What? The bank is using my money? Chutzpah!

No need to worry. Legally, banks must have enough cash reserves on hand so that their customers can withdraw funds from their accounts whenever they want. Your money is still there, safe and sound. Now, because the bank is using your money to lend to other customers, the bank pays you interest too. They still make money because they pay you less interest than they charge borrowers like Mr. Weiss.

Different bank accounts earn different interest rates. Here’s a quick rundown on two popular bank accounts:

$ Checking account: has money coming in and going out all the time. Adults use checking accounts to receive money from their workplace, which they spend in stores and to pay bills. Checking accounts may not earn any interest at all.

$ Savings accounts: more money going in than out. All earn some interest but some types of savings accounts earn much more interest than others. Typically, when a bank knows that you’ll keep your money in an account for a long period of time, they’ll pay you more interest. Some children’s savings accounts have higher interest rates because you’re not allowed to withdraw money until you turn 18. But there are accounts that have even higher interest rates.

FYI, an interest rate of 0.01 percent is nothing to get excited about. Eliyahu can do much better than that.

High-yield Savings Accounts

There are savings accounts, and then there are high-yield savings accounts (HYSA). The main difference between the two is that HYSAs earn you ten times as much interest. I found one kid-friendly HYSA that was offering 0.4 percent interest — that’s 40 times more than Eliyahu’s savings account. Is there a catch? Yes, more than one, but they’re not that big of a deal:

$ Most HYSAs require you to leave your money in there for a fixed period. That can be anywhere from three months to five years or more.

$ Some high-yield savings accounts require you to deposit a fairly high sum of money ($100-$1000) to open the account, but not all do.

$ You may be required to deposit money every month.

$ You may get charged every time you make a withdrawal.

The good news is that there are HYSAs that don’t require a minimum or monthly deposit and don’t have any fees.

For many kids, none of these things are a problem anyway. High-yield savings accounts are usually a much better option than a plain ol’ savings account. None of the kids (and few adults, for that matter) that I spoke to knew about high-yield savings accounts. That’s because most HYSAs are only available at online financial institutions. When a kid walks into a bank with his parents to open his first bank account, the bank is not likely to offer a HYSA. Online banks can offer higher interest rates because they have fewer expenses than a brick-and-mortar bank.

But why should you put your money in a regular savings account if you can put it in a HYSA? Savings account are more practical for people who want to save for short-term goals and don’t want to use the piggy bank option.

Eliyahu might do well with a HYSA rather than a regular savings account. If he can contribute to his HYSA every month and not make any withdrawals for several years, then a HYSA would get him a bigger payoff.

Inflation

Inflation is the big bummer. It’s got nothing to do with balloons, and everything to do with the fact that the value of money decreases over time. “Inflation” sounds like the money is getting bigger, but it’s really getting smaller in value. In 1900, $100 would have bought you the same as $30,000 in today’s money. If someone in 1900 would have put $100 in a savings account, do you know how much his descendants would have today? Just $3,000! That’s because the dollar has an average inflation rate of about 3% every year since 1900. Turns out, the guy should have just spent his $100 in 1900, when he could have bought $30,000 worth of stuff, instead of saving it. He thought he was being smart, but his money is worth a lot less now than it was back then.

Inflation is the number one reason why people invest their money instead of saving it.

Investing

Say the word “invest” and most people will be gone before you can say “money”. Investing can be scary. That’s because there’s always a risk of losing your money. But there are all types of investments, and some are low-risk while others very high-risk.

Wealthy people can afford to invest in high-risk investments because they don’t mind losing a lot of money. High-risk investments can be very lucrative (produce a lot of profit). But the average Joe, and certainly the average kid, should stay far away from high-risk investments.

Most people who want to invest responsibly do so with low-risk investments. The first rule of investing is “know what you’re investing in”. The problem for most people is that they don’t have time to start learning about different types of investments. They just don’t know where to start.

The good news is that there are investing options for dummies. These are investing accounts, and most banks offer them. Investment accounts usually have an average interest rate of 3–12 percent. In an investing account, you choose how much risk you feel comfortable taking. The bank then invests your money for you. That’s it!

Is it really so simple? Yes, but there are some things to be aware of before you start:

$ Investing this way won’t make you rich overnight, or even in one year. In fact, sometimes you’ll even lose money in the short run, because the things you’ve invested in may lose value temporarily. (In the long run, though, most low-risk investments gain in value.)

$ The general rule is: invest for five years or more. Then you’re much more likely to see your money grow. Investing means that your money will grow instead of just sitting in the bank. If it grows at least at the same rate of inflation, then you’ve done well.

If our guy in 1900 would have invested his $100, it could have grown to more than $3 million today.

The side hustle

What could be a better way of growing your money than investing? Well, there’s always the side hustle. A side hustle is a way of making money from something other than your main job. Your main job right now is school. Sorry, not sorry.

To find out more about the potential perks of starting a side hustle, I spoke to Tamara. She is 16 years old and made $1,000 from the day camp she ran in the summer.

JR: Tamara, that’s a lot of money. What did you do with it all?

Tamara: At first, I had no idea what to do with so much money. Then I watched as my friend started a small business. I realized that I can use my $1,000 to start a small business of my own making personalized gifts that I can sell to friends, family, and even my school. It’s a fun thing to do, and a pretty easy way to make money.

JR: Cool plan! How much do you need to set up your business?

Tamara: Several hundred dollars to buy equipment and supplies, but it shouldn’t take too long to make back that money.

JR: Starting a business is a big step. You’re very brave.

Tamara: I’m at a stage in life where I have time to figure out a business and it doesn’t matter if I don’t make loads of money right away. Plus, I’ll only take as many orders as I have time for so it won’t interfere with my school work or helping out at home.

JR: What will you do with the money you make from your business?

Tamara: I’ll invest it right back into the business. I’ll use it to buy more equipment so I can offer customers a greater variety of products.

JR: Have you considered what will happen if your business isn’t successful, for whatever reason?

Tamara: It’s a risk I’m willing to take. I plan on working really hard to make back at least my initial investment. Anything I earn after that will be a huge bonus and I won’t consider it a waste of money if nothing more happens.

Babysitting is also a side hustle. So is Eliyahu’s Friday afternoon job. But Tamara’s side hustle takes things to another level. There are only so many hours that Eliyahu can work in the mikveh, and only so many hours that girls can babysit. Tamara’s side hustle has plenty of room for expansion, if and when she wants to grow her business. She says that she can take large orders because she can pay her younger sisters to help her fill them. Her investment has lots of potential to grow, likely even more than if she would put it in an investment account.

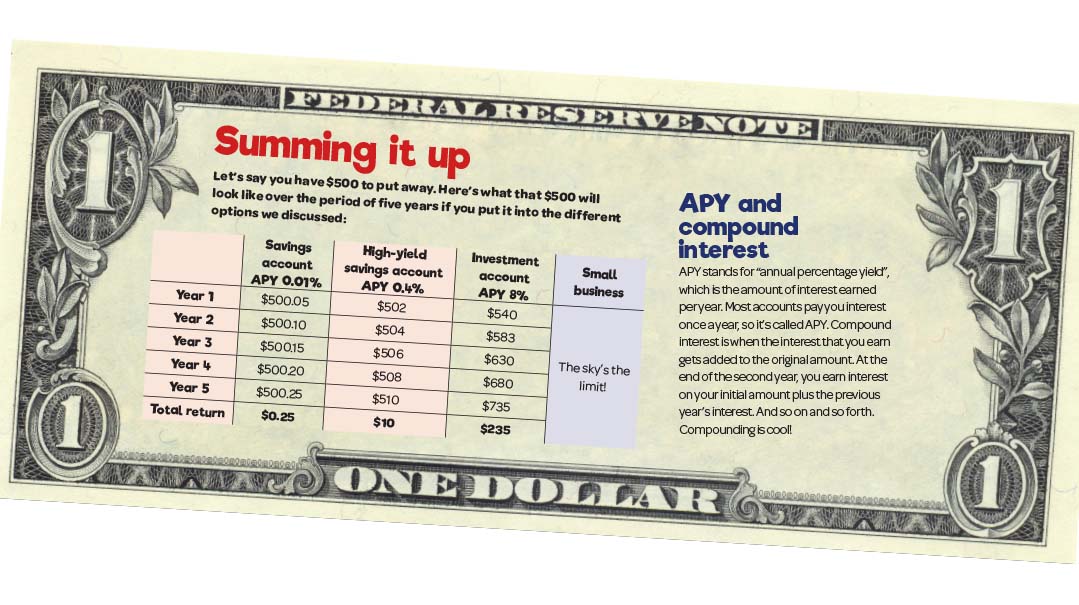

Summing it up

Banks in America

Most people select a bank based on which banks are available in their neighborhood. Here are the US banks that have the most branches:

Chase: 5,100

Wells Fargo: 4,967

Bank of America: 4,203

BB&T: 2,781

PNC: 2,825

There’s no right or wrong place to put your money. There’s only what’s right for you. Now that you know more, you can make a smarter decision.

(Originally featured in Mishpacha Jr., Issue 889)

Oops! We could not locate your form.