An Arm, a Leg, & 30 Years of Scrimping

| September 26, 2023Housing prices, mortgage rates, and inflation have skyrocketed. Yet many young couples are still buying homes. How are they doing it? And should they be?

You’d never know from looking at them. He pushes the stroller, she smiles and the kids run ahead, laughing and holding hands. He takes out the garbage, she joins the meal train, and they’re just the sweetest little family of six.

But the baby sleeps among the suits and dresses in his parents’ walk-in closet. First-grade Chaim sometimes locks himself into the kids’ bedroom just to be alone. The dining room features a precariously balanced pile of toys; the blow-up pool and roller blades and boxes of succah decorations and old stretchies all live on the five-foot-wide porch. There’s nowhere else to put them.

Even the bathroom, which used to be a sacred space, has its door banged down if occupied for any number of consecutive minutes.

Sometimes, Brochi straps all four kids into the car and drives, drives, drives.

She isn’t ready to go back to her cramped two-bedroom apartment.

At their wits’ end, Brochi and her husband are searching for a place to call home.

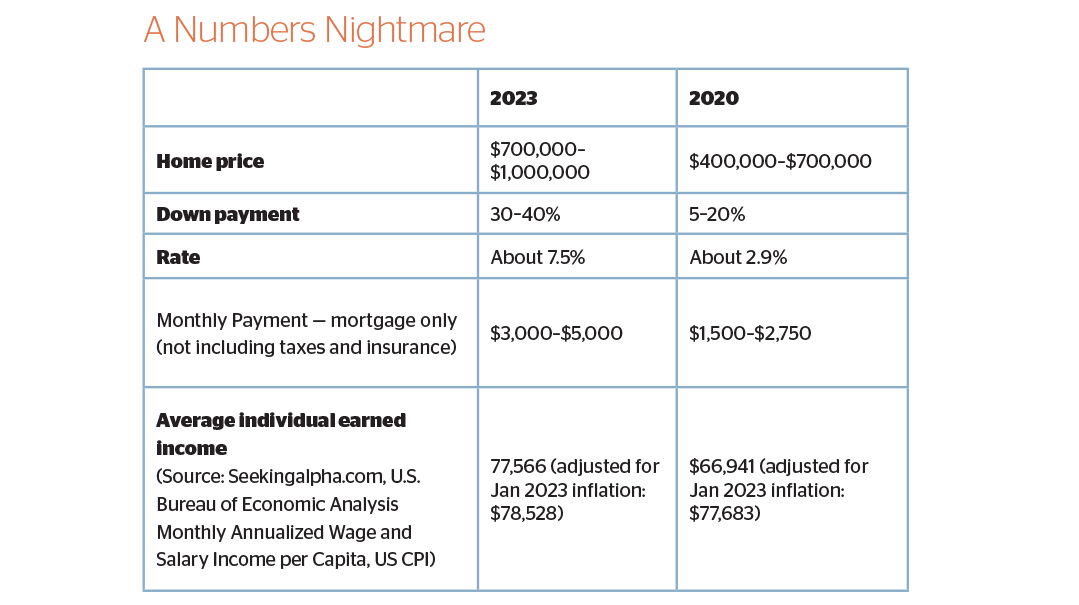

Though they spent their entire married life carefully saving up for a down payment, with sky-high home prices and mortgage rates that make grown men weep, the Lakewood, New Jersey couple was quickly losing hope.

In Brick, a township adjacent to Lakewood, a foreclosed house was up for auction. “We didn’t have a better bet. We bid for that dim, little ranch like our lives depended on it,” Brochi recalls.

A Nation-wide Issue

There’s a housing crisis in the frum velt in the United States.

There aren’t enough properties in the main hubs, driving the prices up. “Here in Monsey, there are bidding wars on most houses we sell,” says Rachel Schnitzler, a real estate associate broker at Q Home Sales.

Mortgage rates and inflation are sky-high. “There’s no question about it,” says Queens realtor Shlomo Meirov. “The real estate market was hit tremendously with the impact of interest rates and inflation.

And many of those who do own properties are struggling to meet their monthly payments. Simi Mandelbaum, founder of PROSPR Financial Wellness, a certified financial therapist and coach, explains, “Because rates were so low during and immediately after Covid, along with government Covid checks, people rushed to buy houses. They overextended themselves and assumed that the lower rates would balance things out. Then mortgage rates went up, and inflation skyrocketed. I’m seeing clients who purchased those large houses and are now feeling a lot of tension around money and earning potential.”

But families are purchasing homes at a younger age than ever. Despite exorbitant listing prices and rising fees and asphyxiating monthly payments, they’re somehow making it work.

How are they doing it?

Parents Pay Up

“When it comes to home buying, younger people who don’t have wealthy parents are doomed,” says Rabbi Avrohom Jaffe, director of SBCO (Southern Brooklyn Community Organization).

“Parents are really stepping up in a lot of cases,” Shlomo observes. “In the last few deals I did, the parents helped their kids a lot more than usual.”

That could mean shelling out the down payment, taking responsibility for the monthly mortgage payments, or cosigning.

A loan officer at Skyrock Mortgage, Adina Jaroslawicz has an insider’s view of hundreds of approval processes. “Heavy reliance on cosigners has become the norm,” she says. That means that even if a couple doesn’t earn enough to qualify for a mortgage, if their parents sign the mortgage as well, the bank or lender will look at both combined incomes, thus enabling them to qualify. “What’s worrying is that although it’s the buyers who are expected to make the monthly payments, the approval is based on the cosigners’ income,” she explains.

“Additionally, when interest rates were at three or four percent, it was common that people wanted to put the lowest down payment possible. That practice is now unsustainable. It’s a lot more common to see people put 30 percent or more down. With rates so high, there’s no other way. For the most part, those who can’t put together a lot of cash aren’t buying right now. And even those who put a lot of cash down are still needing cosigners.”

And by sticking their necks out as cosigners, are they taking the fall for their children’s financial decisions?

As a parent herself, Simi validates the drive to coddle children. “I want to do as much as I can to protect and help my kids. All parents do. That said, I see a lot enabling on the parents’ part. I know a few cases where the wife didn’t know that her husband hadn’t paid the mortgage in months, until her parents told her that as cosigners, they had received threats of foreclosure.”

A Big Bite

Then there are those who do buy on their own.

“People are earning younger and spending faster,” says Simi. “With technology, Amazon businesses, and other new opportunities, there’s more earning potential available than ever before.”

It’s the gilded age of instant wealth.

But there’s a darker side hidden under all that brick, granite, and Swarovski.

“People are going for the splurge without taking all the costs into account. Buying Teslas, because the electric car tax credit has become the norm, without factoring the ongoing monthly finance costs. People today also believe that a house is an asset without any liability, and they’re driven to make the purchase as early as they can.”

Then, when the maintenance fees hit, “They feel tight, anxious, and out of control. That’s when we see them in our office,” Simi says.

Yossi and Sari Schwartz* were stressed about money. He was a nursing home administrator with a six-figure paycheck and she had an office job. Despite having great jobs, the couple was in debt. Simi worked with them for two years to get out of the red and put money away for the future.

Financial stability was regained and all was well.

Then the Schwartzes called.

Interest rates were low and the couple was tired of living in an attached home. They wanted more space and privacy.

They had already signed the initials on a spacious new house on an acre of land, but they didn’t want to make the final move without Simi’s go-ahead.

“Let’s meet. Let’s talk this through and figure this out,” Simi said.

The Schwartzes’ duplex was price-capped. The difference between the two homes’ costs: $700,000.

Yossi promised to work harder in order to fill the gap and pay the higher mortgage.

“Let’s look at a day. What does it look like? What hours are you working? When are you relaxing?”

Yossi was already working from eight a.m. until eight p.m. When would he cram the additional hours? Weekends? Nights? Vacations? When would he enjoy the house? “It isn’t just the cost of the house,” Simi explained. “What will it cost to outfit the house?”

Simi watched as the reality sunk in. Sari realized that if she bought the house of her dreams, she wouldn’t have a husband to enjoy her life with. The couple got very scared when they realized what the purchase would do to them as a couple and a family. They decided to continue looking for a house with a price point they could handle.

“People don’t realize that a house isn’t just a down payment, closing costs, and interest rates. It’s a whole package: mezuzahs and furniture and linens; maintenance and cleaning help and hosting costs, home insurance, taxes, escrow, and an emergency fund in case something breaks. People often don’t take these costs into account, but they quickly add up and can run into the thousands. They don’t look at the whole picture. They don’t realize what their purchase will really cost them — and what it will do to their lifestyles. I often explain that the fact that you were approved for a loan does not mean that you can afford it. All told, your housing costs should not exceed 30 percent of your income,” explains Simi.

“Some people empty their accounts to buy their homes. It makes me feel a little nervous for them,” says one realtor. With no buffer, a broken fridge or a root canal or even an unexpected occasion can collapse the entire house of cards. “Buyers have to ask themselves, ‘Can I handle the jump, or is the gap too large to safely cross?’ If buyers aren’t careful, a wave of foreclosures might be imminent.”

Finding Solutions

What can couples do to enable themselves to qualify for a mortgage and then be able to pay it?

In difficult times, creativity can transcend the confines of circumstance.

Increasingly, owners are renting out their basements, extra bedrooms, garages, and dens to help with mortgage payments.

Adina advises, “Improving their credit or opting for a creative mortgage solution are a couple of options to improve a buyer’s ability of getting the best rate possible.” When couples can obtain lower rates for the first years of their mortgage, it is “easier for them to be approved and makes the monthly payment that much more affordable.”

On how priced-out families should approach home buying, the Lakewood Commons non-profit developer Rabbi Shmuel Lefkowitz says, “I advise people to start slow and buy something small. People want a detached house with a pool and a 100-foot backyard. You have to decide whether you’re ready to live in a place where the next frum neighbor may be two blocks away. People have to tone down their expectations. Think about what’s most important when raising a frum family. I always say that if you want to live among frum Yidden and bnei Torah, you may have to sacrifice on the home.”

And how can you stand out among other potential home buyers outbidding you and be the one to secure the property? “Sometimes, waiving the appraisal or the mortgage contingency is the only way to close a deal,” Rachel says. That means foregoing a professional assessment of the property’s value, or foregoing the opportunity to back out of the deal without financial penalty and losing the down payment if you don’t end up qualifying for a mortgage. These options will expedite the process of buying the house, making you a more ideal buyer for a seller looking to offload a property, but, “I tell buyers not to do this without a backup plan and unless they can afford to risk losing their down payment.”

Migrating Outwards

More and more, families are moving out of town — or at least away from the very centers — to buy their homes.

Rabbi Simon Taylor, National Director at OU’s Community Projects and Partnerships, is working on a solution for those priced out of in-town markets. “At the OU, we very much believe that you can have wonderful, and much cheaper, quality of life in many out-of-town communities across America. The OU is absolutely obsessed with affordability for the frum community,” he explains. “We try to tackle the issue in every way we can.”

Rather than creating communities from scratch, the organization invests in taking existing neighborhoods with Jewish infrastructure to the next level. “We work with over 100 small communities, advising them on how to build on their infrastructure and become more attractive to those living in big towns.”

The OU is developing a website where users can filter for communities with various requirements. Options will include, for instance, “Lakewood kollel,” and “kosher restaurants.” “Painstakingly, community by community, we gather the information from people on the ground. We want to encourage those who feel priced out or unnoticed in their large cities to consider moving out of town. That’s why we run the biannual Savitsky Fair, endowed by former OU president Steve Savitsky. Booths highlight different communities across the country so people can check out the places and schedule live visits where they’d like. The communities draw a diverse mix from yeshivish to left-leaning Modern Orthodox.

Of the many OU-assisted communities, a handful are wildly successful. “The others,” Rabbi Taylor says, “are trickling along. Part of the reason many out-of-town communities stay small is because of the gravitational pull that seems to suck so many into the massive ‘frum’ areas.

“Phoenix, Vegas, and Houston are some out-of-town successes — all these areas are known for their pleasant climates,” Rabbi Taylor notes. “School tuition vouchers that the OU advocates for have also been a game changer and have had a major impact on places like Cleveland, and of course, South Florida.”

But it seems that as soon as an area builds up enough to boast more than a scant minyan, housing prices explode and tri-state troubles quickly migrate. In some places, even people looking to buy out of town are being maxed out of the market. Until recently, North Miami Beach was an ideal low-cost housing destination. Considered the most affordable slice of the Sunshine State, the city is no longer quite so affordable. Shulamit is the founder of My Jewish Florida, a website that helps newcomers and vacationers navigate the area. “When I first moved here a few years ago, houses went for $400–$700,000. Those same homes are now asking between 7K and a million. These are all one-story homes, most of which aren’t in move-in condition and need significant amounts of work done to make them livable.”

And with a shrinking globe thanks largely to travel and Wi-Fi, many feel that true “out-of-town culture” and the lower costs of living there are a rapidly disappearing phenomenon. Shaindel moved to a far-flung Texas town. Her motivation wasn’t a mercenary one; she wanted to make a difference in the kiruv sphere. “I have the same Odyssey and Irene sheitel and Lil Legs sets as my New York- and New Jersey-based friends do,” she says. “I don’t think I’m living any more cheaply than my in-town friends are.”

A Wise Idea?

The state of housing really begs the question: Should we even be working toward the goal of buying a home?

“There are many benefits to owning a house,” says Rachel of Q Home Sales. “People think they’re staying in their rental long-term. They get comfortable there, and then one day, their landlord needs the space and they have to buy. It’s very tough for a family when they’re told out of the blue that they have 60 days to move out. They’re in a total frenzy and often seriously overpay for a home.”

On top of the uncertainties of renting, rent prices have recently increased. It’s a lot less affordable to rent these days than it was in the past. Shlomo, a realtor from Queens, says, “I just sold a house to a young family. I asked them, ‘Are you sure you’ll be able to pay the $7,000 monthly fees?’ They told me, ‘We’re currently renting for $4,000 a month. We’d prefer to own, paying $7,000 a month, knowing that the extra $3,000 will help us down the line.’ I thought that made sense. Yes, the market is difficult right now. Yes, there is less inventory. But serious buyers are making it happen. People who need to buy or sell are doing so; anyone who doesn’t is staying put.”

“I think everyone should own a home,” Rachel says. “I tell people, ‘Don’t wait for next year, don’t wait for rates to change. If you can afford to buy a house, do it now.’ A stable living situation, owner equity, the ability to expand or sell… there’s no reason not to.”

“Each person we see has their own story,” Adina says. “For some, it’s a massive raise at work. For others, it’s a gift or an inheritance or just a crazy good deal. For families who would have otherwise never had the money, it’s somehow working.”

“When you’re buying a house, Hashem blesses you,” says Shlomo. “I’ve been selling homes for 20 years now, and I always notice that after a year or two, mortgage payments somehow fit themselves into the families’ budgets. Somehow, people seem to manage. That’s not to say that we don’t have to do our due diligence and differentiate between need and luxury, but it’s a heartening thing to see.”

When Rivka moved to her apartment after her wedding, she never dreamed how long she’d be there. That’s why she didn’t pay much attention to the slight mustiness and the sad lack of sunlight. The home was old and mold-prone, and all the dehumidifiers in the world couldn’t combat the moistness.

Then her third was born with the worst case of eczema the hapless mother had ever seen. “Every doctor contradicted the other. More baths, no washing, new soap, never soap… we got more and more confused. The only consensus we got was, ‘You must move. An old, musty basement is the worst place for your son’s skin.’

“Every day home with my son was torture. The bleeding, the scratching, the vomiting, the crying… it was so hard to watch. I felt like I was causing him pain because we weren’t living in a house. We were looking, but the market was impossible.”

Then the couple heard that someone had bought an investment house in a sold-during-blueprint-stage Lakewood neighborhood. They called the investor directly and asked if they could buy it off him. A well-off relative offered to help out with the finances. A few deals had gone well, and with extra cash on hand, he decided to give them not the $25,000 he’d promised, but $100K.

During the quarter when Rivka closed the deal, a forgotten investment ripened with massive returns, and the enormous down payment and closing costs were suddenly covered. The mortgage company included the investment returns in the family’s income, and they were finally approved for the loan they needed. “Within two weeks of signing all the documents, we moved into our beautiful, brand-new, blessedly must-free house.”

Best of all, Rivka’s son’s eczema is slowly clearing up.

Not everyone’s story involves obviously orchestrated windfalls. Most are more covert, and it takes effort to pick up on the storyline as it’s occurring.

Buying a home will always be a leap of faith. However, as Simi puts it, “Life is an ebb and flow. So is money. Stocks and rates and inflation don’t stay the same. It may never be the perfect time to buy a home, but if it’s important to you to own one, you can and will find a way to make it work, consistent with you values, goals, and money.”

An Uncommon Solution

In 2003, real estate prices started climbing in Lakewood. Yungeleit at Beis Medrash Govoha asked the roshei yeshivah for help. Lakewood had a lot of vacant land at the time, and through the advocacy of Rabbi Aaron Kotler and BMG yungeleit, the township allocated free land for an affordable housing project. To choose the lucky buyers, blind lotteries were cast.

There were over 5,000 eligible applicants for the total of 380 units built and sold. The last of six building phases is being completed. The 22 newest units sold for a meager $220,000–$300,000, depending on the grant.

The cheapest units have a 30-year selling restriction period. The others can be sold a decade after purchase. Because of the endowments, there are unique contingencies applied to sales.

“The Lakewood Commons model can’t be easily replicated as it requires free land and housing grants,” says Rabbi Lefkowitz. “The project was truly min haShamayim. I don’t see any concrete expansion opportunities today.”

When Rabbi Lefkowitz started Lakewood Commons, Rav Yosef Rosenbloom ztz”l called and asked to see him. “I went to his Brooklyn home, and there was a line of people waiting to talk to him that stretched all the way down the block. I told the gabbai my name and he took me in immediately.

“Rav Rosenbloom told me that it was a great zechus to be building affordable housing for bnei Torah. In order to be zocheh to this, I had to make sure that the houses were built with tzniyus in mind. We discussed some precautions, including separate entrances for each family and higher than average fences between porches. Rav Rosenbloom emphasized that the provisions were especially important because the homes are for yeshivahleit.”

Is This the Right Place for Me?

It’s only during the first showing Rachel does with a client that she sees what they really want.

“Over the phone, people are okay with a lot of things. When they see the place, both they and I start to understand what’s important to them.”

Rachel recently took a cost-conscious buyer to a home. She wasn’t even looking at the size and condition of the home. All she cared about was the fact that there was no privacy between the homes. I later showed her a fixer-upper on a property full of bushes and trees. She immediately fell in love and bought the home.”

Simi believes that honest conversations are the first step to achieving those goals. She once worked with Ahuva, who was absolutely desperate to buy a house. “It was so important to her, she couldn’t talk about anything else. As we discussed the situation, Ahuva shared that she was the oldest child of poor parents. She remembered how stressed and cash-strapped her parents were when they married her off. They wished they had a home they could borrow against, but the family was still renting. When she got married, Ahuva’s first priority was to buy a house. Her husband had heard, ‘I want to buy a home,’ and immediately thought of a million-dollar purchase, while his wife didn’t care if it was a tiny bungalow. She just wanted the security of homeownership.”

(Originally featured in Family First, Issue 862)

Oops! We could not locate your form.