Invested in Marriage

What do couples do when they find themselves disagreeing about how to allocate available funds, or how to come up with funds that simply aren’t available?

W

hen you think about all the Yom Tov charges on the credit card this month, you get a pit in your stomach, but your spouse is nonchalant: “It will even out in a couple months, it always does,” he assures you blithely.

Or perhaps it’s the other way around. You know your husband’s going to open the credit card bill and explode, asking you why you can’t stick to the budget, And you wonder how you’ll defend yourself, when you just can’t manage without certain things.

In many frum households, finances are a challenge, especially before Yom Tov. But financial stress is just the beginning.

What do couples do when they find themselves disagreeing about how to allocate available funds, or how to come up with funds that simply aren’t available?

Better ways for couples to tackle common financial dilemmas

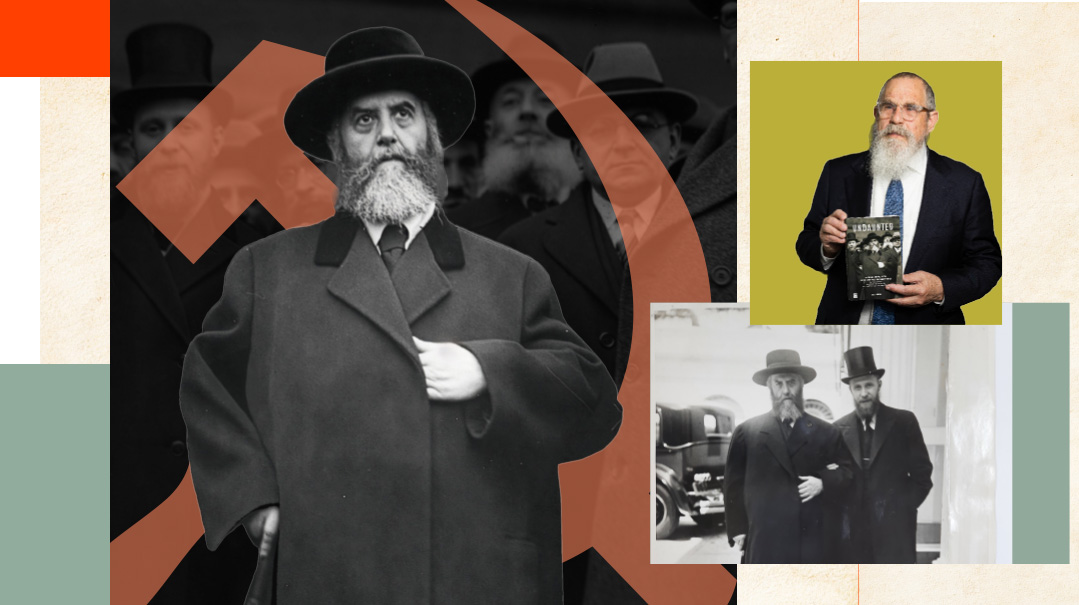

Meet the Experts

Rabbi Yitzchak Shmuel Ackerman is a Brooklyn-based licensed mental health counselor for individuals, couples, and families, in practice for over 30 years. His book, Confident Parents, Competent Children in 4 Seconds at a Time, is due out this spring.

Mrs. Elisheva Kaminetsky, director of spiritual guidance at the Stella K. Abraham High School for Girls, has been involved in Jewish education for over 25 years. She also gives adult lectures and is a kallah teacher. She lives in Woodmere, New York, with her husband and family.

Josh Hurewitz, MBA, PhD, has served as the counselor coordinator at the Baltimore branch of Mesila, an organization that empowers individuals and families to achieve and maintain financial stability. He is also managing director of GrowBridge Consulting, which provides consulting services to companies of all sizes.

Rifka Lebowitz is a financial consultant and speaker in Beit Shemesh who specializes in helping business owners, individuals, and couples be smart with their money. She’s the author of Smarter Israeli Banking and the creator of a course for couples called “Marriage and Money,” as well as an international lecturer for Nefesh B’Nefesh.

Slippery Savings

My husband and I both work. At this point, we get through the month, hold our breath when Yom Tov rolls around, and basically come out even. But our oldest is 15, and I’m starting to worry how we’re going to pay for our children’s weddings. We put away money each month for this purpose, but whenever we’re short — and as the kids get bigger, that happens more and more often — my husband dips into the savings fund. He says it’s better than borrowing, and anyway that’s what it’s for. But I’m getting pretty fed up, since I don’t see how there will be anything left when our children reach marriageable age.

What should our approach be? Should the wedding fund also be our emergency fund, or should it be untouchable? Should we borrow when we have a shortfall or dip into savings? And how can my husband and I get onto the same page?

Rabbi Yitzchak Shmuel Ackerman:

While I hear all of your questions, the main one right now seems to be about which is preferable — borrowing from yourself or from other people. Although your husband is averse to owing people money, if he continues to borrow money from your wedding fund, you’re going to end up borrowing for the weddings.

While you’re convinced that your approach is right, not borrowing from other people may also be a valid approach. Do you have any other solution to your money dilemma when it comes to crunch times or unexpected expenses? If you do, share it with your husband and see if he’s on board. If not, you may have to think outside the box. The end game is not for one of you to convince the other, but rather to find some middle ground or alternative solution.

What can either or both of you do to increase your income, rather than managing with less? Sit down and discuss the situation, without labeling — because once frustration enters the picture, it’s very hard to reach a solution. Really listen to each other, and if necessary, seek outside help to figure out a way out of this win-lose situation.

(Excerpted from Family First, Issue 585)

Oops! We could not locate your form.