Unintended Targets

| May 13, 2025"Trump’s tariff wars hit e-commerce hard — and sellers are scrambling to adapt"

President Donald Trump never fails to deliver on drama — and at center stage since he re-took office have been a series of “on again, off again” tariff wars on imports, especially those from China.

This week, sprint negotiations in Geneva yielded a 90-day pause to what were 145% duties on all Chinese products while the two nations work toward a long-term trade deal.

The hiatus gives importers breathing room, but the possibility of their return and the president’s global trade war have elicited a range of responses from some of the frontline soldiers serving close to home: the frum-saturated e-commerce market.

Wholesale Squeeze

Dovid Pinter, president of Savewize, a New Jersey–based wholesale distribution business, has staked his company on sourcing overseas products at low prices, offering an array of items that runs from vacuums to cosmetics and K-cups.

“We’ve always worked hard to offer real value to our customers,” he says. “But when the cost of imports went up so sharply, there wasn’t any way to keep prices the same. The only option was to pass some of that increase along.”

Products sourced from China — especially small appliances like coffee makers — saw prices jump by as much as 100%.

With China responsible for a large share of global manufacturing, Mr. Pinter says these market changes could impact not only prices but product availability.

“China has entire towns dedicated to making one item,” he says. “You can’t just replicate that in a new country overnight. Other places cost more, take longer, and aren’t as efficient.”

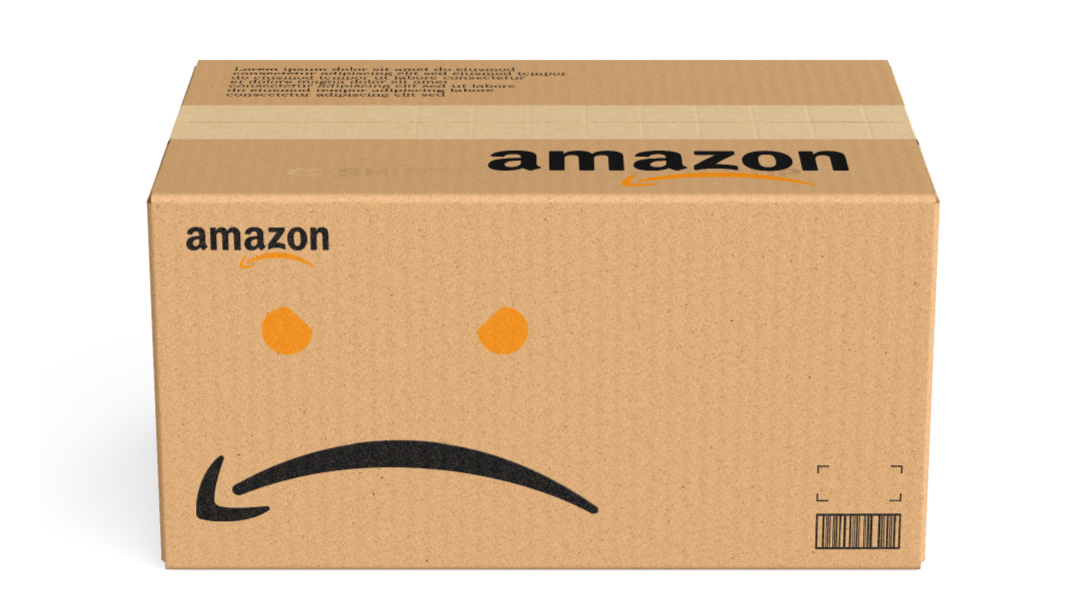

Raising prices is detrimental not only to value-minded individual customers seeking bargains, but also to a vendor’s standing on e-commerce platforms. Amazon, for example, sets pricing thresholds for vendors, and those who exceed them can have their visibility to shoppers reduced or removed. Vendors face the grim choice of selling at or below cost or losing their access to buyers.

“If Amazon takes away your visibility, you can lose 95% of your business — I’ve seen it happen,” says a Brooklyn-based expert in Amazon sales.

Playing Defense

President Trump made little secret of his plans to erect high trade barriers, so many sellers stocked up in advance.

“We pulled our purchasing forward and bought months of merchandise,” says the Brooklyn e-commerce expert. “We speed-shipped it by air, which was much more expensive, but those shipping costs still paled in comparison to what tariffs would do.”

That defensive position paid off when the tariff pause was announced and e-commerce merchants snapped into a frenzy of new purchasing.

“This 90-day reprieve — from a crushing 125% tariff down to just 30% on imports from China — is a great short-term opportunity,” said Mr. Pinter. “We’re already acting on it — buying more aggressively, locking in what we can, and finalizing next season’s imports into the US before any new changes hit.”

While the reprieve was enthusiastically welcomed among online sellers, some felt that the temporary measures and those that remain worked against the goal of encouraging domestic production.

“Unlike end-of-year taxes, these costs hit up front,” says Chaim Avrum Brach, who imports consumer goods for online retail. “That puts a huge strain on cash flow, and more importantly, it kills innovation. Sellers are forced to take fewer risks and make fewer bets when the cost to import is so high.

“They give me every reason to manufacture my products in places like Peru rather than here in the US. If I import components from China into Peru, I pay zero tariffs. Then I ship the finished goods to America at just a 10% duty. But if I try to do assembly or manufacturing in the US, I’m slapped with heavy tariffs on every individual part I bring in.”

Slow Decoupling

As intended, the increased tariffs pushed many sellers to look for alternative sources, which are not so easy to find.

“And finding new suppliers isn’t as simple as shifting to one new factory,” says Mr. Brach. “It takes a full supply chain — a network of manufacturers that work in coordination to produce and assemble complex products. That doesn’t relocate overnight.”

As the steepest duties are on Chinese products, many sellers are seeking to switch to other lower-cost sources — especially Vietnam, which worked for years to emulate China’s production model. Still, with China in control of several key supply chains, many sellers say shifts could take years to actualize.

Moreover, online merchants doubt many of their offerings can be supplied by American manufactures in the foreseeable future. While some products like durable furniture have ample domestic sources, items like small electronics, they say, are nearly nonexistent in the US.

Mr. Pinter is skeptical changes could be made quickly. “There’s more American manufacturing now, but it’s nowhere near the scale needed. People think we can flip a switch — but that’s not reality.”

Underhanded Imbalance

Although the tariffs took a toll on many American e-commerce sellers, there is wide agreement among them that government should do more to curb nefarious foreign trade practices, especially China’s.

“American importers pay full duties and follow regulations,” says Mr. Brach. “Meanwhile, many Chinese companies undervalue shipments, repackage goods through third countries to avoid tariffs, and face virtually no consequences. The system is broken.”

Multiple sellers says that for years, they have been undercut by Chinese sellers who undervalue their shipments to minimize duties and repackage items in other countries before they enter the United States to avoid fees targeting China. They face little risk, as the perpetrators are neither citizens nor residents of America. American e-commerce merchants are presently lobbying for laws like those in other countries requiring an American citizen or entity to take responsibility for importers selling in US markets.

“Free trade should mean fair trade,” says Mr. Brach, who is part of the effort. “Right now, more than half of Amazon’s sellers are Chinese. They’re not hiring American workers, they’re not paying American taxes, and they’re not reinvesting in our economy. That’s the real issue we should be talking about.”

Let’s Make a Deal

Despite the pain tariffs caused to their industry, sellers expressed cautious optimism that they would yield eventual beneficial trade deals. President Trump touted a plan of “90 deals in 90 days,” and one with Great Britain was inked last week.

Even before the 90-day pause was announced, the Brooklyn-based expert pointed to rhetoric from President Trump touting emerging trade deals and a recent decision by several retail giants to go ahead with large orders following a White House meeting. He added that if tariff income facilitates significant tax cuts, consumers would have more money to offset higher costs on imports.

And even though these merchants welcome the present China tariff pause, they say their temporary enactment might have already had some of its intended impact.

“Baruch Hashem, pausing tariffs give us some breathing room,” said Mr. Brach. “However, the long term is still very unclear, and it’s advisable to diversify accordingly.”

(Originally featured in Mishpacha, Issue 1061)

Oops! We could not locate your form.