True Wealth

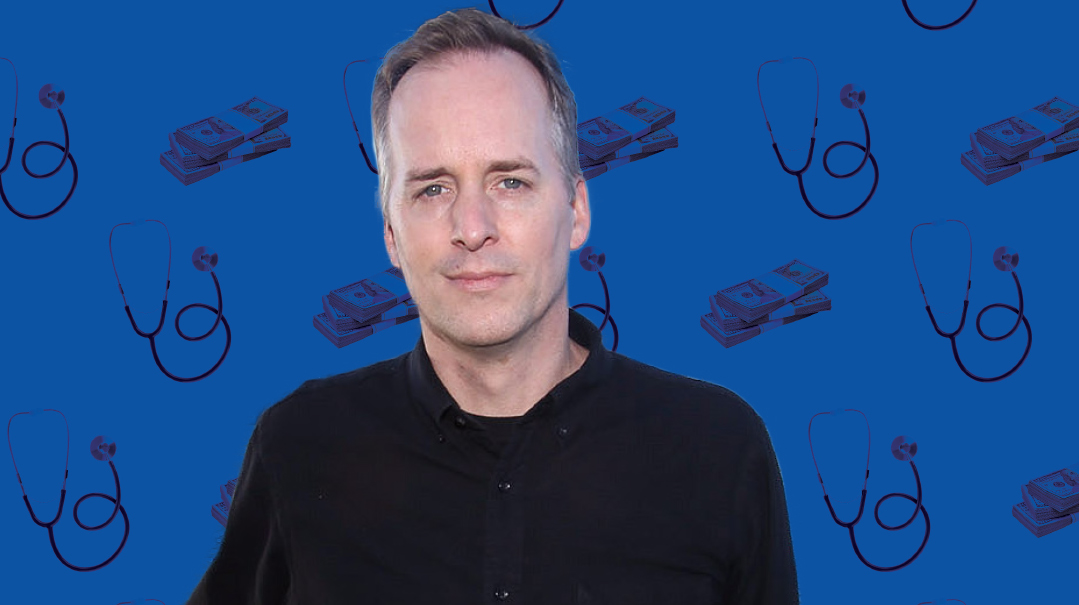

| January 24, 2023Naftali Horowitz is concerned about the frum community’s attitude toward saving, spending, and investment

Naftali Horowitz is a sought-after financial advisor for high net worth individuals, but through the years he’s gleaned insight about smart money management for the little guy too. And he’s concerned about the frum community’s attitude toward saving, spending, and investment — little financial education, lots of guesswork, and risky decisions that often cause bitter, stinging loss. Is there a better way?

Naftali Horowitz is a sought-after financial advisor for high net worth individuals — in fact he’s the managing director and portfolio manager at Morgan Stanley Wealth Management, and he previously held the same positions at JP Morgan, but it wasn’t always that way. He spent his early years as many others do — completely lost about finances.

He’s come a long way since then; his clients today come to him with huge assets and enormous portfolios worth many millions, and Naftali guides them on the best way to preserve and grow their wealth — where should they invest? How? When?

But when he was newly married, he simply scrambled to make ends meet.

“I realized very quickly that not having and stressing about the next bill is not a way to live,” he says. The worry, the concern, the anxiety… they quickly take over your life.

Naftali used that discomfort to motivate him, and it fueled his drive to overcome any barriers and reach for financial success.

It was still a journey, with twists and turns. Early on, a friend convinced Naftali that a certain stock was a good investment. And while he knew very little about it, he let his friend persuade him to put in $150,000. He lost everything.

Ever since then, he has a rule: Either he understands what he owns or he doesn’t own it.

“It’s a problem many frum people run into,” he explains. The community suffers from an overall lack of financial education. Even worse, it’s swarming with misinformation. “We tend to act as a herd, which can lead to some pretty detrimental results. People are chasing pipe dreams, and affinity fraud is more common than in most other communities.”

Today, Naftali has a comprehensive approach to finances, based on the mistakes he’s seen, the mistakes he’s made, and the experience he’s gained from decades in finance.

First off: “Have a financial rebbe,” he says. You’re going to make hundreds of financial decisions over the years, so educate yourself to do them right. Find people whose advice you trust — don’t rush to follow the crowds and sink your money somewhere just because “everyone else is doing it.”

Then do your utmost to spend less than you earn. Think several times before taking on any debt with a new credit card or car lease. Don’t rush to upgrade your lifestyle, because going backward will be more painful than the pleasure you received.

Learn about finances, make smart decisions, and your family’s finances will be in a better, healthier place, he summarizes.

In the podcast, you mentioned that a child’s understanding of money is formed at a very young age. How can parents influence their children’s financial values for the better?

Our children see and hear everything. They’re watching our buying patterns — what we buy and why. They watch why we throw things out — when is something considered junk? When does it need to be upgraded?

They hear the way we speak about people around us — what we think about the things they’re buying, the places they’re going.

All the while, they’re picking up cues on what’s important to us and what’s not.

These conversations are recorded in their subconscious. When they grow older, they’re not going to act on what we spoke to them about. They’re going to act the way we acted.

Your children see your choices. I have people come to me who are beyond bankrupt and the public would never know. They’re miserable, anxious, depressed, and panic-stricken. All because they’re making unhealthy choices to keep up with their neighbors. If you’re going to succumb to peer pressure, how can you expect your children not to?

If someone is looking to cut expenses, where’s an easy place to start?

Look at your non-discretionary spending categories — the things you don’t need. How much are you spending right now and how much can you cut back? For example, do you need to spend that much on restaurants or ready-made food? What about the amounts you’re spending on clothing your kids will anyway outgrow by the end of the year? Do you need so much of that?

I know, it’s just so easy. Amazon and Uber Eats are literally a click away. But you’re going to pay the price somewhere else. You’re trading the convenience of ease today for the future inconvenience of debt. Right now, you’ll get what you want in a few seconds. In the future, you’ll deal with the sleepless nights.

Many people habitually spend money they can’t afford because they never stop to think. There are trade-offs in every decision we make. Even if you’re wealthy — are you going to give a tzedakah check or buy the latest gadget? Are you going to take another vacation or help your children pay their tuition?

Nothing is free, so stop and ask, “What will this cost me?”

What kind of financial literacy would you like to see taught in schools?

When I was in school, I didn’t know the difference between a checking account and a savings account. The only thing I knew about a mortgage was that it was the horrible thing my father always worried about.

What I did learn, however, were things that are completely irrelevant in real life. I’ve never had to stand near a tree and figure out exactly how tall it is based on the shadow it casts. And even though I’m in finance, I’ve never used an algebraic equation to work out the compounded interest on my clients’ accounts. That’s before we get to all the history classes I sat through, discussing countries I’ll never step foot into.

What I would have loved would’ve been to learn about the things that actually matter. Children should know an ATM is not a machine that just prints money — every single one of my kids used to believe this and they’d ask, “So why don’t you just go to the machine and get more money?” Kids don’t understand how money gets into an account. They don’t understand that money is in limited supply.

We need to teach them all this. We can start with the basics. What is money? Where does it come from? How does it get into a bank? What is the purpose of a bank?

Let’s teach them about budgeting. That there’s no endless supply, so everything is a choice between this or that. How do you save money? Why?

How does inflation affect savings? What does it mean to retire?

Then let’s talk about debt. What does it mean to borrow money? What’s good debt? Bad debt? How does debt get people into trouble?

Our mosdos need to wake up and realize that when couples get married, they’re ill-equipped to deal with finances. It’s causing tremendous shalom bayis issues. Instead of teaching them things that are nonsensical, we can be teaching them things they can use from the day they earn their first dollar.

It falls on the parents to press until this happens because it doesn’t come back to the schools. If you send your child into marriage with no financial education, ten years later, you — the parents — are going to be the ones picking up the pieces. When their house goes into foreclosure or they can’t afford tuition, that’s going to fall on you.

So many people have told me that if they had known the dangers of living on debt, they would have been more careful. But they simply didn’t have the knowledge. It crept up on them because they didn’t realize how dangerous it could become.

Learning financial literacy should be as commonplace as going to chassan-kallah classes.

With frum life so expensive, how do people afford it?

We need to divide this answer into two categories. On the one hand, our earning potential has gone up. Frum businesses are flourishing. You have more people in high-income professions like accounting, law, medicine, and finance. People are very successful with Amazon, real estate, and nursing homes.

The frum community has more wealth than it ever had before.

On the other hand, there are those who are fueled by debt. Debt is so accessible, which is a fairly new thing. You can have very little income and credit cards will give you $15,000 to $20,000 in credit, which is ridiculous. There was no such a thing 25 years ago.

If we want to avoid the dangers, we have to pretend the debt option doesn’t exist. Credit cards should only be a mechanism for making payment more convenient. If we use them as a way to access debt, they’re horrible. You fund today’s purchases with tomorrow’s money. You’re mortgaging your future, spending money you don’t have.

People say they can’t afford to live without credit cards, but what would you do if you didn’t have such easy access to debt? You’d do what people did before this crazy concept existed: Cut somewhere else or do without.

Some people are in debt because of peer pressure. Others simply can’t afford their basic living costs. If someone simply can’t make ends meet, what road map would you suggest to them? How can they get out of the bad-debt cycle?

Let’s first talk about the definition of bad debt and how a person should view it.

Buying a house is taking debt, but it’s expected to appreciate in value every year. That’s good debt.

Bad debt is borrowing from the future for something that has no long-term value. You can’t afford something but you buy it anyway. If it’s not going to increase in value — and especially if you don’t have a plan to pay it back — that’s bad debt.

I always ask people, “What did our great-grandfathers do?” There was no debt other than the 100 rubles you could borrow from a relative.

Were they living on the streets? Did they not have what to eat? And if they were, what did they do? They took tzedakah. There simply was no other option.

We need to take debt out of the roster of options and stop relying on it. It’s much better to ask for an actual donation than to borrow money you have no way to pay back.

If you’re not yet in debt, view debt as a drug. Speak to any addict — it always starts as innocently as painkillers when you get your wisdom teeth removed. You can have a good reason, but can’t get off because it’s addictive. I’ve spoken to people who owe hundreds of thousands of dollars in gemach loans, and it all started when they had one good reason to borrow and then it became addictive.

See debt as dangerous. It’s something that will derail your long-term financial well-being.

If someone’s already in debt, they need help.

Just like a drug addict, you won’t be able to get out on your own. You’re too used to falling into it. Reach out to a financial counselor who will sit down and help you create a plan.

You mentioned the difference between success, wealth, and riches. Can you elaborate on the differences?

Riches is somewhat synonymous with “excess,” the things we buy to beautify our lives that have no utilitarian value beyond that. Riches is when I walk into a house and see a very elaborate paint job on the walls, something that will be worthless when the house is torn down. That’s excess. If someone can afford it, then G-d bless them.

I’d rather focus on wealth. Wealth is an asset — real estate, shares in business, stock accounts, private equity. Wealth is the resource from which I can fund my spending needs. It’s also what will help tzedakahs and my future generations. Chovos Halevovos calls it “hon,” access that we don’t need for our actual lifetime. But what makes it different from riches is that wealth is access that appreciates in value. We’re not talking about a fancy car lease or memberships to high-end country clubs. Wealth will grow to still benefit someone at some point in time.

Neither riches nor wealth, though, have anything to do with actual success. Success is very simple. It’s the answer to these questions: Do you feel fulfilled? Do you have meaning and purpose in your life? Do you wake up in the morning and have a drive because you know you’re fulfilling a higher destiny?

Yosef is the only person in the Torah who’s referred to as successful. It’s at the least obvious time, when he’s in prison for a crime he didn’t commit. His brothers just tried to kill him and then sold him. His father doesn’t know he’s alive. He has a bleak future — that’s when the Torah calls him an Ish Matzliach.

Why? Yosef was doing the utmost he could with the life he was given.

There are very successful people who have physical handicaps or monetary handicaps. They have all kinds of issues, but they’re extraordinarily successful because they excel at taking what Hashem gave them and making the best of it.

A financially successful person knows life is not about the things we buy and leave behind. It’s a person who gets up in the morning and builds wealth for the future — whether it’s to support Torah, to support future generations, or to build the world for those to come. They are happy with their purpose. They’re not succumbing to peer pressure. Instead, they’re making informed choices about their individual purpose.

Inflation was in the news a lot last year. What is it, and how does it affect our lives?

Inflation is real, but there’s more than one kind. There’s what the government calls inflation, which isn’t an accurate reflection of what it really costs to live. Then there’s real inflation, which you’ll see on your grocery bills. And then there’s Jewish inflation, which I estimate at about two percent higher than everyone else’s inflation.

We Jews operate in our own ecosystem. We all need more money because our families are growing. The mashgiach has a big family, so he’s getting paid more than a typical supervisor in any other plant. The same is true for rebbeim, office workers, and anyone else in the community. Our lifestyle costs more, so we need to bring home more. That inflation gets passed to the consumers and, in our unique ecosystem, the cost is getting passed to us Jews. Everything about our lives is more expensive.

Does shalom bayis outweigh the need to set a household budget?

If you don’t see finances the same way your spouse does, you must get on the same page. Too many people let their spouse make bad decisions, saying “What can I do?” For the sake of shalom, they’d rather just let things be. But you’re going to have devastating repercussions. It’s like having two people in the same rowboat saying “Let’s each do our own thing.” So one is rowing and the other is digging a hole. It will literally sink you.

Right on the Money

Insights for life

On side hustles:

Success demands intense focus, and it’s hard to focus when you’re doing two things. I see this with my uber-wealthy clients. Your primary earnings will come from the business you focus on. Focus on one thing until it’s self-sustaining and then you can think about diversifying to something else.

If money bought happiness, there would be no therapists in wealthy neighborhoods.

People who leverage wealth to build a wholesome, purposeful life have a tremendous amount of peace of mind. But I also know people with no wealth who have the same meaning and purpose.

Successful people are…

Humble — willing to learn from everyone and everything

Driven — willing to work hard without taking shortcuts

MAKE YOUR MONEY WORK

If your money is in a Chase savings account or in CDs at banks — MOVE IT

SPENDING SHOULD STIING

It’s painful to pull out cash for the cashier, but it feels like nothing to swipe the credit card

DO YOUR RESEARCH

You’re going to be making hundreds of financial decisions over the course of your life. Educate yourself. Read a book, look online, speak with friends — it’s your responsibility

AVOID THE TRAP

Credit card debt is the worst thing in the world because it’s just so easy to slip into. When we married 30 years ago, my wife and I agreed that if there were ever a month where we carried credit card debt, we’d cut up our cards the next day

Different Worlds

A person’s budget is basically their cost of living. How much do they need to spend to live their life? It’s no surprise that frum and secular budgets aren’t the same; frum life is simply more expensive. Why?

SIZE: Baruch Hashem, our families are larger. Where a secular family would have 2–3 kids (and a dog), a frum family will easily triple that.

LOCATION: Housing costs are determined by where you choose to live. Non-Jews can make the choice to live somewhere further out, and therefore cheaper. By contrast, frum Jews who need the infrastructure of community, shuls and schools don’t get to make the same choice.

SCHOOLING: Private school is not a given even for the affluent American middle class. Meanwhile, it’s a non-negotiable cost for frum Jews — and an expensive one.

One Happy Family

Jewish peer pressure is different too. So many people who live beyond their means are doing so because they’re trying to keep up. You’ll see more of this pressure in the frum community than a typical secular one, mostly because we live together, not based on status, but based on our shared Jewish values.

Wealth usually segregates. People often live near others with similar means. People in the Bronx all have beat-up cars or none at all. Everyone in the Hamptons has either a Rolls Royce or Tesla in the driveway. For those people in the Bronx, the idea of being uber-wealthy is conceptual. They don’t associate themselves with it at all.

In the frum community, though, you have a kid whose father makes millions sitting in a desk next to the kid wearing hand-me-downs. They live on the same block and go to the same shuls — which creates problems. There’s a pressure that doesn’t exist elsewhere. People try to impress and fit in when things at home are far from good.

Our peer pressure is more complicated, but our tools are more robust. We have the Torah to guide us on real self-worth. If we turn back to our sources and remember our real values, everyone will be more secure — and less pressured to live above their means.

Jewish Inflation

Inflation is real, but there’s more than one kind. There’s what the government calls inflation, which isn’t an accurate reflection of what it really costs to live. Then there’s real inflation, which you’ll see on your grocery bills. And then there’s Jewish inflation, which I estimate at about two percent higher than everyone else’s inflation.

We Jews operate in our own ecosystem. We all need more money because our families are growing. The mashgiach has a big family, so he’s getting paid more than a typical supervisor in any other plant. The same is true for rebbeim, office workers, and anyone else in the community. Our lifestyle costs more, so we need to bring home more. That inflation gets passed to the consumers and, in our unique ecosystem, the cost is getting passed to us Jews. Everything about our lives is more expensive.

‘Money Talks’ is produced in conjunction with Living Smarter Jewish (LSJ) and Living Lchaim.

LSJ initiatives include free personal finance coaching, education geared toward young couples, referrals to financial planners, curriculum development for high schools and young adults, and video education library.

To request help, please email: info@livingsmarterjewish.org

Living Lchaim is a podcast network dedicated to producing shows that enhance the lives of Orthodox Jews across the world. The Kosher Money podcast, created in partnership with LSJ, hosts lively dialogue around frum financial realities, facilitating awareness and educated decision-making.

(Originally featured in Mishpacha, Issue 946)

Oops! We could not locate your form.