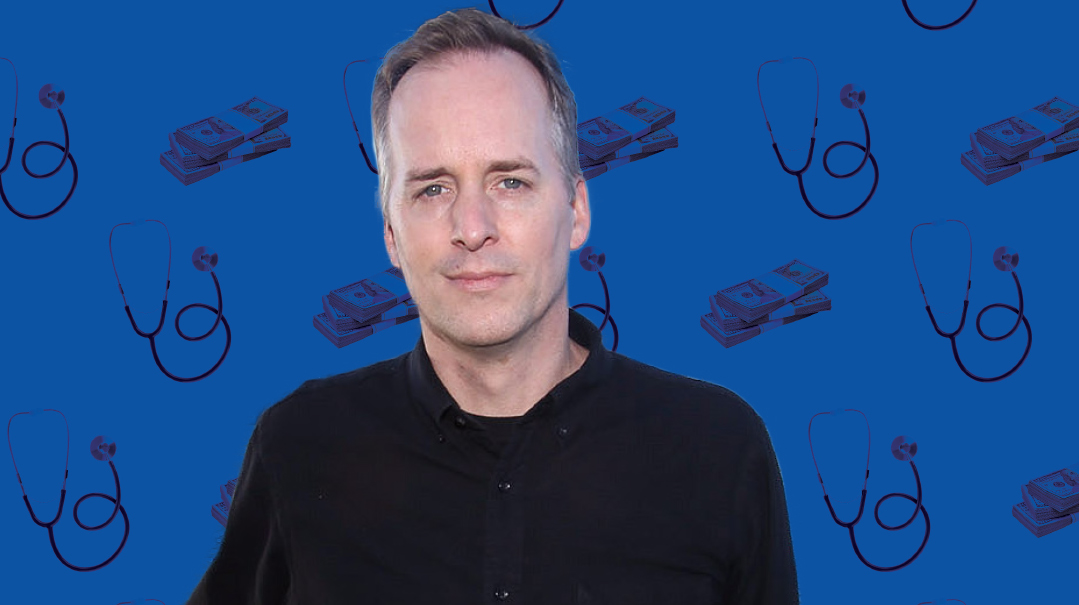

The Best Investment… with Morris Smith

| March 7, 2023Morris Smith shares more about his journey to millions and what prompted him to eventually leave the rat race

Morris Smith’s career was taking off like a rocket. He was 35 years old, and managing $13 billion in assets, when he decided to close up shop and move to Israel.

Here, Morris shares with Kosher Money and Mishpacha readers more about his journey to millions and what prompted him to eventually leave the rat race, as well as his firsthand financial insight from decades in the field

Morris was born in 1957. His parents were Holocaust survivors. Academic success was important to them, and they sent him to Yeshivah of Flatbush. “I always had an interest in numbers,” he remembers. “I was good at math and spent a lot of time looking up the stock tables.” After graduating high school, Morris studied for degrees in both accounting and economics from Queens College. He then went on to earn another degree in finance from the Wharton School of Business.

When he graduated college in 1982, America was recovering from back-to-back recessions. Unemployment was high, hovering around ten percent, and the job market was tough. Morris was lucky to get an offer from Fidelity, an investment firm in Boston, and he relocated there to accept the job.

His starting salary at Fidelity was around $34,000/year (close to $100,000 today), and things escalated quickly. After two short years, Morris was put in charge of a brand-new financial product, the Select Fund, but he didn’t stop there. The top brass had their eye on Morris’s success. When the head of the OTC portfolio (worth more than a billion dollars) left, Morris was asked to take over.

Just five years after landing his first job, at 29 years old, the Orthodox Jew from Brooklyn was managing a portfolio of over a billion dollars. “I woke up every day feeling like the luckiest guy in the world,” he says. But the job didn’t come without tradeoffs. Morris worked 50–60 hours a week. He’d leave the office at around 5:30, go home to help his wife with bedtime, and then return to the computer for another few hours of work.

In 1990, Morris took over Fidelity’s elite Magellan Fund, one of the most profitable funds in the world. It was the opportunity of a lifetime, but the pace only intensified. He was working more than 70 hours a week.

After two years running Magellan, on Erev Pesach of 1992, while picking up romaine lettuce for the Seder, Morris had an epiphany. “I realized I hadn’t done something like this in ages — the day-to-day rhythm of normal life had escaped me.” He barely had a minute to breathe — and he was done. “I’d popped a few stress balls on my desk from squeezing them so hard. The stress was that bad. I spoke to my wife over Pesach and she agreed with me. It was time for a break.” The couple decided they would move to Israel.

The firm didn’t take the news sitting down. For a while after Morris gave notice, they tried convincing him to stay. But he had the clarity he needed and nothing could change his mind. Morris left his post at Magellan and moved his family to Israel.

“I wanted to rebalance myself,” he says. “Life is balanced on a tripod of three things — your relationship with G-d, your relationship with your family, and your relationship with work. I felt like my tripod was disproportionate.”

The Smiths settled in Israel, where he realized his dream of learning part-time while continuing to manage his personal portfolio. Thirty years later, he’s still living the same way — and he considers it the perfect balance.

Based on your own experiences, what advice would you give to people who (baruch Hashem!) are in a situation where they suddenly come into a lot of money?

Your mental fortitude will play a big role. I came from a middle-class family. My father never made more than $55,000 a year, so we never had a lot of excess cash. Even when my own situation changed, my foundational values still came from my parents — things like saving, and not spending on something you don’t need. It’s part of my DNA. And as someone with Jewish ethics and values, there’s a lot to be said for keeping a low profile no matter how much money you have. That’s something I’ve always tried to adhere to.

Practically, how were you able to give everything up to move to Israel?

Stress was a huge factor, but there were a few other things going on at the time, too. I’d always wanted to spend more time learning, which I never had the opportunity to properly do. I also wanted to spend more time with my family, and my wife and I had always shared a dream of moving to Israel. All those variables came together.

I know it seems like it was a rash decision, but it had been building up for a while. I’d probably considered quitting at least once or twice a year before I actually did. It also helped that by the time I left, I’d accomplished a lot. I’d essentially reached the peak of professional growth in my industry, so it made it easier to stop climbing and instead step away.

You mentioned your wife, Devora, quite a few times during this episode. What role did she play in this decision?

I don’t think we give our spouses enough credit. When you work as full-time as I did, your wife is the one shouldering sole responsibility at home. She made sacrifices — she had an MBA herself, but gave up her career so I could have mine instead.

I can’t say that marriage is my area of expertise, but thank G-d it’s been 43 years and it’s working out pretty well. Marriage is a true partnership, and you don’t make arbitrary decisions without your spouse.

You mention the tripod and how life always has to be a balance between family, G-d, and work. Do you think that people who “made it” financially need to step back from the work area to focus on the others?

I can’t extrapolate my personal feelings and the desires I had to other people. But I do think you have to always recalibrate and check how your tripod is doing. Life is short and we all recognize that. You don’t want to give up all your years because they were only focused on business. Everyone has different versions of “made it” and I think once you get there, it’s time to take a step back and redefine your priorities. You should always be working on the parts of life that are about family and Torah.

You mentioned that you didn’t grow up in a wealthy household. What’s your perspective on educating children about money?

When you have a cognizance of the value of money, there’s a certain DNA that gets passed down. I think all my children have some of that in them. There’s an understanding that you never go into deficit spending (i.e., never spend more than you have). If you have your child paying a portion of something, they will be more sensitive to that. I think giving them unlimited spending capabilities is not a great idea. On the other hand, it’s a great idea for them to get a chance to make some money doing something along the way. It helps them appreciate the value of every dollar.

Your day revolves around learning, but you mentioned that you still work part time. What still pulls you to the financial market?

There are two factors. I don’t think you can ever leave your investments alone. The changing global environment may require changes in your overall investment portfolio. We’ve gone through Covid, the war in Ukraine, the changes in Fed policy. You do have to react to events. You can’t leave your portfolio in auto drive.

The second factor is that finance is my “hobby.” In addition, I’m also involved in the OU as a treasurer, and so I have a professional responsibility to be on top of what’s going on in the world.

What are the downsides to accumulating money too quickly?

I think the biggest risk of that is if money affects you as a person, you could have many downside impacts on your life. It’s a tremendous brachah from HaKadosh Baruch Hu when you’re blessed with a windfall. The key is how you handle that windfall. Does it change the people you interact with? Do you change your burn rate of how quickly you spend money?

These are the dangers when someone accumulates wealth quickly as opposed to a slow rise over time, and it doesn’t have as massive an immediate impact on their lives. When you make money fast, you’re more likely to get carried away.

We’re supposed to be tzanua — we’re supposed to be private about the wealth we accumulate. Sometimes it happens so fast that people get exposed to too much, too fast. And they’re not wearing their blinders.

It could create quite a lot of tension and difficulty in your life. I believe in being conservative and not letting a huge payday impact your life. There’s no reason not to enjoy the fruits of your labor, but it has to be with a conscious decision about what you want your lifestyle to be.

It’s important to be cognizant that this is all a brachah from Hashem and you’re only a steward of that cash. Ultimately, you want to be able to devote more and more of that money to tzedakah. That’s where you should be aggressive — with how much you spend on tzedakah.

Is there anything you’d want others to learn from your story?

If someone has the option to make a shift like I did, I would tell them two things:

- Make sure you’re comfortable with what you have saved. If you don’t have enough money saved, and you decide to shift your work-life balance to be earning less, you shouldn’t turn around in a few years and say, “What did I do? I can’t pay my bills. I can’t pay tuition.”

- The second is to make sure you have structure in your life. This also applies to people who retire at 50 or 60. The worst thing is to leave your job, which has been such an important part of your last decades— and you wake up the next morning with no idea how to spend your time. Lack of structure is what brings people into a state of depression and anxiety.

You mentioned that investment banking is a great career choice. What would make someone a good fit for this field?

When it comes to equity markets, and this is probably true of fixed income markets, it has to be something you’re interested it. I always oriented toward numbers. In investment management specifically, you need to have a combination of self-work and humility. The investment business is an incredibly humbling game. If you’re doing a great job, you’re still going to be wrong 40 percent of the time. You could buy stock too early. Buy it too late. You can sell it too early. You can sell it too late. You’re always going to be blindsided by things you could never imagine.

That’s where the self-worth part comes in. In most jobs, you don’t make mistakes 40 percent of the time, so in this field you need a degree of confidence in your abilities.

On the other hand, when you think you’ve got it all figured out, it’s all over. You can almost guarantee that a person who thinks he’s smarter than the rest is going to blow up. The markets may be going your way now, but in a few months it will be completely different. You always have to be looking for the markets to shift.

Basically, it’s a personality type that’s a combination of self-confidence, humility, and a sixth sense. That’s what makes a successful investor.

Right on the Money

Insights for life

The road not taken: If you look back at life, the job you didn’t take is what afterward turned into a new opportunity.

A nod from the wife: When I started managing the Magellan fund, I had to ask my wife permission, because it was going to affect her and our children. I knew it would be disconcerting to them that I would be in the public eye, constantly under scrutiny.

Closing the door: I can honestly say, looking back, there’s never been a regret about the decision to leave.

Know your value: Thinking about a raise? See what your value would be if you moved to another job. It helps you understand how much to ask for.

Boring is best: The golden rule of the stock market: Never put in more money than you can afford to lose. If you can’t sleep at night, you’ve probably invested too much. For the average person who’s not working in finance, the best way to grow your money is to put it in an index fund — a diversified portfolio where you don’t get blown out of the water. It may be unexciting, but it will deliver returns.

Who owes who: Our generation has lost the appreciation for our employers. He’s investing in you, and you need to produce for him. You cannot shortchange him.

Faithful stewards: One of the things Hashem blesses us with is money. We have no right to that money. We’re not any more deserving than our parents and grandparents, who didn’t have as much. We are stewards and have to use that money to help other people.

True growth: I’m an investor, but I view the key part of my day as being able to learn — my ability to really invest in and grow my connection to G-d, and being able to help the Jewish community.

On wasting time: Wasted time is a lost asset. It’s the worst thing you could possibly do, because you can never get that time back. I think most wasted time is at night. Efficiency levels go down; you start surfing the net. If instead you go to sleep just a half hour earlier and get up a half hour earlier in the morning, you gain hours. You’re going to change your life.

On Jewish pride: When I worked at Fidelity, I didn’t wear a kippah in the office. I was told by poskim that if you’re in an environment where it might not work out, you have two minimum requirements:

Wear a kippah whenever you make a brachah.

Wear a kippah whenever you travel.

That was in the 1980s. Fortunately things have changed. In today’s climate, I probably wouldn’t even ask the question.

On wills and estates: By the time you have your first child, you’d better have your will in place. It’s not only about money. If something happens, did you outline who will raise your children?

No one likes to think about the finality of life but it’s irresponsible not to. Think of estate planning like taxes — no one likes to do it, but it still needs to get done.

Home first: People should not invest in any sort of higher-risk area before they’ve bought their first home. I very much believe that the capital that you accumulated for that should be staying in a very safe place until you’ve made that purchase. It’s important to own a house, and only once you’ve done that can you consider investing.

‘Money Talks’ is produced in conjunction with Living Smarter Jewish (LSJ) and Living Lchaim.

LSJ initiatives include free personal finance coaching, education geared toward young couples, referrals to financial planners, curriculum development for high schools and young adults, and video education library.

To request help, please email: info@livingsmarterjewish.org

Living Lchaim is a podcast network dedicated to producing shows that enhance the lives of Orthodox Jews across the world. The Kosher Money podcast, created in partnership with LSJ, hosts lively dialogue around frum financial realities, facilitating awareness and educated decision-making.

(Originally featured in Mishpacha, Issue 952)

Oops! We could not locate your form.