Play Your Cards Right

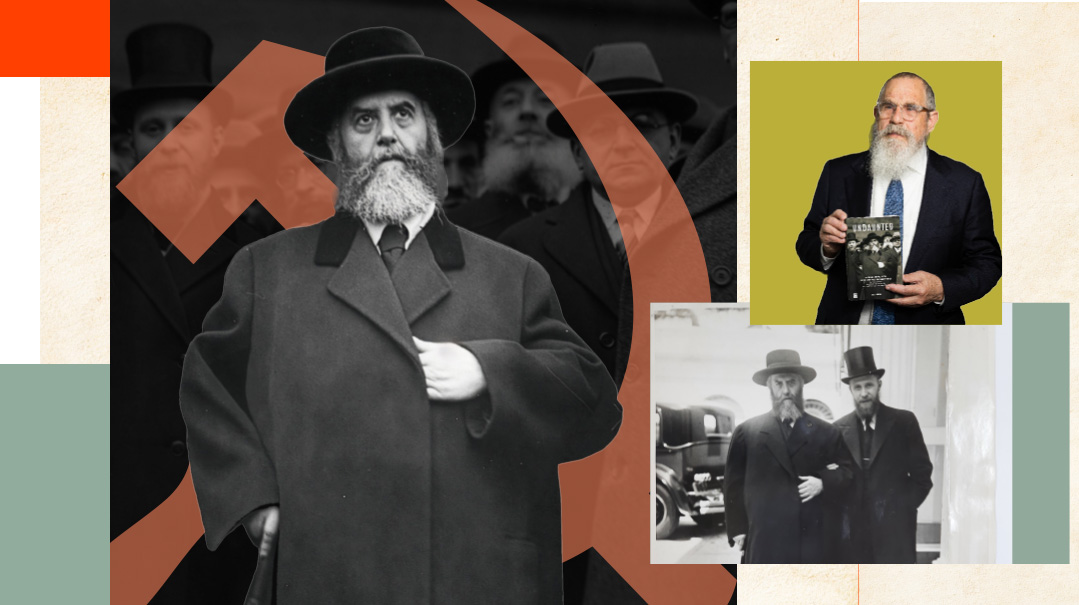

WINNERS AND LOSERS “Most people don’t understand the benefits” says Laurence J. Kotlikoff professor of economics at Boston University in an interview with Mishpacha. “This is the largest financial asset for virtually everyone. If you mess it up too bad.” (Images: Shutterstock)

Y

osef is a 65-year-old IT consultant while his wife Dina is a 61-year-old social worker. Yosef knew he could start collecting Social Security at age 62 but decided to wait as long as possible before claiming his benefits. After all Dina was still working and there were no kids living at home so the couple didn’t feel pressed for the income.

As she approached her 62nd birthday Dina got a letter from the Social Security Administration outlining exactly how much she would receive if she were to start her benefits. Like others in this situation Dina started to feel the “retirement itch.” Perhaps it was time to consider retiring from the agency she thought. And how nice if Yosef could do the same.

Dina and Yosef made an appointment with the Social Security Administration to learn more about their options. The representative told them how much they would each receive in Social Security benefits if they were to file right away — an amount far less than Dina had expected. However her spousal benefit wouldn’t be too shabby. The only catch was that if Dina wanted to take that benefit Yosef too would have to start taking his benefits.

Suddenly they had a myriad of options. Should one of them retire? Should both of them retire? If they retire today they’ll both receive less than they would at full retirement age. But maybe it will all even out?

All good questions. Unfortunately Social Security representatives aren’t there to advise clients but merely to provide information.

Yosef and Dina are therefore in danger of making a decision that could cost them tens of thousands of dollars over their lifetimes.

If an individual dies well before 80 he would have maximized his cumulative lifetime benefits by starting at 62. Yet if he lives well past age 80 he will maximize his benefits by waiting until 70

And they aren’t alone. Regardless of their level of financial sophistication or educational background many people in their 60s simply don’t know how Social Security works. For example according to Get What’s Yours: The Revised Secrets to Maxing Out Your Social Security by authors Laurence J. Kotlikoff Philip Moeller and Paul Solman “A minuscule 1 to 3 percent of people wait until 70 to take their Social Security retirement benefit — when it’s 76 percent larger than at age 62 and 32 percent larger than at 66.” What percentage start their benefits at 62? Thirty-five percent of men and 40 percent of women.

“Most people don’t understand the benefits” says Kotlikoff professor of economics at BostonUniversity in an interview with Mishpacha. “This is the largest financial asset for virtually everyone. If you mess it up too bad.”

Kotlikoff says a full 50 percent of the population relies either entirely or primarily on Social Security for their income. “So we have people not taking care of their most important asset. There are 10000 baby boomers retiring every day. Almost all are making major mistakes when it comes to their Social Security choices.”

With that startling bit of information in mind we put together a brief guide on making the best Social Security choices. With a little foresight and siyata d’Shmaya everyone can profit.

Oops! We could not locate your form.