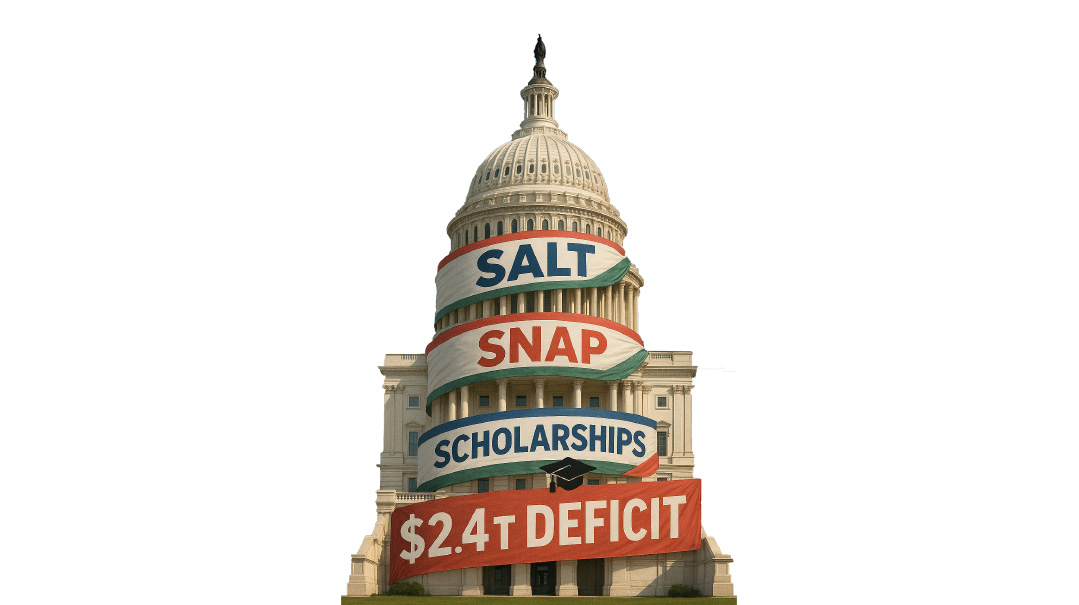

One Big Beautiful Bill

| June 10, 2025The bill runs to some 1,000 pages, and a dozen or so of its provisions have attracted wide attention

Many presidents have put forward what they hoped were signature pieces of legislation, and it only seems fitting that the one associated with the Trump administration is called the “One Big Beautiful Bill Act.”

The bill squeaked through the House on May 22, largely on a party-line vote, and is now before the Senate. President Donald Trump and Republicans in both houses are working overtime to steward the major tax and spending package toward the finish line.

The bill runs to some 1,000 pages, and a dozen or so of its provisions have attracted wide attention. Below are four toplines most likely to have major impact on America’s

SALT

Here, SALT means state and local taxes. For middle-class residents of blue states like New York, New Jersey, and California, who hope to write off their high SALT taxes on their federal IRS returns, the present bill is a win, raising the deduction level to $40,000 for middle income families, up from the present $10,000.

The SALT deduction cap became the bill’s most contentious point. The $10,000 cap was put in place in the 2017 Tax Cuts and Jobs Act, to help offset revenue losses from that law’s tax cuts. The argument was that citizens in red states shouldn’t have to pay higher federal taxes to subsidize those in blue “tax and spend” states.

Now, with a paper-thin majority, the small cadre of House Republicans from competitive districts in blue states were able to include relief for their constituents. But Senate Republicans (none of whom are from high-tax states) are already unhappy with the $40,000 cap. Many would like to see it reduced or eliminated, endangering the Big Beautiful Bill’s future.

SNAP

Presently, SNAP, or the food stamp program, is fully funded by the federal government. The bill would transfer 5% of program costs to the states beginning in 2028, with more cost shifting in the years after that. The goal is not only to cut back federal spending but also to encourage states to do a better job of rooting out fraud.

Another change tightens work requirements, raising the maximum age at which individuals are required to show employment, from 54 to 64. It would exempt only parents of children under seven — down from the present law, which frees parents of kids under 18 from work requirements.

Scholarships

Deep in the bill’s fine print is a measure that, if passed, would be a historic gain for school choice — the first federal tax credit scholarship program.

The proposal would allow individuals to receive a dollar-for-dollar federal tax deduction for contributions to privately run scholarship-granting organizations, with the total capped at $5 billion. Funds would be available in all 50 states for middle- and lower-income families.

Deficit

The bill’s most controversial item is something many feel it does not sufficiently address — America’s $21 trillion deficit.

Although the bill makes spending cuts, including to some entitlement programs, it also seeks to enshrine temporary tax cuts as permanent, among other measures. The Congressional Budget Office estimates the bill will increase deficits by $2.4 trillion over the next ten years. This led former DOGE head Elon Musk to lambaste the bill as a “disgusting abomination.”

The White House and Congressional Republican leaders are waving off the criticism and insist the bill will actually generate more revenue and lead to a modest decrease in the national debt.

In the Senate, the issue has set up a showdown between a small cadre of spending hawks and those critical of even the modest cuts proposed to SNAP and Medicaid.

(Originally featured in Mishpacha, Issue 1065)

Oops! We could not locate your form.