Money Mindset: Chapter 4

| December 26, 2023How to parent with money, how to teach our children about money, and what we want our own finances to look like

Last time, we asked you to discuss with your husband what each of you wish you’d known about money earlier, your money-related fears, and which “money school” you want your kids to grow up in. This homework was a way for you to get on the same page as your spouse. Moving forward, we’re going to talk about how to parent with money, how to teach our children about money, and what we want our own finances to look like. If you’re not aligned with your spouse, that can be a huge block.

So let’s start by reviewing the conversations you had during this week’s date night:

What do you wish you’d each known about money in childhood or before marriage?

Elisheva

My husband grew up extremely affluent, but when he became frum, his family cut him off. He went from having everything to nothing. I grew up with a single mom and no money, so we were both starting from ground zero.

My husband says wishes he would have known how to recognize all the new fears around not having money — which only began for him as an adult — and how to communicate them to me. Also, because he grew up wealthy, he knew nothing about finances. In a way, because I grew up without money, I had to know more about how it works from an earlier age.

But I still wish my parents had schooled me more on things like budgeting and investments. It would have pushed me to save more earlier. Most of what I know, I learned from a cousin who started his own store and hired me to work there. I’m grateful for everything he taught me.

Russy

My husband and I both came into marriage money conscious, and I’m grateful for that. He’s the one who set up all our accounts while we were engaged.

Kayla

Both of us immediately agreed that what we wish we knew about money is that there’s never enough. We both grew up in a secure environment in terms of what we had and what we needed, but as adults, we’re always wanting more. It’s never been enough to feel secure. There’s always a new expense, a new tuition bill, another need for money. Growing up in two-child secular homes, we were completely not prepared for frum spending.

Tamar

It would have been good to know that stability and finances are not necessarily tied to each other and that you can feel very secure even if you don’t have a lot money — or vice versa. It’s like my husband pointed out: There are people who feel very secure on welfare. And many people who make more and more money and still feel insecure.

We wish we had known that it’s a mindset thing, not a numbers one. Then we wouldn’t have been waiting to make more, make more, make more before working on feeling secure.

What are your fears around money?

Elisheva

My father made a lot of money at one point — but not honestly. When I was around 11 or 12, I discovered how he made his money, and I refused anything he gave me. My grandmother had always told me that money acquired in a bad way will get lost anyway. I didn’t want to touch it.

I’ve been scared of money ever since — maybe it’s not honest money. And there’s also the other thing we talked about last session; this fear that people with money don’t have good middos.

I’ve always said that when we have money, I want to get it in a good way and use it in a good way. I want to still be a good person.

Russy

My money fears are about going into debt. We’ve had many conversations about it — my husband will want to buy more investment houses, but I’m scared to spend all our money on those. The conversation always goes in circles and hasn’t changed much over the years.

Kayla

We’re scared to go into debt from the cost of daily living — not even seminaries or weddings. The everyday expenses really accumulate, and we’re scared we’ll have to spend more than we’re making.

Tamar

My fears are mostly that there’s just not enough — that we’ll have more bills than income.

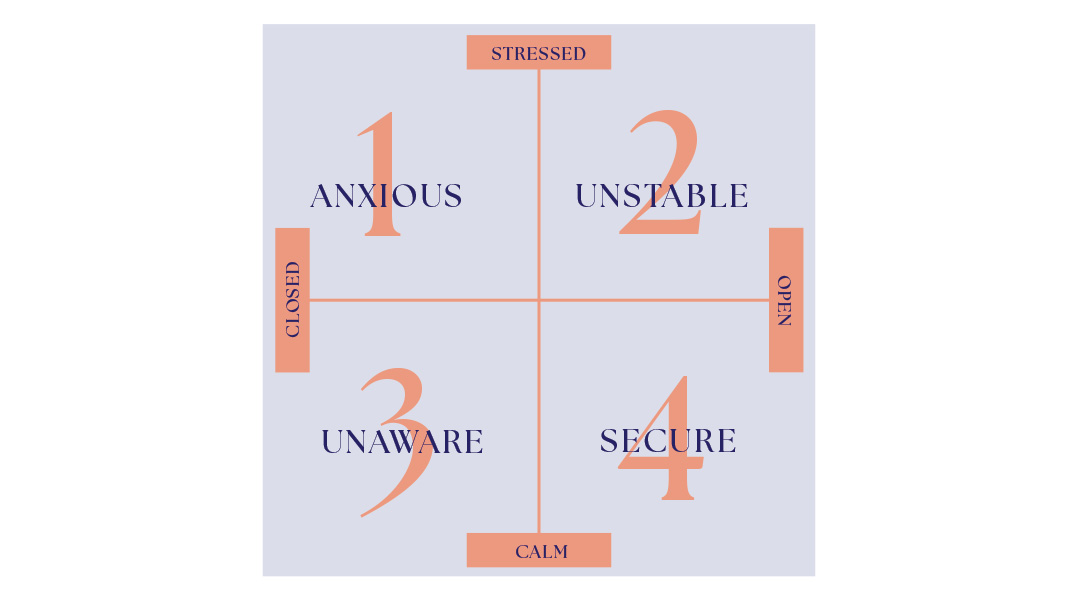

The last homework question was which money school do you want your kids to grow up in. Remember that graph from Rachel Cruze?

When we present this chart and ask this question, most people say they want their kids to grow up “secure” or maybe “unaware.” It’s important to recognize that and understand why, so you can reference your decision down the line. For example, if you find yourselves in a stressful situation, you and your husband can remind yourselves, “We want our kids to feel secure. How should we be handling this right now?”

It’s also important to get on the same page as your spouse because if one of you wants the kids aware, and the other thinks children should have no knowledge about the household finances, you’ll need to be aware, communicate, and establish protocol so you don’t end up fighting or feeling resentful about how your spouse handles a money situation with the kids.

Elisheva

I grew up in the Quadrant 2. My mother was very open and would say, “Oh, I don’t have money for that right now.” But it was very stressful, because there was truly not enough. When I was a teenager, I stepped in to help her out and taught myself a lot about budgeting or general finances.

There were times that I was working three to four jobs to support her and my siblings, so even though I was making money, I never had enough to save. There was a lot of pressure, and I definitely don’t want that for my kids. I want them to be secure.

Russy

My husband and I agreed that we’d like the kids to grow up in this secure quadrant — calm and aware. We do think it’s important that they are money conscious. Raising kids who are secure is easy when you have money. When you have challenges, then you need to work out how to juggle it.

Interesting that you say it’s easy to raise your kids to be secure around money when you have more money. In our experience, this is not always the case. There are families who have a lot of money, but raise kids who are anxious or unstable. This could be because the parents have completely different values about how to spend their money and haven’t learned how to communicate effectively about money. On the flip side, you have families with very little money, but whose children grow up feeling secure. One component that can be a really helpful tool toward financial peace is emunah and bitachon. Often, when you work on your emunah, you can reshape the relationship you have with money, even if you don’t have as much as you’d like to have.

Kayla

Obviously, we want them to be secure and feel like we’re open about money. But I told my husband last night, “Well, we already failed that one.” They’re definitely feeling anxious and unstable, and the teens always tell me that they feel like we’re the poorest family on earth.

It’s not necessarily too late. I was listening to a parenting expert recently who said that he originally thought that by the time he learned about his own traumas, it was too late, he’d already passed them down to his kids. But then he pointed out that it’s not true. Research shows that you can repair the damage because our brains have neuroplasticity and can always rewire in a remarkable way.

It’s a very hard balance. Of course, I want them to be secure even now, but I also want them to know enough to make decisions like buying a pair of shoes for $50 instead of $250. I think those are good life lessons.

Tamar

My husband grew up aware but anxious — in the unstable category. As a child, I was definitely aware of the stress in the house. For our kids, we want them to be secure, but we also think it’s healthy to have a nervousness that makes you intentional. I want them to feel secure, but I want their range to stay at the top of the quadrant.

Rivky and Tsippi speak:

Wow, look at that: You’ve all come to similar conclusions about how you’d like to raise your kids, but your reasoning is totally different. Keep those reasons in mind, they’re very important. When you know why you want your kids to grow up a certain way, you know what you consider important — and what you need to work on.

Which brings us to your homework.

HOMEWORK

Think about your answers and what you learned from them. Based on what you discovered about yourself, what’s one idea of an action you can take to change the narrative?

Choose a challenge — either for yourself, with your husband, or with your entire family.

Example: If you’re struggling with the emunah piece, your challenge can be to learn with your husband for five minutes a day. If you’re not currently paying attention to pricing, your challenge can be to only use cash in the grocery store.

Rivky Rothenberg, CPA, has vast experience helping families with money. Tsippi Gross is a business consultant and fractional COO who focuses on results. Together they started Ashir, a nonprofit financial consulting program, to help families go from financial stress to money confidence. Rivky and Tsippi can be reached via Family First.

(Originally featured in Family First, Issue 874)

Oops! We could not locate your form.