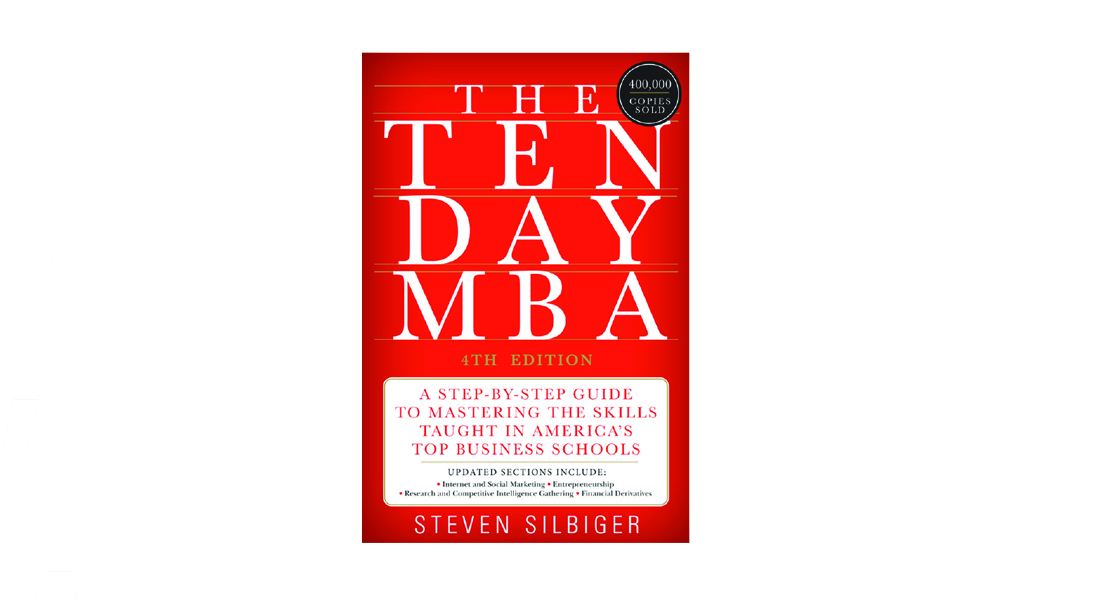

I READ IT FOR YOU: THE TEN DAY MBA

| December 18, 2019I’m an anxious person, so I keep a pillow stuffed with eight months’ worth of living expenses. It’s a little stiff , and the crinkly sound drives my wife crazy, but it helps me sleep better.

E

veryone wants a deal these days. If it’s a hotel, we want to pay with points. If it’s a flight, we want to pay with miles. And it’s not just purchases that whet our appetite for deals — it’s also our time. Yeshivos frequently offer programs where you can finish college during bein hazmanim. If that’s too burdensome — and for many it is — we’ll soon have programs offering PhDs that just require you to listen to a podcast series on your drive to morning seder. So, if you’re looking for a great deal on mastering a large amount of material in a short amount of time, consider reading Steven Silbiger’s The Ten Day MBA (Harper Collins, 2012). And if you’re not much of a reader, here’s an even better deal — I read it for you.

The Ten Day MBA has ten chapters, so you really can finish it in ten days. Essentially, the book is designed to give you a basic overview of key principles and concepts that normally cost tens of thousands of dollars to learn in an MBA program. The best part, for language lovers like myself, is the jargon. As the author explains: “When MBAs congregate, we tend to engage in ‘MBA babble.’ Our use of mystical abbreviations like NPV, SPC, and CRM is only a ruse to justify our lofty salaries and quick promotions.” Seasoned yeshivah students know that the real entry into the Torah world is not so much the body of knowledge as it is the movements and motions. Knowing the difference between “shtel tzu” and “tzu shtel” is half the battle. I should know. As a doe-eyed boy from a modern orthodox school, I could have used a Ten-Day BTL [Bachelor’s of Talmudic Law] book when I first arrived at Ner Yisroel. I needed to learn the hard way for yeshivah, but with this book you won’t have to do that for business.

The book covers the following nine subjects: marketing, ethics, accounting, organizational behavior, quantitative analysis, finance, operations, economics, and strategy. Day number ten is dedicated to what the author terms “MBA Minicourses,” which include a bunch of shorter subjects such as public speaking, negotiating, business writing, and financial planning. The danger of the book is how smoothly it reads — it’s remarkably easy to convince yourself that you know something when you’re finished. Keep in mind, though, how quickly — and superficially — some of the subjects are being presented. Given the dense structure and the breadth of the book, there is no central thesis or one main idea inside the text. There are, however, several highlights worth sharing: The Ten-Minute Financial Planner: This really only takes ten minutes, and there are five rules Silbiger presents. As some may already know, it’s nearly impossible for me to ignore a list of five.

So here it goes.

1) Pay yourself first. 401(k) and 403(b) aren’t supposed to sound fun. Discipline is not fun, and deferring payment requires discipline. But the author argues that the fastest way to build wealth is by taking advantage of deferred taxes that allow you to keep more of what you earn. There’s a famous study known as the Stanford marshmallow experiment. In the test, led by Dr. Walter Mischel, researchers gave children a choice of having one marshmallow immediately or, if they waited patiently, they could have two marshmallows later. The children were left alone in the room with one marshmallow and the psychologists noted whether the children ate that single marshmallow in front of them or remained disciplined, holding off for the double portion. Psychologists found that a child’s ability to delay gratification correlated with experiencing more success in life as an adult. In many ways, learning to save money properly is life’s marshmallow test. A bigger paycheck is one marshmallow now. A robust retirement account is more marshmallows later.

2) Own your home. Ask your financial adviser about this one before you do anything drastic. But, as Silbiger argues in the book, there are many potential long-term financial benefits to owning a home rather than renting.

3) Create an emergency fund and investment portfolio. In the book, the author recommends saving enough money for three to six months, but that the exact cushion may depend on your relationship to risk — and how easily you can fall asleep at night. I’m an anxious person, so I keep a pillow stuffed with eight months’ worth of living expenses. It’s a little stiff , and the crinkly sound drives my wife crazy, but it helps me sleep better.

4) Invest wisely. This is the simplest advice, and a tip we will likely return to when we more closely examine some of the key works on constructing a portfolio. However good it sounds, don’t buy the stock based on the tip you heard in shul. Oh, it’s about to get FDA approval? You’ll need the medication after you lose your money. Stick to broad-based index funds. If you don’t know what that is, google “Vanguard ETF.” Buy those, and save the FDA pending drugs for bein hazmanim.

5) Be selectively extravagant and pervasively frugal. This may be the best advice in the entire book. Enjoying life is important, but you’ll enjoy it more — and have more money to do it — if extravagance is an occasion rather than the norm. A healthy default is sensible frugality.

The Ten Day MBA is a remarkable book. More than the content, it is a reminder to the reader of how much can be accomplished in ten days. It’s taught me to never doubt how much I can learn in a short period of time. And that’s a good deal, if you ask me.

Rabbi Dovid Bashevkin, director of education for NCSY, teaches Jewish Public Policy at Yeshiva University’s Sy School of Business and is currently completing a dissertation in public policy at the New School, focused on crisis management. His book, Sin•a•gogue: Sin and Failure in Jewish Thought, was recently published by Academic Studies Press. He has been rejected from several prestigious fellowships and awards.

(Originally featured in 2.0, Issue 7)

Oops! We could not locate your form.