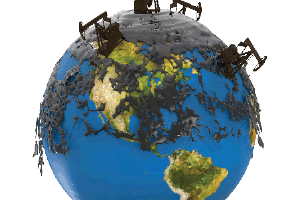

Drowning in Oil

| February 17, 2016 The stock market is crashing there’s talk of 99-cent-per-gallon gas and oil — the commodity that was supposed to one day dry up and go the way of the Dodo bird — seems as plentiful as water. What got us to this point? And will things ever be the same? The simplest way to understand the great oil glut of 2015-2016 is supply and demand. There is simply more oil on the market than we can use. Global oil supply today is 97 million barrels per day (mb/d) but demand is 94.8 mb/d. Just to provide perspective the difference is nearly all of Canada’s daily oil consumption. But that’s not the entire story. In addition to oversupply three factors have collided to force prices to levels not seen in 12 years: the declining Chinese economy an abundance of US oil and a decision by the government of Saudi Arabia to keep pumping oil — even if it means losing money in the short term — to price out the competition. So while we’re all enjoying cheap gas consider that it comes at a price. The stock market which is highly sensitive to the oil market has lost $1 trillion in just the last six weeks alone. Moreover new oil producers in the United States that had seen a boom over the last few years are now facing bankruptcy. The loss of thousands of skilled jobs can’t be good for the American economy. Toss the highly flammable ingredient of geopolitics into this mix. Thanks to the nuclear deal negotiated by the White House Iran has just entered the oil market again — much to the dislike of regional rival Saudi Arabia. So far despite White House promises it does not seem as though Iran is spending its “nuclear dividend” on the improvement of its citizenry but on exporting its influence across the Middle East.

The stock market is crashing there’s talk of 99-cent-per-gallon gas and oil — the commodity that was supposed to one day dry up and go the way of the Dodo bird — seems as plentiful as water. What got us to this point? And will things ever be the same? The simplest way to understand the great oil glut of 2015-2016 is supply and demand. There is simply more oil on the market than we can use. Global oil supply today is 97 million barrels per day (mb/d) but demand is 94.8 mb/d. Just to provide perspective the difference is nearly all of Canada’s daily oil consumption. But that’s not the entire story. In addition to oversupply three factors have collided to force prices to levels not seen in 12 years: the declining Chinese economy an abundance of US oil and a decision by the government of Saudi Arabia to keep pumping oil — even if it means losing money in the short term — to price out the competition. So while we’re all enjoying cheap gas consider that it comes at a price. The stock market which is highly sensitive to the oil market has lost $1 trillion in just the last six weeks alone. Moreover new oil producers in the United States that had seen a boom over the last few years are now facing bankruptcy. The loss of thousands of skilled jobs can’t be good for the American economy. Toss the highly flammable ingredient of geopolitics into this mix. Thanks to the nuclear deal negotiated by the White House Iran has just entered the oil market again — much to the dislike of regional rival Saudi Arabia. So far despite White House promises it does not seem as though Iran is spending its “nuclear dividend” on the improvement of its citizenry but on exporting its influence across the Middle East. To read the rest of this story please buy this issue of Mishpacha or sign up for a weekly subscription

Oops! We could not locate your form.