Diverging Roads

| November 6, 2024As the months of promises are replaced with actual policy, a look at the road ahead and the road not taken

Photos: AP Images

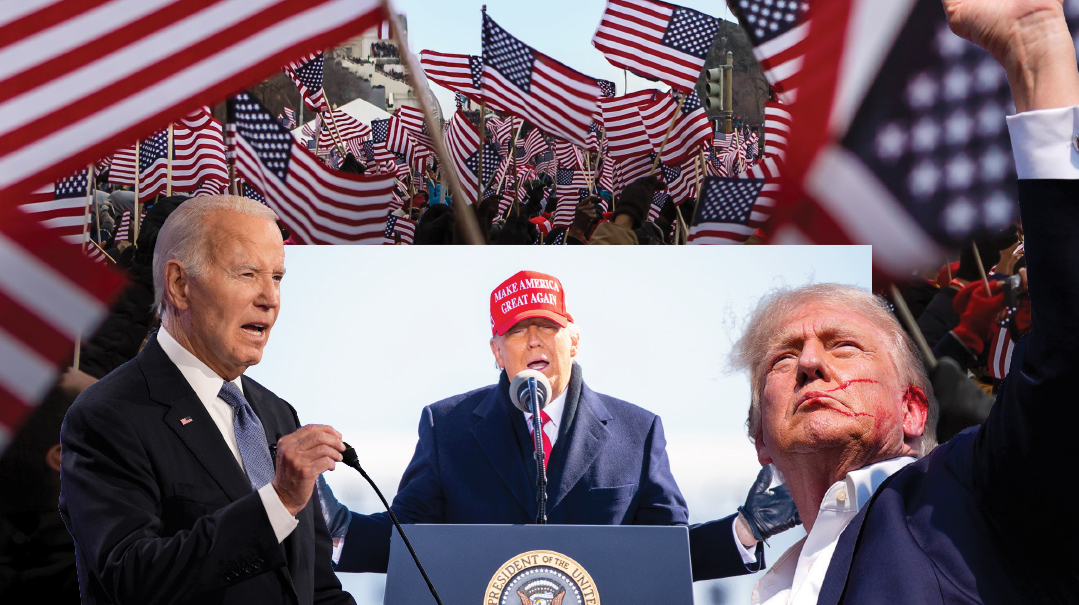

With a majority of Americans saying they feel their nation is “heading in the wrong direction,” and a dangerous constellation of conflicts abroad, Vice President Kamala Harris and former president Donald Trump were challenged to give voters hope the next four years would herald brighter horizons. Each did so with a cocktail of soaring rhetoric and wonkish details to either “Make America Great Again” or usher in a “New Way Forward.”

At the risk of oversimplification, the two platforms’ dueling themes carry heavy doses of irony and extrapolation from campaign messaging. While Mr. Trump’s mantra hearkens back to an unidentified point in America’s past, many of his positions, from waging a war against imports to taking a step back from international attachments and sizing down the administrative state, would mark a stark departure from decades of American norms.

And while Ms. Harris’s appeal to “turn the page” chiefly referenced the acrimonious tenor and drama of the Trump-era, her plans — from loyalty to international bodies to expanding government’s role in economic planning and education — bespoke a bigger, bolder version of the status quo.

As the months of promises are replaced with actual policy, a look at the road ahead and the road not taken.

Taxes & Economy

Every presidential campaign includes plans to cut taxes.

Both candidates proposed raising the child tax credit for newborns, presently at $2,000. The idea was first pitched by Senator J.D. Vance, who called for it to be upped to $5,000. Ms. Harris raised the ante to $6,000. Neither side paid much attention to how the tax cuts would impact the already gargantuan national debt.

Road Ahead

“Everybody knows what I’m going to do. Cut taxes very substantially. And create a great economy, like I did before.”

Mr. Trump’s tax agenda is rooted in bolstering the changes Congress enacted during his term, which modestly lowered rates for most individuals and slashed corporate taxes from 35% to 21%. Most of these changes are set to expire in 2025. The campaign wanted to make them permanent and further cut corporate rates to 15% for companies that produce in America.

Mr. Trump credits his tax cuts for the economic growth that marked his pre-pandemic term in office.

The 2017 cuts eliminated the ability to deduct state and local taxes (SALT), a significant loss for residents of high tax states like New York, New Jersey, and California. On the 2024 campaign trail, Mr. Trump said he wanted to restore the deduction.

Another campaign season proposal was eliminating taxes on Social Security.

Imposing steep tariffs was the key item in Mr. Trump’s toolbox to revive domestic manufacturing and struggling working-class communities. He memorably commented, “The most beautiful word in the dictionary is ‘tariff.’ ”

Team Trump said that duties of 10% to 20% would be placed on all foreign produced items, 60% on goods made in China. The goal was to give “Made in the USA” alternatives an automatic advantage, reviving industries gutted by low-cost foreign competitors.

In addition to the role Mr. Trump envisioned tariffs playing in his economic vision, the income they generate would be the chief source of income to offset revenue losses from tax cuts.

Road Not Taken

“I am offering what I describe as an opportunity economy.”

The Harris campaign marketed her tax plan as “cuts for middle-class families.” One proposal was to make permanent a $3,600 per child credit, a temporary measure enacted as part of a Covid relief package.

Another highly touted initiative was a plan to make home rental and ownership more affordable. That included policies to encourage construction of three million new homes and a tax credit for first-time home buyers. Ms. Harris proposed giving homebuyers $25,000 toward a downpayment.

Ms. Harris also rolled out a plan to raise the tax deduction for start-up businesses from $5,000 to $50,000, accompanied by a vague pledge to encourage venture capital to flow toward small enterprises.

To offset cuts, the Harris team says it would “ensure the wealthiest Americans and the largest corporations pay their fair share.” That translated into reversing many of the Trump-era tax cuts, including raising corporate taxes to 28%. Other proposals included a new set of earnings and capital gains taxes on wealthy individuals.

Border Security & Immigration

No issue was more central to Mr. Trump’s initial political ascendance than immigration, punctuated by his 2016 promise to build a “big, beautiful wall” across the US-Mexican border. Yet after four years of widespread criticism of the Biden administration’s inability to control illegal border crossings, Ms. Harris, too, struck a tougher stance on the issue.

Road Ahead

“At the heart of the Republican platform is our pledge to end this border nightmare, and to fully restore the sacred and sovereign borders of the United States of America — on Day One.”

Mr. Trump came to the campaign with an upper hand on the border, as the policies of his administration proved effective in controlling it and the Biden administration’s suspension of key measures sparked a flood of illegal migrants. His plans are basically to turn back the clock.

Doing that includes using federal law enforcement to arrest and deport thousands who entered the country illegally and subsequently broke other laws while here, focusing on violent crime and drug trafficking.

Mr. Trump said he would use executive orders to restore policies that made it more difficult for migrants to claim asylum or to disappear into the US while their cases are pending. These include requiring them to “remain in Mexico” while their claims are reviewed and denying asylum to those caught crossing into the country between designated ports of entry.

Mr. Trump introduced plans to revise the legal immigration system, which would require an act of Congress. The theme of these changes is implementing a system that is “merit based,” meaning it would prioritize those with skills lacking in the domestic workforce. That would switch away from the family-based system presently in place, which critics say played a major role in taking jobs from US citizens.

Road Not Taken

“I reject the false choice that suggests we must choose either between securing our border and creating a system that is orderly, safe and humane…We can, and we must do both.”

Ms. Harris’s most repeated statement on the issue was support for the failed bipartisan bill that would have given the White House more tools to stop asylum claims and add 1,500 border agents.

Her campaign signaled that she would continue the executive measures the Biden administration took after the bill stalled, restricting asylum seekers and creating other barriers to illegal entry.

Inflation

At a time when sharp price hikes have taken a bite out of most Americans’ budgets, candidates were under pressure to come up with ways to reverse inflation. Past trends show that it is nearly impossible to drive prices down significantly —especially from the White House — but that has never stopped politicians from promising.

Road Ahead

Mr. Trump’s plans to reduce prices ran through two other flagship policy promises, tariffs and domestic energy production. Imposing duties on food imports, he claims, would encourage a more competitive domestic market.

Cranking up domestic energy production, Mr. Trump argued, will lower costs of oil and gas, which historically have been a price driver across markets.

Road Not Taken

Ms. Harris pinned high food prices on “bad actors,” who exploited the post-pandemic economy to maximize profits, and promised to use the hand of government regulation to “go after” them. She supported passing a federal ban on food price gouging, which would have granted the FTC power to determine and punish unfair pricing.

Ms. Harris also said that she would use the Biden administration’s beefed-up anti-trust enforcement to attack anti-competitive moves by food wholesalers.

Energy & Climate

While the right and left speak different languages on climate and energy, the candidates were not as far apart from each other as in other areas. While Mr. Trump is far more brash in his promises to “drill, baby, drill,” Ms. Harris did not distance herself from the Biden administration’s approval of more domestic production. Her measured approach on climate drew criticism from progressives, who saw Ms. Harris as timid on the issue.

Road Ahead

“Under the Trump Administration, just three and a half short years ago, we were Energy Independent, but soon we will be Energy DOMINANT and supply not only ourselves but the world.”

Unleashing domestic oil and gas production was a leading Trump team promise. Mr. Trump pledged a return of the abundance of licenses that were granted for drilling and other extraction methods during his administration, claiming his policies would slash energy prices in half.

Mr. Trump criticized environmental regulations, saying, “One of the things that’s so bad for us is environmental agencies. They make it impossible to do anything.” He pledged to end what he labeled “the Biden administration’s electric vehicle mandate,” a set of policies encouraging electric vehicle production and use.

Road Not Taken

“My position is that we have got to invest in diverse sources of energy so we reduce our reliance on foreign oil.”

Ms. Harris backed away from prior support for the “Green New Deal” and near blanket opposition to domestic oil drilling. That included a reversal of her 2019 support for a fracking ban.

She touted the Biden administration’s energy policies, which increased licensing for US gas and oil production, while promoting growth of clean energy industries. That included incentives to produce more electric cars. She supported the United States’ rejoining the Paris Climate Agreement, calling it essential for “our children’s future.”

Education

Education is an area where Mr. Trump and Ms. Harris drew sharp contrasts, with the latter planning to bolster the nation’s public schools using the federal government as her tool, and the former planning to blow up the Education Department, use federal funding as a cudgel against progressive agendas, and create a national school choice initiative.

Road Ahead

“We will drain the government education swamp and stop the abuse of your taxpayer dollars to indoctrinate America’s youth with all sorts of things that you don’t want to have our youth hearing.”

Opposition to the status quo of American education took many forms in the Trump campaign. He pledged to pull federal funding from schools pushing ideas like critical race theory, promoting progressive social agendas, or exposing children to inappropriate material. Team Trump also said it would hold universities responsible for fostering support for terror groups like Hamas or failing to address intimidation of Jewish or pro-Israel students.

Mr. Trump pledged to make federal dollars available to expand school choice options, which would require Congressional action.

His boldest proposal was eliminating the federal Education Department as a means of trimming bureaucracy and funneling more money directly to state school systems.

Road Not Taken

“We are not going to let [Trump] eliminate the Department of Education that funds our public schools.”

Education played little role in the Harris campaign. Her positions focused on directing additional funding to public schools to create programs like universal pre-kindergarten and expanding the Biden administration’s policy seeking forgiveness for student debt.

When parent groups and some states took action to prevent explicit material being taught in the classroom, Ms. Harris criticized their efforts, saying, “We want to ban assault weapons, and they want to ban books.”

She has also opposed pushback against progressive narratives of American history, characterizing those behind such efforts as “extremists.”

NATO and Internationalism

One of the starkest distinctions between the candidates was how they viewed America’s role on the world stage. Consistent with his nationalist message, Mr. Trump broke with decades of bipartisan consensus to loudly question whether NATO and other alliances that come with high financial and potentially human costs serve the nation’s interests. Ms. Harris remained a stalwart defender of alliances, claiming robust US support is the only way to defend American interests and preserve world order.

Road Ahead

“We were supporting NATO. They [hurt] us on trade so bad, the European nations. And then on top of that, they were [cheating] us on the military. So, they’re taking a tremendous advantage of us… It’s not sustainable. You can’t keep doing this.”

Mr. Trump’s administration rattled many with ties to the globalist political system. Some of that involved renegotiating or leaving trade agreements. Through threats to quit NATO, he cajoled European partners to pay millions more on defense. Mr. Trump insists that America is still paying far more than it should for an organization he sees as chiefly protecting Europe.

Despite his skepticism over the NATO’s effectiveness, Mr. Trump said that if partners paid their “fair share,” he would stand by America’s commitment.

The issue goes beyond NATO or any other organization. In general, a fundamental of Mr. Trump’s nationalist message is that the US is best able to protect its interests unfettered by binding international agreements.

Road Not Taken

“We are committed to pursue global engagement, to uphold international rules and norms, to defend democratic values at home and abroad… I strongly believe America’s role of global leadership is to the direct benefit of the American people.”

Ms. Harris squarely aligned herself with the Biden administration’s goal of reassuring NATO and other international bodies, including the United Nations, of America’s commitment to working jointly to preserve world order. She argued that only by America acting in concert with other democratic nations can it effectively confront mutual enemies and protect its own national security and economic interests.

Israel

With the fallout of Hamas’s October 7 attacks in the background, Israel played an outsized role in the 2024 elections. Surprisingly, little separated the two candidates on official policy lines with both backing Israel’s attempts to defend itself from Hamas and Hezbollah threats. But away from the carefully crafted world of policy, anti-Israel sentiment on the left pushed Ms. Harris to balance her statements, leaving Mr. Trump room to cement his reputation as an unfettered backer of Israel.

Road Ahead

“You have a big protector in me.”

Mr. Trump’s prior approach broke from previous administrations’ emphasis on seeking direct resolution between Israelis and Palestinians, instead focusing on promoting deals between Isreal and Sunni states. The next step in that process would be to turn to the grand prize of an accord between Israel and Saudi Arabia, a nation that Mr. Trump maintained strong relations with while in the White House.

On the present conflicts with Hamas and Hezbollah, most assume Mr. Trump will give Israel a wide berth to achieve its security goals, but he has expressed an interest in ending operations quickly with statements like, “Get it over with and let’s get back to peace and stop killing people.”

Road Not Taken

“I will always give Israel the ability to defend itself… But we must have a two-state solution where we can rebuild Gaza, where the Palestinians have security, self-determination, and the dignity they so rightly deserve.”

Ms. Harris’s comments consistently straddled a thin line between continuing US support for Israel’s security interests and heightened sympathy for Palestinians.

Most analysts predicted Ms. Harris would do little to alter the US’ defense aid to Israel, but she might have been more open in pressuring its leaders to restrain their military operations, in line with a comment she made repeatedly that, “Israel has a right to defend itself… And how it does so, matters.”

In step with most Democrats, Ms. Harris favored a two-state solution. However, what that would have meant in reality is unclear as even among liberal policy minds, most acknowledge there is no basis to work toward that goal.

Iran

In the 2024 election cycle, Iran found itself universally viewed as an implacable foe of American interests. His 2020 campaign featured Mr. Trump defending his “maximum pressure” policy against team Biden’s hopes for a return to a nuclear deal. Now, after attempts to revive the pact failed, and a year of attacks on US troops by Iranian proxies, the space between the candidates was not over whether to treat Iran as an enemy, but the level of risk acceptable in doing so.

Road Ahead

“Iran was broke under Donald Trump. Now Iran has $300 billion because they took off all the sanctions that I had. Iran had no money for Hamas or Hezbollah or any of the 28 different spheres of terror.”

Most of Mr. Trump’s comments on the campaign trail regarding Iran focused on calls for a tougher line. If they are made reality, that would likely mean more sanctions and more sanction enforcement, like attempts to stop its oil sales to China. It could also mean targeted strikes like the one that killed Qassem Soleimani in 2020.

During his administration, Mr. Trump worked to isolate Iran by strengthening US support for its regional archrival Saudi Arabia.

Road Not Taken

“We will never hesitate to take whatever action is necessary to defend US forces and interests against Iran and Iran-backed terrorists.”

Ms. Harris used some of her toughest foreign policy rhetoric on Iran, labeling it America’s “greatest adversary.” She backed US actions targeting Iran-backed proxies in the region and those deflecting aerial attacks on Israel.

While she supported a return to the Iran nuclear deal during her 2019 primary run, in this campaign Ms. Harris did not speak of such an option.

Some of Ms. Harris’s statements on Iran were offset by echoes of the Biden administration’s aversion to risks of escalation, like when she couched comments on America’s role in shooting down Iranian missile attacks on Israel by saying, “The critical point is that there must be a de-escalation in the region.”

Ukraine and Russia

The Ukraine war served as proxy for the candidates’ views on America’s role in the world. For Mr. Trump, while he holds Russia in the wrong, it is a conflict in which the US has limited national interest. For Ms. Harris, Ukraine was the stage on which to prove that aggression can only be held in check by America acting as an international leader.

Road Ahead

“I will get that settled, and fast. And I’ll get the war with Ukraine and Russia ended. If I’m president-elect, I’ll get it done before even becoming president.”

Mr. Trump said that he would leverage his relationships with Vladimir Putin and Volodymyr Zelensky to end the war, but never presented a roadmap to navigating the as-yet unbridgeable terms both sides present. He has not committed to continuing defense aid to Ukraine, saying its European neighbors should take a larger share of the burden.

Road Not Taken

“If we stand by while an aggressor invades its neighbor with impunity, they will keep going — and in the case of Putin, that means all of Europe would be threatened.”

Ms. Harris continued to back the Biden administration approach of sending military aid to Ukraine for “as long as it takes,” arguing that a solution to the conflict can only be achieved through support for the war and heightened international pressure on Russia.

(Originally featured in Mishpacha, Issue 1035)

Oops! We could not locate your form.