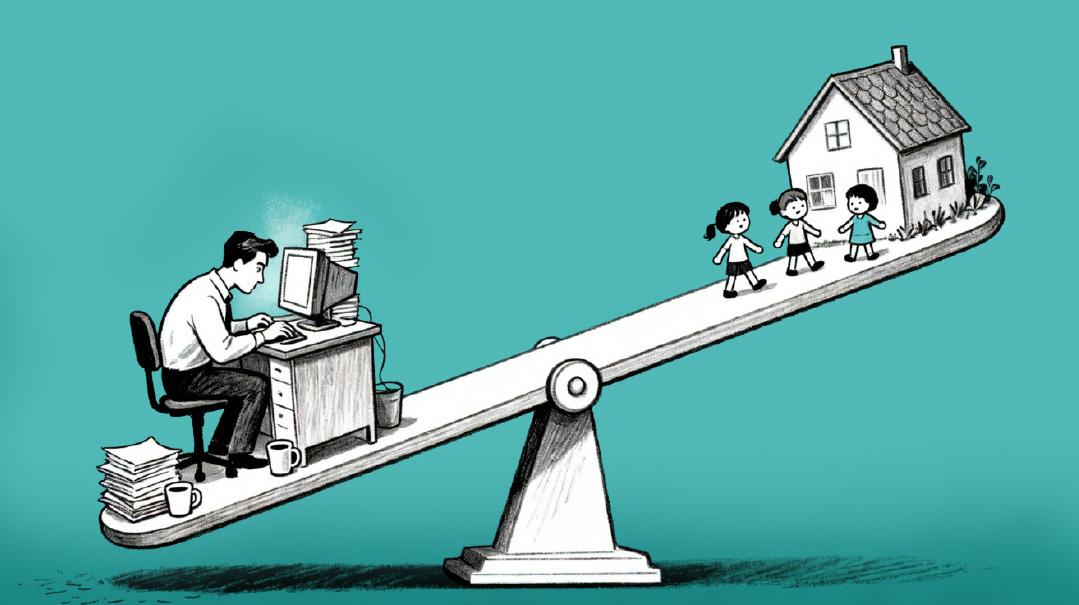

Are Parents Giving Too Much?

| September 30, 2025The entitlement and quiet greed we’ve allowed to creep into our culture is tearing families apart

I

used to think that if I ever got rich, I’d leave it all to my kids.

Now? I’m not so sure.

I am the CEO of VisionRE, a realty advisory firm. I’ve been in the real estate consulting business for over ten years. Specifically, over the last 2.5 years, I have been asked to advise on the remediation of troubled real estate assets across the US as a response to changes in the market. Real estate was once considered a relatively safe way to earn income and build wealth. But now with shifts in interest rates, demand, and regulations, many properties are struggling with cash flow and have crippling debt — which leaves the owners without a lucrative parnassah.

Recently, I posted on LinkedIn about wealth, children, and inheritance. I shared how I’ve seen families fall apart when “Dad’s hard-earned money” — or his inheritance — is lost, leading to resentment or broken relationships. And how even when children inherit wealth or join their father’s business, they are often unequipped to manage it because those skills were never needed when dollar bills were simply handed to them on a golden tray.

Why does this happen?

Many children grow up with the belief that their parents’ money is essentially “theirs,” as if it is owed to them. And when that money is lost, they feel personally wronged — a mindset that is unhealthy and deeply misguided, and it can lead to family machlokes.

And as a result of entitlement, there’s a deeper issue too: a lack of preparation. Having only seen an endless flow of easy money, these children often don’t have the skills and tools to acquire or manage wealth properly if it ever comes their way.

I raised this point with my followers: “Maybe Bill Gates and Warren Buffett are right to give away most of their wealth. As Warren Buffett says, ‘Leave your kids enough to do anything, but not enough to do nothing.’ Maybe the best legacy isn’t money at all. Maybe its values, preparation, and the freedom to earn your own way.”

I expected a few comments. But instead, the post sparked a reaction. Dozens of people reached out — some publicly, many privately — sharing stories they’ve witnessed about children and their relationship with their parents’ money in every capacity. Many also shared their take on why things turned out the way they did in their specific situation.

One person shared the story of a friend who was fully supported by his father after 20 years of learning in kollel. When the father lost all his money, the son found himself unable to afford his first child’s wedding, since he had relied on his father’s support his entire life and had not saved adequately for the future.

In another case, one we were actually involved in, a son-in-law inherited a substantial sum from his father-in-law as a yerushah. But without the skills to manage the inheritance wisely, he ultimately lost it all through poor investments and personal guarantees — and now carries chovos three times the original inheritance amount.

And another — a family that sold a health care empire reinvested over $30 million through a 1031 exchange into a Sunbelt property alongside a nephew, who personally guaranteed the loans. Today, they face a near-worthless investment, enormous personal liabilities, and a massive tax burden. Thirty years of blood, sweat, and sacrifice have come to nothing — and the constant family fights that erupt because of the loss is the saddest part of all.

Clearly, the topic on the dynamic between children and family wealth struck a chord and proved a point regarding the younger generation today: This newfound and unhealthy sense of entitlement that children have toward their parents’ money has become endemic within our communities.

So many children today don’t just hope for support. They expect it. Not as a gift, but as a right. Not as a blessing, but as a baseline.

There are children — some already grandparents themselves — who saw their parents as never-ending bank accounts. They saw their parents’ money as an entitlement. They relied on them for all their expenses. And they often lacked the skills to manage money independently or work to make their own income.

And when something went wrong and the money wasn’t there?

The anger. The blame. The resentment.

Not “What happened?” but “How could you let this happen to us?”

Losing the money peeled back the cover on what was always there: an unhealthy mindset of entitlement. And once that safety net was gone, the children were left exposed — unequipped to handle the loss or get themselves back on their feet financially because they had been relying on their parents’ money all along. This vulnerability is the root of the anger and blame that quickly turns into conflict between family members.

I’ve been involved in advising for failing real estate portfolios that were once families’ inheritances and dreams. Sadly, I know of some $2.5 billion — possibly even more — of hard-earned or inherited equity that has been wiped out from our community in real estate, and that’s just what I know about. In other fields, too, people who spent decades building businesses find themselves suddenly underwater, facing completely changed financial realities.

But what haunts me most isn’t the dollars lost. It’s the gut-wrenching fights and families torn apart because of it.

This isn’t a one-off. It’s becoming a pattern. A pattern rooted in the sense of entitlement that’s crept into our communities.

Which leads me to ask: Is this the consequence of parents giving too much, too easily and encouraging this mindset?

I wish this were just a philosophical debate — about whether parents should help their children or let them sweat for their money, and the repercussions of each. But for me, it’s real. I’ve seen firsthand the consequences when parents lose their money through real estate — and then face the anger and resentment of their children. And when children aren’t equipped to deal with their parents’ money and lose it all when it’s given to them.

Parents don’t have to lose money before a child’s flawed “entitlement” mindset comes into play.

When I think about how “yerushah” played out in my family, I often reflect on my maternal grandparents — the Kastels from the Lower East Side. They came from humble beginnings as children of 1920s immigrants and lived lower-middle-class lives. But they were grounded in strong values: hard work, humility, and gratitude. Those principles didn’t just shape their children — they shaped us, their grandchildren.

Though they lived with modest means, my grandparents worked hard to support their children in any way they could. But it was never expected, and it was always given based on what each child needed and what was appropriate for them.

I still remember my grandmother’s annual visits to Yerushalayim. She would take my aunt — raising 11 children on a tight budget — shopping for shoes and clothes for each child, and quietly pay off months of overdue grocery bills. Her generosity was quiet, deeply intentional, and most importantly, need-based.

And my family — who didn’t need as much financial help — didn’t receive as much. We received other help, such as my grandmother coming every week, in her mid-seventies, to watch us while my mother worked on Sundays.

When it came time to divide up some stocks they owned, my grandparents chose to divide them by the number of grandchildren — not equally by child. I come from a family of three, while my aunt and uncle have much larger families. So the larger the family, the more they received. And again — we all understood. They needed it more.

That spirit lives on. Today, my parents support my brothers in chinuch, and I don’t resent it. I understand it. That’s the legacy we were given: to give based on need, not entitlement, or blood line.

To rephrase Warren Buffett’s famous line: “Leave your kids enough to do anything, but not enough to do nothing.” This doesn’t have to mean that we shouldn’t give to our children in whatever ways we can, whether it’s helping them start off their marriages in kollel, buying them a home, supporting them fully throughout their lives or even letting them have the knowledge of relying on the family business for long-term support. But it does mean making sure we’re giving them the backbone, skills, and mindset to stand on their own financially, rather than raising children who rely on their parents as a permanent safety net.

After that LinkedIn post and its reaction, I spoke to a posek about this issue of parents supporting children. He told me this isn’t a new question. The Rishonim grappled with it, too.

What is our obligation to our children when it comes to wealth? Are we meant to provide security — or to instill strength? Can we give away 90 percent of our wealth like Buffett, or are we bound to a different framework — al pi halachah — when it comes to distributing assets?

These aren’t theoretical questions anymore. In today’s frum business world, they’re playing out in real time — with real consequences.

I’m not here to give answers. I’m still wrestling with them myself. But I do know this: The entitlement and quiet greed we’ve allowed to creep into our culture is tearing families apart.

And in our world — especially in the frum real estate community — we need to have serious conversations about the legacies we’re actually trying to leave behind.

Because if we’re not careful, the money won’t be the only thing we lose. We stand to lose our families to machlokes as well. I’ve seen it happen in real time.

Joseph Kahn is the CEO and founder of VisionRE, a realty advisory firm based in Lakewood, New Jersey.

(Originally featured in Mishpacha, Issue 1081)

Oops! We could not locate your form.