Extra Credit

| April 1, 2025Will the ECCA school choice bill be the promised lifeline for families drowning in tuition?

A proposed federal bill, if passed, would enable parents to receive taxpayer-funded scholarships to pay for tuition costs, the newest development in the ongoing national school choice effort. And for Orthodox families, for whom school choice isn’t just about accountability, productive competition, or academic outcomes, but a financial lifeline, the bill’s passage could be a vital step in transforming the tuition landscape

Washington, D.C. has always been a fixture in the news cycle, the seat of global power commanding the world’s attention. Yet ever since the President Trump and the Republican juggernaut retook control of the White House and Congress with its stunning trifecta in the November federal elections, the resulting upheaval in national politics and the international order has thrust the city into the spotlight like never before. Even the nation’s media corps, accustomed to a breathless news cycle, is struggling to keep pace.

YET

beyond the political spectacle dominating the headlines, a quieter yet crucial battle is playing out — one that could, for the first time in American history, bring real tuition relief to millions of parents. The Educational Choice for Children Act (ECCA) is a proposed federal bill that, if passed, would provide tax credits for donations to nonprofit scholarship-granting organizations, enabling parents and students to receive taxpayer-funded scholarships to pay for educational expenses, including private school tuition costs. For many of the bill’s supporters, ECCA is another development in the wider school choice effort: More choice equals improved academic outcomes, increased parental satisfaction, and a more diverse and competitive education landscape.

For Orthodox Jewish families, in which tuition bills often rival mortgage payments, school choice isn’t just another wonkish policy debate about accountability or educational doctrine. It is a financial lifeline. Yeshivah tuition for a single student can be in the tens of thousands and there are no signs of those numbers coming down anytime soon. With many families juggling multiple such tuitions, the financial strain is staggering. Given ECCA’s annual allocation of ten billion (that’s billion, with a “b”) dollars, the act’s passage can create a sustainable pipeline for tuition assistance and transform the tuition landscape for frum families.

As budget negotiations ramp up and President Trump presses congressional Republicans to present him with a “big, beautiful bill,” the Agudah is working overtime with its coalition partners to ensure that ECCA is prioritized and included in the final package. The Agudah organized a two-hundred-person mission to converge on Capitol Hill this Wednesday, April 2, to advocate for ECCA. During the mission, business owners, community members, and askanim from around the country will hold dozens of meetings with Congressional leaders to impress upon them the importance and impact that ECCA could have.

Breakdown of a Bill

So what, exactly, is ECCA and how does it work?

Like all legislation, it’s a complex bill, replete with legal jargon and multi-digit cross-references to the Internal Revenue Code. Rabbi A.D. Motzen, who serves as the Agudah’s national director of government affairs, is widely acknowledged as one of the country’s leading experts on the topic. Over the last year, he’s presented on the bill hundreds of times, to audiences ranging from Agudah conventions, Torah Umesorah functions, webinars for community leaders, yeshivah summits, media interviews, intimate gatherings of high-level policymakers in marble-lined congressional offices, and fellow shul-goers seeking the inside scoop after Shacharis.

Prior to the mission, Rabbi Motzen broke down the bill, which unlike some voucher programs, does not provide direct government funding to private schools. “Under the ECCA, the federal government will make ten billion dollars in tax credits available to individuals and businesses that donate to nonprofit scholarship organizations. Families can apply to these organizations for scholarships to help pay for educational expenses, including private school tuition,” he says.

On a more granular level, the bill is best explained divided into three separate aspects — the donor, the organization handling donations, and the recipients.

The Donor

A taxpayer (individual or corporation) starts the process by making a donation to a nonprofit organization called a “Scholarship Granting Organization” (or an “SGO” for short) of their choice. For each dollar that is donated, the taxpayer receives a full credit (not a deduction) against their tax liability. ECCA allows a taxpayer to donate up to ten percent of his or her adjusted gross income and receive a dollar-for-dollar credit. For a corporation, the maximum credit cannot exceed five percent of the company’s taxable income. Thus, an individual who earns $150,000 annually and pays approximately $16,000 a year in federal taxes can donate up to $15,000 to an SGO, and reduce their tax liability to just $1,000.

Given the one hundred percent tax credit, a donation to an SGO is essentially earmarking tax dollars to benefit chinuch rather than the United States Department of the Treasury. Once a donation is made to an SGO, the taxpayer can claim a tax credit.

The SGOs

The SGO is essentially charged with accepting donations, vetting applicants, and processing scholarships to those that are eligible.

The Act does require that an SGO service students attending more than one school (so not every school can set up their own SGO), and that the SGO prioritize students who were awarded scholarships the previous year and any siblings the awardee may have. Aside from those provisions, there is significant autonomy granted to the SGO in deciding how to allocate scholarships.

In fact, ECCA proponents (including government bureaucrats) specifically want the process to remain free of intrusion of government bureaucrats. To achieve that, the bill explicitly states that, “To the extent permissible by law, this Act, and any amendment made by this Act, shall be construed to allow scholarship granting organizations maximum freedom to provide for the needs of the participants without governmental control.”

The Recipient

How does the money reach yeshivah-tuition-paying families? Families can apply to an SGO for a scholarship. The bill has a relatively high eligibility rate for students to qualify for the scholarships (300 percent of an area’s median income), which ensures that scholarships can be awarded to both lower- and middle-income families. As an example, in Ocean County, New Jersey, which encompasses Lakewood, Toms River, Jackson, and Manchester and is home to more than 50,000 Orthodox Jewish students attending private schools, the median income is over $130,000, allowing students in households with incomes up to $390,900 to be eligible for scholarships. In Brooklyn, New York, the cut off for a family to be eligible for a scholarship would be an annual income of $283,200 or higher.

Rabbi Motzen points out that “while we continue to advocate for universal eligibility, this would easily cover the struggling middle class.” Once determined as eligible, a student can receive a scholarship for the full amount of their educational expenses, limited only by the donations that the SGO received.

Since the scholarships are designed to be donor driven, ultimately, how much our community benefits will be determined by how actively we participate and generate donations. “If every family and business in our community, whether or not they have children in our schools, donates the maximum allowed contribution, it would generate enough funds to significantly lower tuition and in some cases, allow students to attend for free,” says Rabbi Motzen. “It could also help parents afford expensive special education services and other approved educational expenses.” While the law prohibits donors from earmarking their donation to specific students, there is nothing preventing donors from designating their contribution to a specific school or group of schools — and that model has proven to be successful. “That is exactly how many of the more than twenty existing scholarship tax credit programs around the country in states that have such programs currently work,” he says.

Gamechanger

At the opening session of the recent Torah Umesorah Presidents Conference, the topic was the spectacular opportunity that ECCA may herald. As it got underway, the moderator asked a rather blunt question, one that is being asked increasingly as news about ECCA spreads. “The ten-billion-dollar question,” he stated somewhat sardonically, “is if indeed the bill is signed into law, will it actually help parents? Or will schools simply raise tuition, allowing parents to get the scholarships but not see any significant relief?”

In response to this pointed question, let’s bring up Exhibit A: A case study of how a similar tax-credit-funded scholarship program worked out for a community that shares the demographics and dynamics of many frum communities across the United States.

In 2017, the Illinois state legislature enacted the “Invest in Kids Act” — or IIKA for short. Like ECCA, IIKA (government is notorious for throat-clearing-sounding acronyms) was a scholarship tax credit — or STC — program enacted with the express goal of providing low-income students with access to private school education. It allowed individuals and businesses to receive a 75 percent state income tax credit for donations made to SGOs, which then distributed scholarships to eligible students. Under the STC program, families earning below 300 percent of the federal poverty level could apply. The total statewide tax credit cap was $75 million per year, effectively incentivizing up to $100 million in donations.

Unfortunately, despite an intense lobbying effort by Chicago’s frum community and like-minded partners, the program expired at the end of 2023, after failing to secure enough support for an extension.

During the period STC was alive and kicking, Rabbi Sammy Joseph served as the program’s coordinator at Joan Dachs Bais Yaakov-Yeshivas Tiferes Tzvi Elementary School, the largest frum school in Chicago. He says the program was an absolute game changer for parents and schools, and everyone worked together to make sure everyone benefited. “The school prioritized families seeing real relief,” he says.

During the first year of the program, full tuition at JDBY-YTT was $13,100. Parents on the lower end of the financial spectrum were paying significantly less. When those parents received STC scholarships for $12,973 (the maximum scholarship under Illinois law), the school was able to reduce the tuition to a token $127 for the entire school year — allowing low-income parents to save $3,173 per student, while the school received full payment for them. “These families went from struggling to pay $3,300 in tuition to becoming full-paying parents overnight,” he explains.

The impact on families was profound, Rabbi Joseph recalls.

The school gained as well. JDBY-YTT’s tuition revenue increased by an additional $9,800 per scholarship recipient. This enabled the school to grow responsibly in proportion to increased enrollment and run a more robust and successful operation.

Rabbi Shlomo Soroka, the Illinois Agudah’s Director of Government Affairs, said going in with the right mindset is crucial. Parents needed to understand that education comes with real costs, including payroll and operational expenses. Once that awareness is established, donors need to step up and schools need to adopt a uniform formula: Any scholarship amount exceeding the full cost of tuition would be adjusted accordingly.

According to Rabbi Soroka, one of the most important points to convey to schools is that programs like this are not designed to subsidize education — they are meant to give students a choice. If schools treat it as a subsidy, it reflects poorly and makes legislators less likely to support it. Additionally, parental involvement is crucial; parents must continue advocating for these programs, as strong-arm tactics from the school will only go so far. “If the program is structured correctly, parents will apply, donors will contribute, and everyone will benefit,” he says.

That’s exactly what happened in Chicago, Rabbi Joseph says. “Schools worked together, donors stepped up, accountants helped both donors and families applying to receive scholarships navigate their tax situations. STC was one of the greatest expressions of achdus I’ve experienced outside of a tragedy. Everyone benefited.”

Recipients Turned Donors

According to the National Center for Education Statistics, a federal statistical agency responsible for collecting, analyzing, and reporting data on the condition of US education, there are approximately five million K-12 students in the United States that attend nonpublic schools. While there is no official data on how many of those students are Orthodox, Rabbi Chaim Shimon Neuberger, the National Director of Torah Umesorah, estimates that the number is approximately 350,000 — ranging from Modern Orthodox to right-wing chassidic, representing a full seven percent of nonpublic-school students (although arguably the number of nonpublic-school students may increase if there is funding available).

ECCA, were it to pass, would provide a whopping ten-billion-dollar tax credit. If the frum population receives just its proportionate share, that would mean $700 million in new funding for scholarships — a sum large enough to alter the education landscape for our community. Given our community’s drive and determination, some advocates are optimistic that our community will be able to obtain even more, since the amount of scholarships available to each community will be dependent on the donations that SGO can generate. With a 100 percent tax credit for every dollar donated, there isn’t a reason even those who usually are not in a position to make significant donations won’t be able to pump in serious cash to communal coffers. Everyone has some tax liability, so why not send that money to support Torah instead of the Treasury?

That was a point that the schools in Chicago drove home. “Your tax dollars can fund the state… or provide relief to your friends and neighbors,” read one ad ran by JDBY-YTT. “Giving is not just for gvirim. Even recipients can be donors,” read another. One parent was quoted in an ad saying that “STC enabled me to give more tzedakah than I’ve ever given before — and far more than I thought possible.”

There will be a learning curve and people will have to talk to their accountants on how to reallocate their tax dollars. But the effort will be well worth it. “If we’re armed and ready to act, we can get more, since this is a first come, first served program,” says Rabbi Motzen. And the Agudah is already gearing up to make sure that happens. “We are working diligently to put the infrastructure in place so that if the bill passes, the community will be well positioned to take full advantage,” he says. “When they instituted this program in Illinois, the Jewish community received a total of thirty percent of the funds, which is far beyond our share of private school students.”

The Time Is Ripe

ECCA was first conceived of approximately three years ago by a coalition of groups that comprise the pro-school-choice community. The motley group includes libertarians, who support minimizing government control and maximizing parental choice; conservatives, who emphasize competition and educational freedom to improve quality; free-market proponents, who support voucher programs to drive innovation and accountability; and religious groups, such as Agudah, that advocate for policies that help families afford a Jewish education. Rabbi Motzen and his team at Agudah have spent the last few years feverishly working on this very bill, and have emerged as one of the most impactful and key players. Hours were spent drafting, debating, and refining, all while keeping hawkish vigilance on federal politics and policy debates, with the aim of creating legislation that offers parents tangible relief while also having a realistic chance of becoming law.

One point that Rabbi Motzen helped promote was the relatively high level of eligibility. At a preparation meeting for a Congressional hearing, a staffer pressed Rabbi Motzen on that very point. “A public school student costs the government between fifteen and thirty thousand dollars a year, and no one asks how much money their parents earn annually,” Rabbi Motzen answered. “So why when a child wants to leave public school do we suddenly start asking for their 1040?”

Aside from the policy smarts and making the bill “frum friendly,” the Agudah brought something else to the table, something more valuable than the wonkiest think tank experts and polished lobbying firm: an engaged constituency. The chairman of the Invest in Education Coalition, a national leader in championing school choice on the federal level, noted that “there has been no better partner than Agudah” and that “ECCA wouldn’t be possible without their support because of their grassroots advocacy and extensive reach of their networks.”

Over the last year, Agudah redoubled their boots-on-the-ground effort, keeping their constituents engaged and knocking on the doors of Republican members of Congress to shore up support (or, in the case of Democrats, tame down opposition) for ECCA. Agudah members have traveled to Washington, D.C. to meet their representatives and engaged with cabinet level officials and members of Congress at the highest level to ensure ECCA remains a priority. Rabbi Abba Cohen, the Agudah Washington director, has impressed the importance of this legislation on some of the most veteran policy insiders.

Yossie Charner, Agudah’s Director of Congressional Affairs, has made dozens of visits to Capitol Hill in the past months, where he met with nearly every Congressional official whose constituents include Orthodox Jews. Orthodox businessmen who own properties and healthcare facilities in areas with a minimal Jewish population have chipped in, too, introducing Yossie to “their” representatives in Congress.

ECCA has garnered significant support from political powerhouses such as House Speaker Mike Johnson and Vice President J.D. Vance, who cosponsored the bill when serving as Ohio’s senator. Last year, more than 180 Republican House Representatives signed on to the bill and Agudah helped get a version passed through the Ways and Means Committee before the bill officially died when the session ended at the end of the year.

This year, there is renewed optimism that ECCA can finally become law, primarily because of the fact that 1600 Pennsylvania Avenue has a new occupant, one who isn’t afraid of upsetting the status quo. Throughout his campaign, President Trump has made educational freedom a cornerstone of his campaign. Just nine days after entering office, the President signed an order making it the official policy of his administration “to support parents in choosing and directing the upbringing and education of their children.” Karoline Leavitt, the President’s press secretary, also reiterated her boss’s strong support.

In an interview on Fox News, an anchor for the outlet asked Florida Congressman Byron Donalds, a strong ally of the President and a budget hawk, about what he predicts will be included in the reconciliation bill — the budget bill that the president asked Congress to send that will include all his priorities as “one big, beautiful bill.”

“My crystal ball tells me we’ll get this done by June or July, which will give us plenty of time to get a reauthorization of the Trump tax cuts, plus some of the other items that the president campaigned on, including no tax on tips, no taxes on overtime, no taxes on social security, 100 percent expensing for small businesses — and ECCA,” says Donalds.

“Imagine pumping an additional one billion dollars into our community coffers,” says Rabbi Naftali Miller, Agudah’s Chief Development Officer, himself one of the most prolific fundraisers and askanim in the world of chesed. “I’m not sure how much money is raised overall for all causes in Klal Yisrael, but a billion dollars has to be a very significant percentage of that amount. With all our faults, we are probably the most charitable people in the world, and more importantly, we are very efficient and productive with our charity. We get a lot done. Our ROI is impeccable, thanks to the fact that we have so many talented volunteers and askanim who are passionate, dedicated, and brilliant. A billion dollars will go far beyond the chinuch scene and generate a lot of new resources for people who need them.”

Seeing It Live

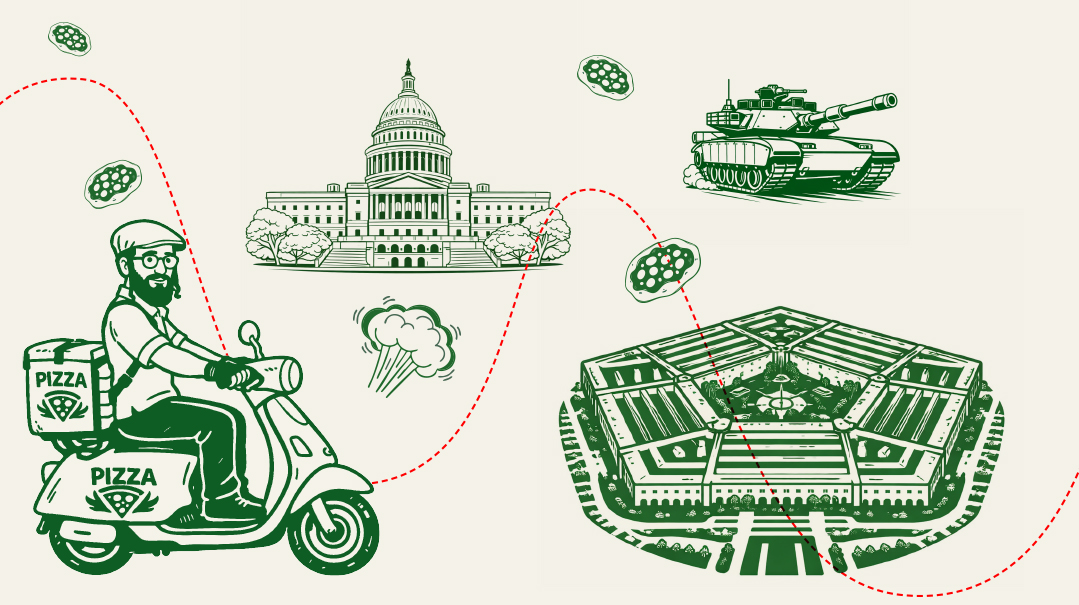

Representatives of Orthodox groups from around the country have made dozens of trips to Washington, D.C. to lobby for the bill, for a simple reason: If the frum population receives just its proportionate share, that would mean $700,000,000 in new funding for tuition scholarships. Among them is this group from Ohio, of which Rabbi A.D. Motzen (5th L.) is a part

O

ne day last February, I traveled to Washington, D.C. to be there for the first hearing of the Committee on Education and Workforce. The congressional committee is responsible for overseeing federal policies related to education, labor, and workforce development, and while they didn’t release their agenda prior to the hearing, there was a solid chance that the ECCA bill would come up during the discussions. I would be observing Rabbi Avi Schnall, who left his post at the New Jersey office of the Agudah after being elected to the New Jersey General Assembly and transitioned to a new post as the organization’s director of federal education affairs. We met at the Trenton train station, where we boarded the 6 a.m. Amtrak that would take us down the Northeast Corridor.

Most of the early-morning riders were catching a precious few minutes of shut-eye while others were already knee-deep in work, sitting hunched over laptops and clacking at their keyboards to the rhythmic hum of the locomotive as it sliced through the morning fog. Rabbi Schnall was familiarizing himself with the committee members before arriving on Capitol Hill, reviewing online bios and scrolling through their social media feeds. When he noticed a newly appointed member that he didn’t recognize, he turned to his national rolodex of political insiders.

“Shlomo,” wrote Avi to his Agudah colleague in Chicago, Rabbi Shlomo Soroka. “Congresswoman Miller — Republican from Illinois — is she a supporter? Do you know her?”

“Yes, I’ve discussed it with her and she’s all in,” wrote Soroka. “You can send her regards from Shlomo. The short guy with the yarmulke who works with her husband in Springfield. She knows me.”

“Perfect.”

After a two-hour-forty-five-minute ride, the conductor announced that the train was finally nearing its final destination. Washington’s Union Station, where passengers alight, is a far cry from Trenton, whose train station can pass as decent on a good day. In contrast, the station in Washington is grand, befitting the nation’s capital. The neoclassical masterpiece is adorned with towering Corinthian columns and intricate friezes, while inside, the soaring, coffered ceilings gilded in 22-karat gold reflect grandly on the marble floors below, as if welcoming its occupants to a city of elegance and power. The Capitol dome is visible right outside the station’s arched doors and the distinct MAGA energy is still present months after the decisive GOP win. A massive, two-story billboard offers “Congratulations 47!” and souvenir shops hawk everything from shot glasses to footwear bearing the distinctive face of the city’s most famous occupant.

The hearing was held in the Rayburn House Office Building, a two-and-a-half-million-square-foot government office building just across the avenue from the Capitol Building. As we waited on the security line which stretched outside the D.C. landmark, a motorcade that appeared to be carrying the president of Kosovo, Vjosa Osmani, raced by, snarling the already gridlocked traffic. (Officially known as the Republic of Kosovo, Kosovo is a landlocked country in Southeast Europe with partial diplomatic recognition. The United States has maintained warm ties with the Balkan country ever since it declared independence from Serbia in 2008). A few unfortunate souls with huge placards offered unsolicited advice to the President and Elon Musk to resign.

By the time we were cleared to enter, a nervous energy was beginning to build. Committee staff filed in, their arms bulging with reports and paperwork and their demeanor heavy with self-importance as they swept past us. Members of Congress trickled in, taking their seats around the large, curved dais, as the witnesses spent their last few minutes reviewing their testimony, and journalists jockeyed for the best position to catch the exchanges. About 100 or so chairs were packed into the back of the room for members of the public to participate, all of which were filled within minutes of the staff allowing us in.

We secured two aisle seats — offering an excellent view of the proceedings. The minor hassle of standing whenever someone needed to pass was outweighed by their most important feature — easy access to the room’s exit — crucial for anyone hoping to catch the legislators as they inevitably slip out after delivering their own remarks.

The proceedings began with the chairman of the committee, seated behind an elevated, commanding podium, banging the gavel. For all the stuffiness and formality that govern these Congressional proceedings, the content devolved right into the usual political shenanigans. The chairman — a Republican — used his pulpit to hail the Trump administration’s heroic efforts to roll back Biden-era DEI initiatives in educational institutions. Not to be outdone, the ranking member — a Democrat — decried them.

The floor then turned over to four expert witnesses, whose diverse views represented the fierce ideological divide of Americans over education — as well as the Republican majority on the committee.

Two of the witnesses urged committee members to recommit to rooting out social equity ideologies that infect American education, buttressing their arguments with evidence and research. A third pleaded for legislators to empower schools to ensure that their curriculum better aligns with eventual employment opportunities, something members on both sides of the aisle were happy to get on board with.

Finally, a lawyer with the NAACP bickered that “school choice, private school voucher programs, and tax credit scholarship proposals endorsed by President Trump are just veiled attempts to maintain and expand the vestiges of racial segregation,” and admonished Congress not to abandon educational equality “by siphoning funding to private entities,” which would, in her view, be “furthering harmful racial disparities among future generations of American students.” Members of Congress were then given five minutes each to question witnesses or give their own brief remarks.

If you ever watched a concert producer during an event as he listens to the music while simultaneously keeping a watchful eye on the evening’s developments, you can get a sense of what it takes to be a lobbyist in a committee hearing. Avi listened to the proceedings for any mention of “school choice,” while also watching the various members of Congress as they attempt to inconspicuously enter and exit the room through a back door. Every time he heard a Republican praising school choice, Avi kept an eye on that member, and exited the room as the member disappeared through a back door of the committee room.

The committee room, which is off limits to the public, leads to the hallway, which is just about a ten-second walk to the elevator banks servicing the Rayburn building. (The elevator itself is exclusively for the use of “members only,” ensuring a few precious moments of quiet bliss for members.) The small hallway is the only chance to catch a legislator and briefly make the case to ensure that ECCA remains a legislative priority.

A healthy majority of key Republicans in Congress support the bill, yet given the GOP’s razor-thin majority in the House (currently at 218–215), ECCA’s supporters aren’t taking any chances. Avi has a succinct and focused before-the-elevator-pitch: “Congressman, we appreciate your passion for school choice and hope you can sign on to support ECCA, which would open up opportunities for students around the country,” he urges.

In these government hallways, where tones are hushed and expressions are serious, the former Oorah head counselor’s booming voice and hearty laugh offer a somewhat welcome contrast to the solemn character of the Rayburn. A surprising number of members agree to sign on right then and there, instructing their staff to take the procedural steps to cosponsor the bill, while others politely nod, promising to consider the measure. (Hallway advocacy, by the way, isn’t unique. Etymologists posit that the term “lobbyist” was coined by Ulysses S. Grant as a snarky reference to the men who populated the lobby of the Washington D.C.’s famed Willard Hotel, approaching him for influence.)

One of the congressmen who took part in the hearing was Representative Burgess Owens, a pro football player turned politician, whose athletic prowess is showcased by the massive and gaudy Super Bowl ring proudly ornamenting his finger. He is an impassioned, even emotional advocate for school choice, and when I asked him about the ECCA, the Congressman was unequivocal. “The Educational Choice for Children Act gives families the freedom to choose schools that work, not a system that fails. With the most pro-choice President in history back in the White House and a unified Congress, we have a one-in-a-generation chance to pass ECCA, restoring real accountability in education and securing a future where every child can succeed.”

As the committee hearing was about to get underway, Chairman Tim Walberg walked in, a hush falling over the room as the gentleman from Michigan entered. Avi jumped up, leaning in and whispering just one word to the powerful member: “ECCA.”

The chairman smiled back. “This is the time to get it done,” he said.

(Originally featured in Mishpacha, Issue 1056)

Oops! We could not locate your form.