Ask a VC – How do you choose what to invest in?

| May 1, 2019

The mystery behind how VC firms allocate their money is being pulled back a bit. In the last issue, we dug into some of the most-asked questions these companies get.

Now, Jordan Odinsky at Ground Up Ventures is back, zooming in on a specific brand so we can learn the strategy behind how they got their funds.

WHY WE INVESTED IN FRANK

Throughout the year, we meet with hundreds of startups. Sometimes those meetings consist of a founder introducing us to a market opportunity that we never previously considered. Other times, we meet a founder who is actualizing an investment thesis that we’ve long been convinced of. Frank was the latter. Since studying at Wharton Business School, Charlie Javice, founder and CEO of Frank, explored how to best approach the problem of college affordability. It’s no secret that student debt is a major economic crisis plaguing the United States.

According to the news site Bloomberg, there is over $1.5 trillion in outstanding student loans. It’s the “second-largest consumer debt segment in the country after mortgages, and it keeps growing.” So after thoroughly researching the causes of student debt, Charlie concluded that the problem with college affordability starts at the very beginning, with financial aid.

THE HORRIBLE PROCESS OF FAFSA

If you haven’t had the pleasure of going through the FAFSA (Free Application for Federal Student Aid) process, you should count your blessings. FAFSA is the process by which the federal government determines and distributes almost all college financial aid. The paperwork — which is nearly three times the length of the standard federal income tax form — takes you down a dark journey riddled with confusion.

In fact, the application process is such a pain that every year $20 billion in financial aid — including $3 billion in Pell Grants — is left on the table. Of 45 million people in the United States who are eligible and seeking to enroll in some form of higher education, only 20 million submit their financial aid forms.

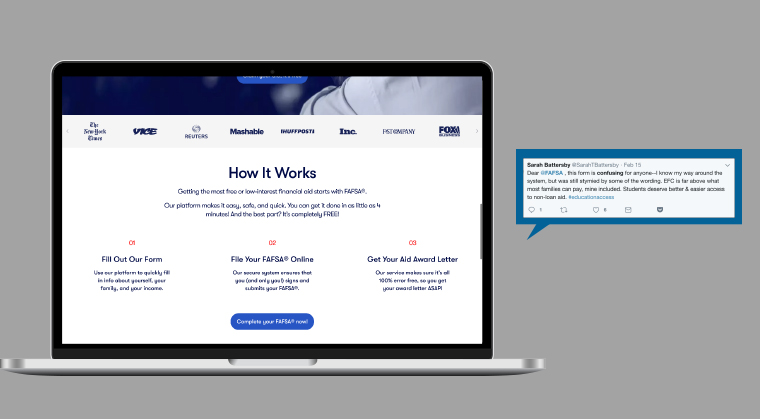

MEET FRANK

Frank is on an ambitious mission to radically change the relationship between students, their finances, and quality yet affordable education. Frank has overhauled the FAFSA application by drastically simplifying the process in plain English and retrieving data from other sources where students have already answered similar questions. To put this in context, think of the impact that TurboTax made on those who prefer to file their own taxes.

By using Frank, students and parents can complete the entire process in under four minutes. The company breaks it down into very easy questions and then uses its algorithms to fill out all of the formal paperwork without you ever having to see it. It therefore comes as no surprise why over 300,000 families have already used Frank to receive over $7 billion in aid, with thousands of new users signing up each week.

THE INFLECTION POINT STRATEGY

Aside from creating a real impact on the world, Frank is well-positioned to build long-lasting relationships with its customers, beyond assisting them with fi nancial aid. In a post by Angela Strange and Alex Rampell on the Andreessen Horowitz blog, the authors highlight that the best strategy for fi nancial tech (fi ntech) startups to generate customer demand quickly and cheaply is to target customers at what are called infl ection points. These infl ection points can be life events or milestones such as graduation, immigration, or marriage that mark a new set of circumstances where customers are open to making a change in their fi nancial products.

This open-mindedness enables these customers to be acquired at much lower customer acquisition costs than more general customer segments. There are three steps to successful implementation of the infl ection point strategy: 1. Create awareness of the alternative solution off ered by the company. 2. Provide a better product. 3. Build a trusting relationship with the consumer through multiple touchpoints. The benefi t to step #3 is that it also provides a solid foundation for scaling the company. Once the trusting relationship with the consumer is established, the startup can expand by off ering additional products. And since Frank is acquiring its users at such an early infl ection point (end of high school), the users have not yet adopted the fi nancial products they will need in the future and should be open to purchasing those products from a provider they know and trust. Naturally, the risky part of venture capital is that we don’t know if it’s a good investment until there’s some sort of exit (either a merger, or acquisition, or an IPO).

What we can say is that Frank has made tremendous progress since we’ve invested — they’ve helped 200,000 more families through the process, launched new products that simplify the college application process further, raised a subsequent $10 million, and expanded with 17 new employees — so the team is proving to be making a real impact. We look forward to seeing them fulfi ll their mission of making college more aff ordable for all.

To learn more about Frank, visit withfrank.org.

Jordan Odinsky is an investor at Ground Up Ventures, an early-stage venture capital fi rm based in the United States and Israel. Prior to joining Ground Up Ventures, he led portfolio development at OurCrowd, managing and supporting 130+ startups with business development, marketing, and fundraising. Jordan is also a Global Mentor at WeWork Labs, WeWork’s global innovation platform for startups. Originally from New York, Jordan has a degree in economics and business from CUNY Queens. Ground Up Ventures was founded in 2018 by Cory Moelis and David Stark. It is a generalist fund that invests in pre-seed and seed stage companies. Ground Up Ventures has invested in eight companies to date across the insurance, retail, fi nancial, real estate, and enterprise verticals.

(Originally featured in 2.0 Issue 3)

Oops! We could not locate your form.